Comprehensive insurance covers damages to your vehicle caused by non-collision events such as theft, vandalism, fire, and natural disasters, while collision insurance specifically pays for damages resulting from accidents with other vehicles or objects. Choosing between comprehensive and collision coverage depends on factors like your vehicle's value, driving habits, and risk exposure. Combining both types offers extensive protection by addressing a wider range of potential damages and financial losses.

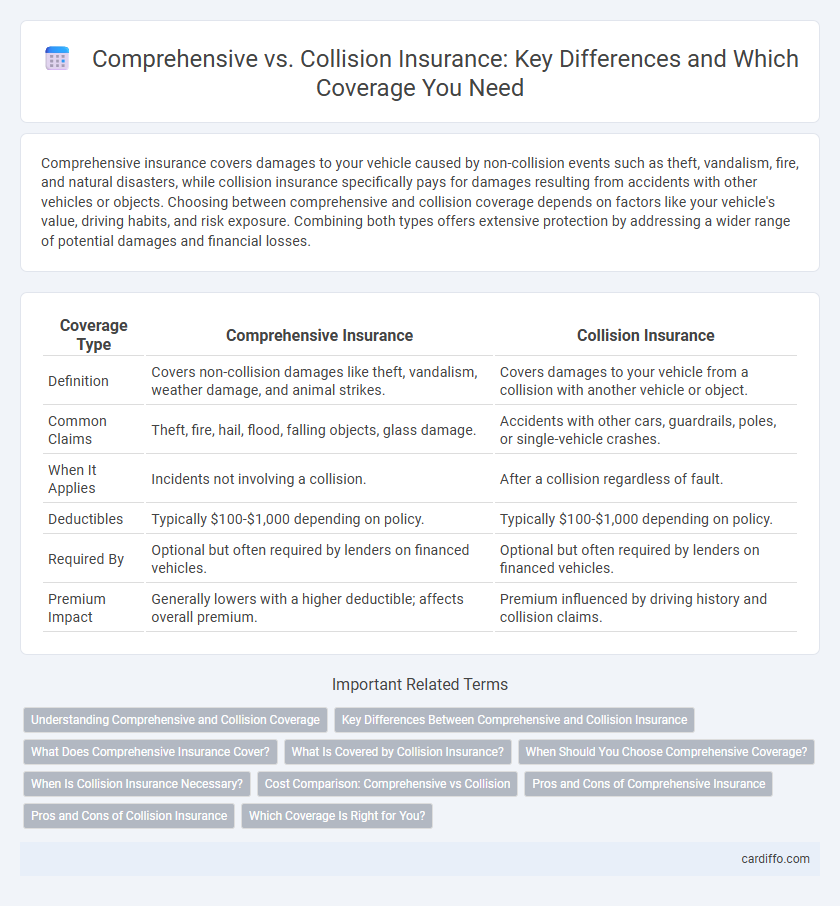

Table of Comparison

| Coverage Type | Comprehensive Insurance | Collision Insurance |

|---|---|---|

| Definition | Covers non-collision damages like theft, vandalism, weather damage, and animal strikes. | Covers damages to your vehicle from a collision with another vehicle or object. |

| Common Claims | Theft, fire, hail, flood, falling objects, glass damage. | Accidents with other cars, guardrails, poles, or single-vehicle crashes. |

| When It Applies | Incidents not involving a collision. | After a collision regardless of fault. |

| Deductibles | Typically $100-$1,000 depending on policy. | Typically $100-$1,000 depending on policy. |

| Required By | Optional but often required by lenders on financed vehicles. | Optional but often required by lenders on financed vehicles. |

| Premium Impact | Generally lowers with a higher deductible; affects overall premium. | Premium influenced by driving history and collision claims. |

Understanding Comprehensive and Collision Coverage

Comprehensive coverage protects against non-collision-related damages such as theft, vandalism, fire, and natural disasters, while collision coverage handles damages from accidents involving other vehicles or objects. Understanding the distinct protection each coverage offers helps in choosing the right insurance policy tailored to your vehicle's exposure to risks. Comprehensive typically covers a broader range of incidents, whereas collision focuses solely on accident impacts.

