Third-party coverage protects you against claims made by others for injuries or damages you cause, while first-party coverage reimburses your own losses from incidents regardless of fault. Understanding the distinction helps customize insurance policies to suit specific risks, ensuring comprehensive financial protection. Choosing the right balance between third-party and first-party coverage enhances overall risk management in insurance planning.

Table of Comparison

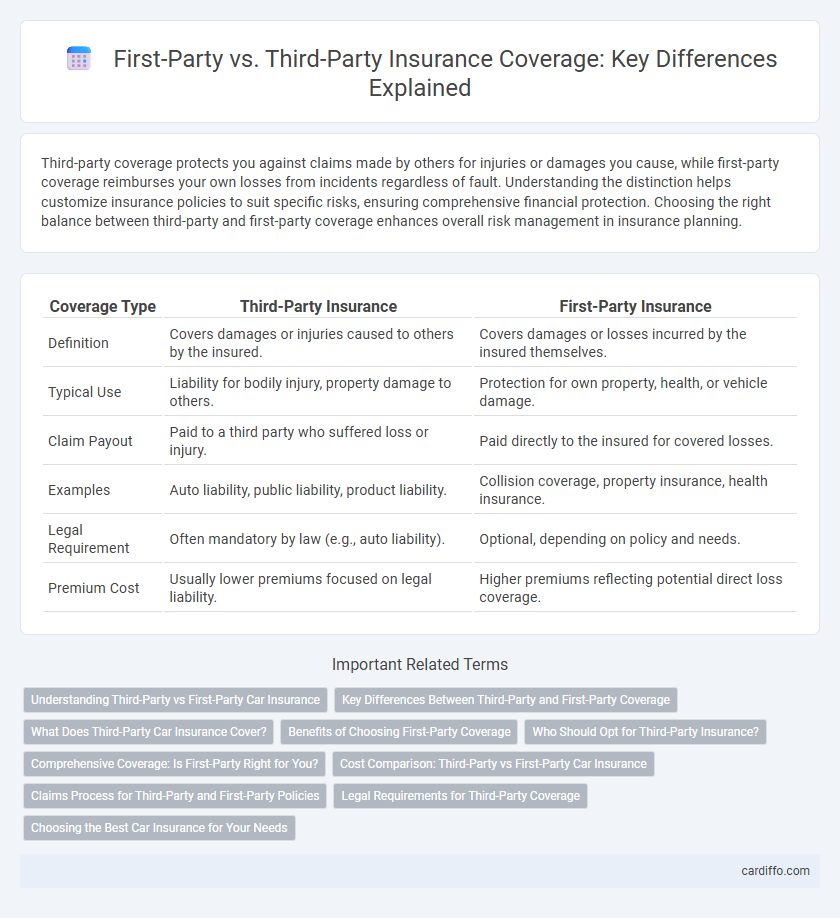

| Coverage Type | Third-Party Insurance | First-Party Insurance |

|---|---|---|

| Definition | Covers damages or injuries caused to others by the insured. | Covers damages or losses incurred by the insured themselves. |

| Typical Use | Liability for bodily injury, property damage to others. | Protection for own property, health, or vehicle damage. |

| Claim Payout | Paid to a third party who suffered loss or injury. | Paid directly to the insured for covered losses. |

| Examples | Auto liability, public liability, product liability. | Collision coverage, property insurance, health insurance. |

| Legal Requirement | Often mandatory by law (e.g., auto liability). | Optional, depending on policy and needs. |

| Premium Cost | Usually lower premiums focused on legal liability. | Higher premiums reflecting potential direct loss coverage. |

Understanding Third-Party vs First-Party Car Insurance

Third-party car insurance covers damages and injuries you cause to others, including their vehicle and property, while first-party coverage protects your own vehicle and medical expenses after an accident. Third-party is often legally required and more affordable, but offers limited protection compared to first-party policies like comprehensive or collision insurance. Understanding the distinction helps drivers choose appropriate coverage based on risk tolerance, legal requirements, and financial protection needs.

