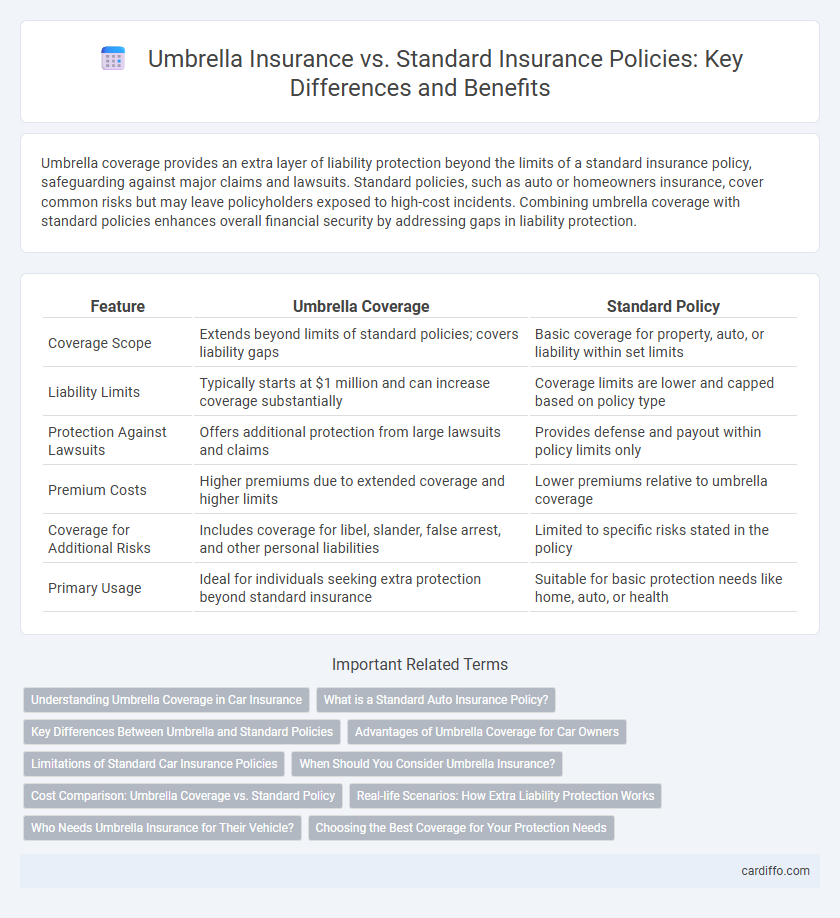

Umbrella coverage provides an extra layer of liability protection beyond the limits of a standard insurance policy, safeguarding against major claims and lawsuits. Standard policies, such as auto or homeowners insurance, cover common risks but may leave policyholders exposed to high-cost incidents. Combining umbrella coverage with standard policies enhances overall financial security by addressing gaps in liability protection.

Table of Comparison

| Feature | Umbrella Coverage | Standard Policy |

|---|---|---|

| Coverage Scope | Extends beyond limits of standard policies; covers liability gaps | Basic coverage for property, auto, or liability within set limits |

| Liability Limits | Typically starts at $1 million and can increase coverage substantially | Coverage limits are lower and capped based on policy type |

| Protection Against Lawsuits | Offers additional protection from large lawsuits and claims | Provides defense and payout within policy limits only |

| Premium Costs | Higher premiums due to extended coverage and higher limits | Lower premiums relative to umbrella coverage |

| Coverage for Additional Risks | Includes coverage for libel, slander, false arrest, and other personal liabilities | Limited to specific risks stated in the policy |

| Primary Usage | Ideal for individuals seeking extra protection beyond standard insurance | Suitable for basic protection needs like home, auto, or health |

Understanding Umbrella Coverage in Car Insurance

Umbrella coverage in car insurance provides an extra layer of liability protection beyond the limits of a standard policy, safeguarding against major claims and lawsuits. It covers bodily injury, property damage, and legal fees that exceed the primary policy's limits, offering broader protection for serious accidents. This additional coverage is essential for high-net-worth individuals or those seeking enhanced financial security beyond standard auto insurance.

