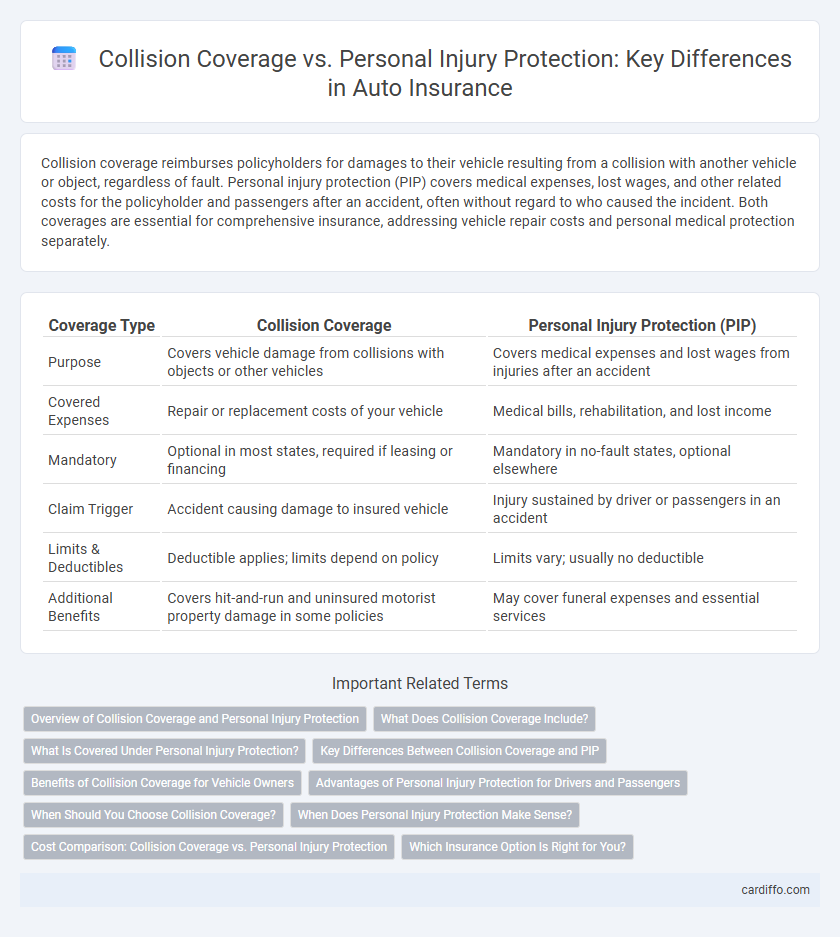

Collision coverage reimburses policyholders for damages to their vehicle resulting from a collision with another vehicle or object, regardless of fault. Personal injury protection (PIP) covers medical expenses, lost wages, and other related costs for the policyholder and passengers after an accident, often without regard to who caused the incident. Both coverages are essential for comprehensive insurance, addressing vehicle repair costs and personal medical protection separately.

Table of Comparison

| Coverage Type | Collision Coverage | Personal Injury Protection (PIP) |

|---|---|---|

| Purpose | Covers vehicle damage from collisions with objects or other vehicles | Covers medical expenses and lost wages from injuries after an accident |

| Covered Expenses | Repair or replacement costs of your vehicle | Medical bills, rehabilitation, and lost income |

| Mandatory | Optional in most states, required if leasing or financing | Mandatory in no-fault states, optional elsewhere |

| Claim Trigger | Accident causing damage to insured vehicle | Injury sustained by driver or passengers in an accident |

| Limits & Deductibles | Deductible applies; limits depend on policy | Limits vary; usually no deductible |

| Additional Benefits | Covers hit-and-run and uninsured motorist property damage in some policies | May cover funeral expenses and essential services |

Overview of Collision Coverage and Personal Injury Protection

Collision coverage reimburses policyholders for vehicle repairs or replacement after an accident with another vehicle or object, regardless of fault. Personal injury protection (PIP) covers medical expenses, lost wages, and rehabilitation costs for the policyholder and passengers injured in a car accident. While collision coverage focuses on vehicle damage, PIP emphasizes healthcare and related financial support following injury.

