No-fault insurance allows policyholders to receive compensation from their own insurer regardless of who caused the accident, ensuring faster claims processing and minimizing disputes. At-fault insurance requires the responsible party's insurer to cover damages, often leading to longer investigations and potential liability disputes. Understanding the differences between no-fault and at-fault systems is crucial for choosing the right coverage and managing legal responsibilities effectively.

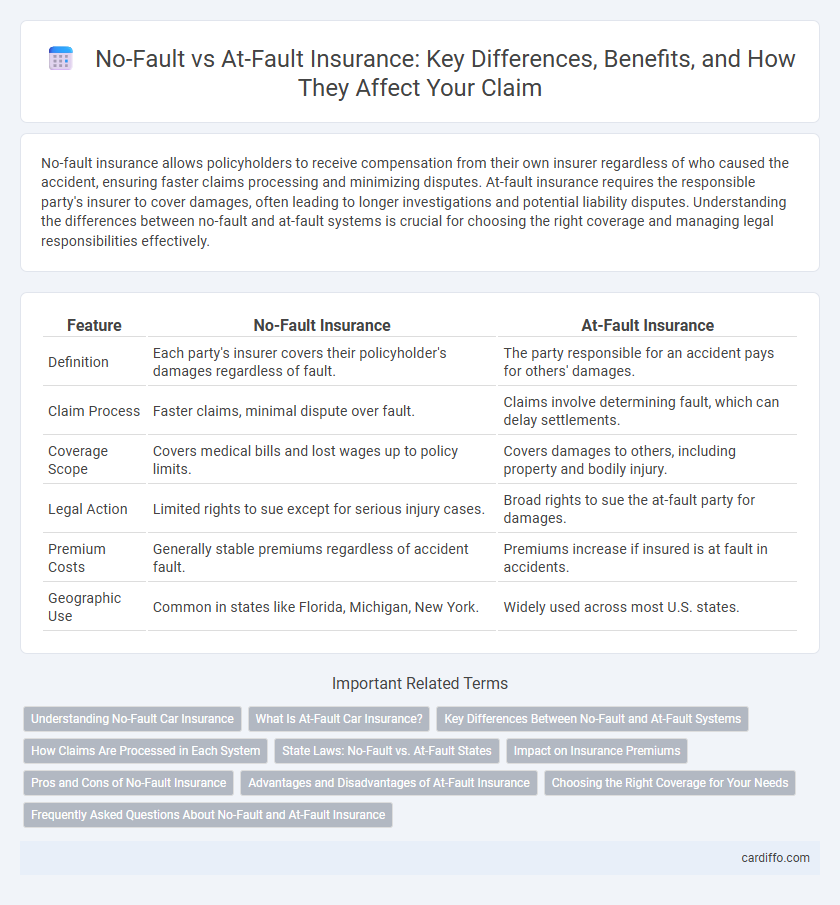

Table of Comparison

| Feature | No-Fault Insurance | At-Fault Insurance |

|---|---|---|

| Definition | Each party's insurer covers their policyholder's damages regardless of fault. | The party responsible for an accident pays for others' damages. |

| Claim Process | Faster claims, minimal dispute over fault. | Claims involve determining fault, which can delay settlements. |

| Coverage Scope | Covers medical bills and lost wages up to policy limits. | Covers damages to others, including property and bodily injury. |

| Legal Action | Limited rights to sue except for serious injury cases. | Broad rights to sue the at-fault party for damages. |

| Premium Costs | Generally stable premiums regardless of accident fault. | Premiums increase if insured is at fault in accidents. |

| Geographic Use | Common in states like Florida, Michigan, New York. | Widely used across most U.S. states. |

Understanding No-Fault Car Insurance

No-fault car insurance requires each driver's insurance company to cover their own policyholder's medical expenses and losses regardless of who caused the accident, reducing the need for legal battles over liability. This system aims to expedite claim processing and provide quicker compensation for injuries, often limiting the ability to sue the at-fault party except in severe cases. Understanding no-fault insurance laws, which vary by state, is essential for policyholders to know their coverage limits and rights after a collision.

What Is At-Fault Car Insurance?

At-fault car insurance assigns responsibility to the driver who causes an accident, making their insurance liable for damages and injuries. This type of policy often leads to increased premiums for the at-fault driver due to the financial coverage required. It contrasts with no-fault insurance, where each party's own insurer pays for losses regardless of fault.

Key Differences Between No-Fault and At-Fault Systems

No-fault insurance systems compensate policyholders regardless of who caused the accident, minimizing litigation and speeding up claim settlements. At-fault systems require determining liability, which can lead to longer legal processes and potentially higher premiums for the responsible party. These fundamental differences impact how claims are processed, the financial responsibility of drivers, and the overall claims experience in personal injury and property damage cases.

How Claims Are Processed in Each System

In a no-fault insurance system, claims are processed through the claimant's own insurance provider regardless of who caused the accident, streamlining the payout process and reducing litigation. At-fault systems require determining the responsible party before claims are paid, often involving more complex investigations and potential legal disputes. This fundamental difference affects the speed of claim resolution and the likelihood of compensation for damages.

State Laws: No-Fault vs. At-Fault States

State laws determine whether an accident is handled under no-fault or at-fault insurance systems, impacting claim processes and liability determination. In no-fault states, drivers file claims with their own insurance regardless of fault, aiming to reduce litigation and expedite compensation. Conversely, at-fault states require the driver who caused the accident to be responsible for damages, often involving insurance claims against the liable party and potential legal action.

Impact on Insurance Premiums

No-fault insurance systems typically lead to more stable and predictable insurance premiums because claims are settled regardless of fault, reducing litigation costs. In contrast, at-fault insurance models often result in higher premiums for drivers found responsible for accidents, as insurers adjust rates based on individual fault and claims history. Understanding the distinction between no-fault and at-fault liability is crucial for anticipating how premiums may fluctuate after an incident.

Pros and Cons of No-Fault Insurance

No-fault insurance streamlines claims processing by allowing policyholders to receive compensation from their own insurer regardless of who caused the accident, reducing legal costs and speeding up settlements. However, it may lead to higher premiums due to increased claim frequency and limits the ability to sue the at-fault party except in severe injury cases. This system provides financial predictability but can sometimes restrict full recovery for damages and diminish accountability for negligent drivers.

Advantages and Disadvantages of At-Fault Insurance

At-fault insurance requires the driver responsible for an accident to cover the damages, which can lead to higher premiums for the at-fault party but may reduce costs for other drivers. One key advantage is that it incentivizes careful driving by holding individuals financially accountable for their mistakes. The primary disadvantage is the complexity and delay in claim settlements due to fault determination, potentially resulting in disputes and increased legal expenses.

Choosing the Right Coverage for Your Needs

Selecting the appropriate insurance coverage requires understanding no-fault and at-fault systems, which determine how claims and liability are handled after an accident. No-fault insurance provides compensation regardless of who caused the accident, typically offering faster payouts and reduced litigation, while at-fault insurance holds the responsible party liable, potentially affecting premiums based on fault determination. Evaluating personal risk factors, state regulations, and financial protection needs helps consumers choose coverage that balances cost-efficiency with adequate protection.

Frequently Asked Questions About No-Fault and At-Fault Insurance

No-fault insurance covers your own damages and medical expenses regardless of who caused the accident, streamlining claims and reducing litigation. At-fault insurance requires the party responsible for the accident to pay for damages, often involving liability determination and potential lawsuits. Frequently asked questions typically address claim procedures, coverage limits, and how each system affects premiums and legal rights.

No-Fault vs At-Fault Infographic

cardiffo.com

cardiffo.com