What is a Standard Auto Insurance Policy?

A standard auto insurance policy provides essential coverage including liability for bodily injury and property damage, collision, and comprehensive protection against theft, vandalism, and natural disasters. This policy sets the base level of financial protection required by law, ensuring that damages or injuries you cause to others are covered up to specified limits. Umbrella coverage supplements this by offering higher liability limits and broader protection beyond the standard auto insurance policy's scope.

Key Differences Between Umbrella and Standard Policies

Umbrella coverage provides additional liability protection that exceeds the limits of standard insurance policies such as auto, home, or renters insurance, offering broader coverage for lawsuits and major claims. Standard policies typically have fixed limits and cover specific risks related to the insured property or vehicle, whereas umbrella policies cover a wider range of liabilities including personal injury, property damage, and legal defense costs. Umbrella insurance is designed to protect assets and future earnings by filling gaps and extending coverage beyond the scope of standard policies.

Advantages of Umbrella Coverage for Car Owners

Umbrella coverage offers car owners extended liability protection beyond the limits of standard auto insurance policies, safeguarding assets in case of severe accidents or lawsuits. It covers claims that may be excluded under standard policies, such as libel, slander, or rental car incidents, providing comprehensive financial security. This additional layer of protection ensures peace of mind by reducing the risk of out-of-pocket expenses from catastrophic events or multi-vehicle accidents.

Limitations of Standard Car Insurance Policies

Standard car insurance policies typically provide limited liability coverage that may not fully protect against extensive damages or multiple claims in severe accidents. These policies often have lower coverage limits, exposing policyholders to significant out-of-pocket expenses when medical bills, property damage, or legal fees exceed their policy thresholds. Umbrella coverage supplements standard policies by offering higher liability limits and broader protection against claims, reducing financial risk beyond the standard policy's limitations.

When Should You Consider Umbrella Insurance?

Umbrella insurance should be considered when your standard policy limits are insufficient to fully protect your assets and future earnings from large liability claims or lawsuits. This coverage provides an extra layer of protection beyond the limits of auto, home, and other personal insurance policies, typically starting at $1 million in coverage. Individuals with significant assets, high risk professions, or those who regularly host events or operate rental properties benefit the most from adding an umbrella policy.

Cost Comparison: Umbrella Coverage vs. Standard Policy

Umbrella coverage typically costs between $150 and $300 annually for $1 million in liability protection, offering extensive coverage beyond the limits of a standard policy. Standard insurance policies such as homeowners or auto insurance have lower premiums but provide limited liability coverage, often between $100,000 and $500,000. Investing in umbrella coverage proves cost-effective for high-net-worth individuals seeking broader protection without significantly increasing insurance expenses.

Real-life Scenarios: How Extra Liability Protection Works

Umbrella coverage provides an extra layer of liability protection beyond the limits of standard insurance policies, such as home or auto insurance, offering coverage for substantial claims that exceed primary policy limits. In real-life scenarios like severe car accidents or major property damage incidents, umbrella policies can cover legal fees, medical bills, and settlements that standard policies may not fully address. This additional protection helps policyholders avoid significant out-of-pocket expenses and financial hardship resulting from lawsuits or large claims.

Who Needs Umbrella Insurance for Their Vehicle?

Drivers with substantial assets, high-risk professions, or multiple vehicles benefit from umbrella insurance as it provides extra liability protection beyond standard auto policy limits. Standard policies typically cover damages up to a certain threshold, whereas umbrella insurance steps in to cover costs exceeding those limits, offering enhanced financial security. Individuals seeking broader protection against lawsuits and severe accidents should consider adding umbrella coverage to their vehicle insurance portfolio.

Choosing the Best Coverage for Your Protection Needs

Umbrella coverage provides extra liability protection beyond the limits of standard policies, safeguarding against large claims and lawsuits. Standard policies cover specific risks such as auto, home, or renters insurance but may have lower liability limits that can leave gaps. Choosing the best coverage depends on factors like asset value, risk exposure, and whether you seek broad liability protection or specific coverage for particular events.

Umbrella Coverage vs Standard Policy Infographic

cardiffo.com

cardiffo.com