What Does Collision Coverage Include?

Collision coverage includes repairs or replacement costs for your vehicle resulting from accidents with other cars or objects, regardless of who is at fault. It typically covers damages from collisions with vehicles, guardrails, trees, or other obstacles, ensuring your car is restored after impact. This coverage usually requires a deductible and is essential for protecting your investment in your vehicle after collision incidents.

What Is Covered Under Personal Injury Protection?

Personal Injury Protection (PIP) covers medical expenses, lost wages, and rehabilitation costs resulting from injuries sustained in a car accident, regardless of fault. It also includes coverage for necessary services such as ambulance fees, nursing care, and even funeral expenses in severe cases. Unlike Collision coverage, which pays for vehicle repairs or replacement, PIP focuses on the health and recovery of the insured and passengers.

Key Differences Between Collision Coverage and PIP

Collision coverage reimburses policyholders for vehicle repairs or replacement after an accident regardless of fault, specifically addressing physical damage to the insured car. Personal Injury Protection (PIP) covers medical expenses, lost wages, and other related costs for the insured and passengers, providing a broader scope of injury-related financial protection. The key difference lies in collision coverage focusing on property damage, while PIP prioritizes medical and injury-related costs following an accident.

Benefits of Collision Coverage for Vehicle Owners

Collision coverage provides vehicle owners with financial protection against repair or replacement costs resulting from accidents with other vehicles or objects. This insurance benefit minimizes out-of-pocket expenses by covering damages regardless of fault, ensuring quicker vehicle restoration and reducing the risk of significant financial loss. Collision coverage enhances peace of mind for drivers by safeguarding their investment in case of unexpected collisions.

Advantages of Personal Injury Protection for Drivers and Passengers

Personal Injury Protection (PIP) offers comprehensive medical expense coverage regardless of fault, ensuring immediate access to healthcare for drivers and passengers after an accident. PIP also covers lost wages and rehabilitation costs, providing financial support beyond vehicle repairs. Unlike Collision coverage, which is limited to vehicle damage, PIP enhances overall financial security by addressing health-related and income-related consequences of accidents.

When Should You Choose Collision Coverage?

Choose collision coverage when you want financial protection for damages to your vehicle after an accident, regardless of fault. Collision coverage is essential if you have a newer, valuable car or a loan or lease requiring full coverage. Personal injury protection covers medical expenses and lost wages but does not pay for vehicle repairs, making collision coverage necessary to safeguard your car investment.

When Does Personal Injury Protection Make Sense?

Personal Injury Protection (PIP) makes sense when you need coverage for medical expenses, lost wages, and other related costs regardless of fault in an accident. It is especially valuable in no-fault insurance states where your own policy pays for injuries regardless of who caused the collision. PIP complements collision coverage by addressing injury-related expenses rather than vehicle damage, providing broader financial protection.

Cost Comparison: Collision Coverage vs. Personal Injury Protection

Collision coverage typically involves higher premiums because it covers vehicle repairs after an accident, which can be costly depending on the damage. Personal injury protection (PIP) tends to have lower premiums as it focuses on medical expenses and lost wages, providing a cap on coverage limits that reduces insurer risk. Comparing the two, collision coverage usually results in greater out-of-pocket expenses due to deductibles and repair costs, while PIP offers more predictable costs with a focus on health-related claims.

Which Insurance Option Is Right for You?

Collision coverage protects your vehicle from damage resulting from accidents with other cars or objects, making it ideal for those who want to ensure repair costs are covered regardless of fault. Personal injury protection (PIP) covers medical expenses, lost wages, and other related costs for you and your passengers after an accident, which is essential if you prioritize healthcare security. Choosing the right insurance depends on whether you need financial protection for vehicle repairs or comprehensive medical and injury-related benefits.

Collision coverage vs Personal injury protection Infographic

cardiffo.com

cardiffo.com