Telematics-based insurance uses real-time data from devices to monitor pet activity and health, enabling personalized premiums and proactive care, unlike traditional insurance which relies on static information and fixed rates. This data-driven approach rewards responsible pet owners with lower costs by assessing individual risk more accurately. Telematics fosters improved pet wellness through continuous monitoring, reducing claims and enhancing prevention compared to conventional insurance policies.

Table of Comparison

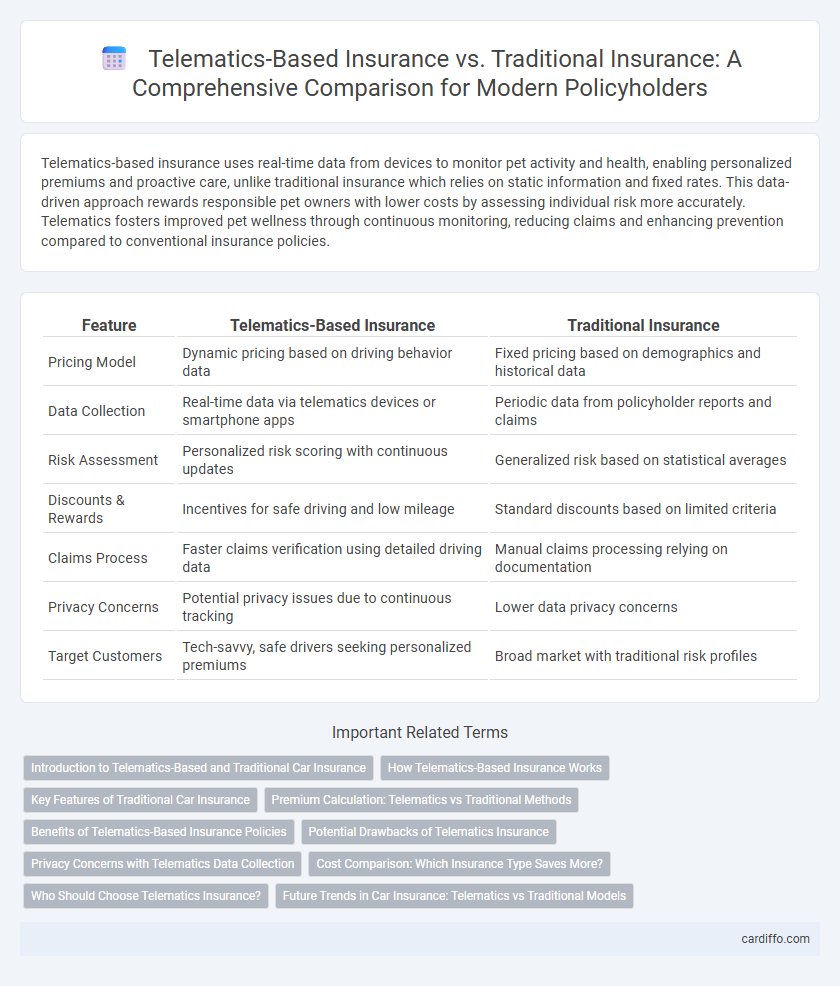

| Feature | Telematics-Based Insurance | Traditional Insurance |

|---|---|---|

| Pricing Model | Dynamic pricing based on driving behavior data | Fixed pricing based on demographics and historical data |

| Data Collection | Real-time data via telematics devices or smartphone apps | Periodic data from policyholder reports and claims |

| Risk Assessment | Personalized risk scoring with continuous updates | Generalized risk based on statistical averages |

| Discounts & Rewards | Incentives for safe driving and low mileage | Standard discounts based on limited criteria |

| Claims Process | Faster claims verification using detailed driving data | Manual claims processing relying on documentation |

| Privacy Concerns | Potential privacy issues due to continuous tracking | Lower data privacy concerns |

| Target Customers | Tech-savvy, safe drivers seeking personalized premiums | Broad market with traditional risk profiles |

Introduction to Telematics-Based and Traditional Car Insurance

Telematics-based insurance uses data collected from a vehicle's GPS and onboard diagnostics to tailor premiums based on real-time driving behavior, such as speed, braking patterns, and mileage. Traditional car insurance calculates premiums primarily on static factors like driver age, location, vehicle type, and historical claims data. This dynamic data-driven approach in telematics allows for personalized pricing and potential savings for safe drivers compared to the more generalized risk assessment in traditional insurance policies.