Key Differences Between Third-Party and First-Party Coverage

Third-party insurance covers damages or losses that the policyholder causes to another person or their property, such as liability in car accidents or property damage claims. First-party coverage protects the policyholder's own assets and losses, including comprehensive and collision coverage for vehicles or property damage to the insured's home. The key difference lies in the beneficiary of the claim: third-party coverage benefits external parties affected by the insured, while first-party coverage directly compensates the policyholder.

What Does Third-Party Car Insurance Cover?

Third-party car insurance primarily covers damages and injuries that the insured driver causes to other people or their property, including bodily injury and property damage liability. It does not cover the insured vehicle's damages or the driver's personal injuries, which are typically included in first-party coverage. This type of insurance is often mandatory by law, ensuring protection for third parties involved in an accident caused by the policyholder.

Benefits of Choosing First-Party Coverage

First-party coverage offers direct reimbursement for losses or damages to your property, providing faster claim settlements without the need to prove fault. It includes benefits such as comprehensive protection for vehicle damage, theft, or natural disasters, which third-party insurance does not cover. Policyholders gain greater control and peace of mind with first-party coverage, ensuring financial security against a wide range of risks.

Who Should Opt for Third-Party Insurance?

Third-party insurance is ideal for individuals seeking to fulfill legal requirements without covering personal damages, such as drivers wanting to protect against liabilities caused to others in accidents. It suits cost-conscious policyholders or those with older vehicles where repair costs might exceed value. Businesses aiming to mitigate risks from lawsuits or property damage caused to clients or third parties often prioritize third-party coverage for financial protection.

Comprehensive Coverage: Is First-Party Right for You?

Comprehensive coverage, a type of first-party insurance, protects your vehicle from non-collision incidents such as theft, vandalism, and natural disasters, offering broader protection than third-party coverage which only covers damages to others. Choosing first-party comprehensive insurance ensures financial security against a wide range of risks affecting your own property, making it ideal for owners of newer or high-value vehicles. Evaluating the cost of premiums against potential out-of-pocket expenses can help determine if first-party comprehensive coverage aligns with your risk tolerance and budget.

Cost Comparison: Third-Party vs First-Party Car Insurance

Third-party car insurance typically costs less than first-party coverage because it only protects against damages or injuries caused to others, excluding any repairs to the insured vehicle. First-party car insurance, such as comprehensive or collision coverage, involves higher premiums since it covers a broader range of risks, including damages to the insured's own car and medical expenses. Analyzing regional factors and individual risk profiles can further influence the cost disparity between third-party and first-party insurance policies.

Claims Process for Third-Party and First-Party Policies

The claims process for third-party insurance involves the insured filing a claim to cover damages or injuries caused to another party, often requiring extensive documentation of the incident and cooperation between both parties' insurers. First-party claims are submitted by the policyholder for their own losses, typically involving a more straightforward process focused on assessing the damage to the insured's property or health. Third-party claims frequently necessitate liability determination, while first-party claims prioritize evaluating the extent of covered damages under the policy terms.

Legal Requirements for Third-Party Coverage

Legal requirements for third-party coverage vary by jurisdiction but generally mandate minimum liability limits to protect victims from damages caused by insured drivers. Most states impose compulsory third-party liability insurance to cover bodily injury and property damage claims, ensuring financial responsibility in accidents. Failure to carry adequate third-party coverage can result in fines, license suspension, or vehicle impoundment, emphasizing its critical role in lawful vehicle operation.

Choosing the Best Car Insurance for Your Needs

Selecting the best car insurance involves understanding the core differences between third-party and first-party coverage, where third-party insurance covers damages to others and their property, and first-party insurance protects your own vehicle and injuries. Evaluating your driving habits, vehicle value, and financial risk tolerance helps determine whether comprehensive first-party coverage or basic third-party insurance best suits your needs. Prioritize policies with clear terms, robust claim support, and tailored coverage limits to ensure optimal protection and cost efficiency.

Third-Party vs First-Party Coverage Infographic

cardiffo.com

cardiffo.com