Key Differences Between Comprehensive and Collision Insurance

Comprehensive insurance covers damages to your vehicle caused by non-collision events such as theft, vandalism, fire, or natural disasters, while collision insurance specifically pays for repairs resulting from accidents involving other vehicles or objects. Comprehensive claims often involve incidents like hail damage or animal strikes, whereas collision claims focus on vehicle-to-vehicle impacts or rollovers. Understanding these distinctions helps policyholders select the appropriate coverage based on their risk exposure and vehicle usage.

What Does Comprehensive Insurance Cover?

Comprehensive insurance covers damages to your vehicle caused by non-collision events such as theft, fire, vandalism, natural disasters, and falling objects. This coverage also protects against damage from animal strikes and windshield cracks that are not related to accidents. Unlike collision insurance, comprehensive does not cover damage resulting from collisions with other vehicles or objects.

What Is Covered by Collision Insurance?

Collision insurance covers damages to your vehicle resulting from a collision with another car or object, regardless of fault. It includes repairs or replacement costs for incidents such as hitting a tree, fence, or guardrail, as well as single-car accidents like rollovers. This coverage does not extend to damages caused by natural disasters, theft, or vandalism, which are typically covered under comprehensive insurance.

When Should You Choose Comprehensive Coverage?

Choose comprehensive coverage when you want protection against non-collision-related incidents such as theft, vandalism, natural disasters, and animal damage. This type of insurance is ideal for vehicles parked in high-risk areas or during harsh weather conditions, reducing out-of-pocket expenses after unexpected events. Comprehensive coverage complements collision insurance by covering damages not caused by vehicle impact, providing broader financial security.

When Is Collision Insurance Necessary?

Collision insurance is necessary when you want coverage for damage to your vehicle resulting from a collision with another car or object, regardless of fault. It is particularly important for drivers with newer or financed vehicles, as lenders often require this coverage to protect their investment. Choosing collision insurance ensures repair or replacement costs are covered after accidents, reducing out-of-pocket expenses.

Cost Comparison: Comprehensive vs Collision

Comprehensive insurance typically costs 20-30% less than collision coverage due to its broader protection against non-collision events like theft, vandalism, and natural disasters. Collision insurance premiums are higher because they cover damages resulting from vehicle accidents, which statistically present a higher risk and claim frequency. Choosing between the two depends on factors such as vehicle value, driving habits, and risk exposure, but comprehensive coverage generally offers a more affordable way to protect against diverse hazards.

Pros and Cons of Comprehensive Insurance

Comprehensive insurance covers a wide range of non-collision damages, including theft, vandalism, natural disasters, and falling objects, providing extensive protection beyond just accidents. It often comes with lower deductibles and premiums compared to collision coverage, making it cost-effective for protecting against unpredictable events. However, comprehensive insurance does not cover damages from collisions with other vehicles or objects, requiring a separate collision policy for full vehicle protection.

Pros and Cons of Collision Insurance

Collision insurance covers damages to your vehicle resulting from accidents with other cars or objects, providing essential protection against repair costs after a collision. Pros include coverage for your car regardless of fault and the ability to repair or replace your vehicle quickly, while cons involve higher premiums and deductibles that may not justify the cost for older vehicles. Evaluating the total repair expenses versus the insurance costs helps determine if collision coverage is a financially sound investment.

Which Coverage Is Right for You?

Comprehensive insurance covers damage to your vehicle from non-collision events such as theft, vandalism, or natural disasters, while collision insurance pays for repairs after accidents involving other vehicles or objects. Assess your driving habits, vehicle age, and risk exposure to determine if comprehensive protection against unpredictable events or collision coverage for accident-related repairs better suits your needs. Combining both policies often provides the most thorough financial security, especially for newer or high-value vehicles.

Comprehensive vs Collision Infographic

cardiffo.com

cardiffo.com