How Telematics-Based Insurance Works

Telematics-based insurance relies on data collected from GPS devices, accelerometers, and onboard diagnostics within a vehicle to monitor driving behavior, including speed, acceleration, braking, and mileage. This real-time data is transmitted to insurers to assess risk more accurately and personalize premium rates based on actual driving habits rather than demographic factors. By leveraging telematics technology, insurance companies can offer usage-based policies that reward safe driving with potential discounts and tailored coverage.

Key Features of Traditional Car Insurance

Traditional car insurance relies on fixed premiums based on factors such as driver age, vehicle type, and driving history, rather than real-time data. Policies typically offer standardized coverage options like liability, collision, and comprehensive protection without personalized adjustments. Claims processing involves manual assessments and longer turnaround times compared to telematics-based methods.

Premium Calculation: Telematics vs Traditional Methods

Telematics-based insurance calculates premiums using real-time driving data such as speed, braking patterns, and mileage, enabling personalized and dynamic risk assessment. Traditional insurance relies on static factors like age, gender, driving history, and vehicle type, leading to less precise premium estimates. By leveraging telematics, insurers can offer more accurate pricing and incentivize safer driving behavior through data-driven insights.

Benefits of Telematics-Based Insurance Policies

Telematics-based insurance policies offer personalized premium rates by analyzing real-time driving behavior, leading to potential cost savings for safe drivers. These policies enhance risk assessment accuracy using GPS and sensor data, allowing insurers to provide tailored coverage and incentives. Improved road safety is encouraged through feedback and rewards systems, reducing accident frequency and claims.

Potential Drawbacks of Telematics Insurance

Telematics-based insurance may raise privacy concerns due to continuous tracking of driver behavior and location data, potentially leading to data misuse. The reliance on technology can result in inaccuracies or technical issues that unfairly impact premium calculations. Traditional insurance offers more predictable pricing without the risk of data-driven biases affecting coverage and costs.

Privacy Concerns with Telematics Data Collection

Telematics-based insurance collects detailed driving data such as speed, location, and driving behavior, raising significant privacy concerns over data misuse and unauthorized sharing. Unlike traditional insurance, which relies on historical records and basic demographic information, telematics exposes continuous, real-time monitoring that may infringe on personal privacy. Consumers worry about data security breaches and the extent to which insurers access and analyze sensitive information beyond just insurance purposes.

Cost Comparison: Which Insurance Type Saves More?

Telematics-based insurance typically offers lower premiums by utilizing real-time driving data to accurately assess risk, resulting in cost savings for safe drivers compared to traditional insurance, which relies on generalized statistical data and higher risk estimates. Studies indicate that telematics policies can reduce insurance costs by 10-30% for cautious drivers, while high-risk drivers may see fewer savings or increased premiums. The personalized pricing model of telematics promotes fairer rates, whereas traditional insurance often charges more to cover a broader risk pool.

Who Should Choose Telematics Insurance?

Drivers seeking personalized premiums based on actual driving behavior benefit most from telematics-based insurance, as it rewards safe driving habits with potential cost savings. Younger or inexperienced drivers, who typically face higher rates in traditional insurance, can gain improved rates by demonstrating responsible driving through telematics data. Those comfortable with technology and privacy trade-offs find telematics insurance advantageous for its usage-based pricing models and enhanced risk assessment.

Future Trends in Car Insurance: Telematics vs Traditional Models

Telematics-based insurance leverages real-time data from vehicle sensors to offer personalized premiums based on driving behavior, significantly enhancing risk assessment compared to traditional insurance models reliant on static factors like age and claims history. The integration of artificial intelligence and big data analytics is expected to drive the growth of usage-based insurance, promoting safer driving habits and reducing overall claim frequencies. Future car insurance trends prioritize dynamic pricing models and proactive risk management, positioning telematics as a transformative force in the industry.

Telematics-Based Insurance vs Traditional Insurance Infographic

cardiffo.com

cardiffo.com