Third Party Only insurance covers damage or injury you cause to other people or their property but does not include protection for your own vehicle. Third Party, Fire and Theft extends this coverage by protecting your car against fire damage and theft, offering broader security without full comprehensive coverage. Choosing between these options depends on your budget and how much protection you want beyond liability.

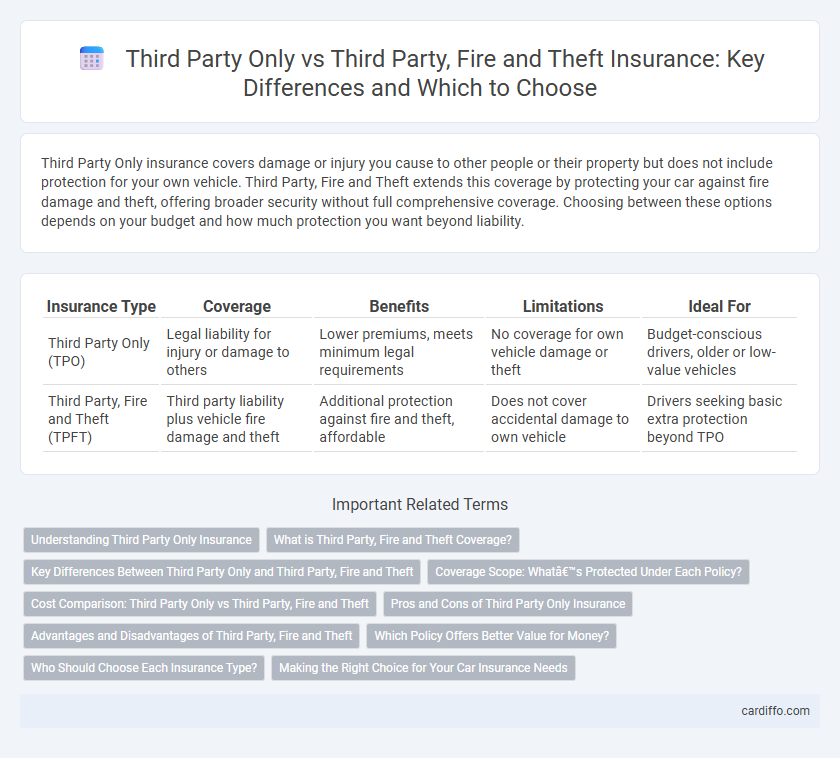

Table of Comparison

| Insurance Type | Coverage | Benefits | Limitations | Ideal For |

|---|---|---|---|---|

| Third Party Only (TPO) | Legal liability for injury or damage to others | Lower premiums, meets minimum legal requirements | No coverage for own vehicle damage or theft | Budget-conscious drivers, older or low-value vehicles |

| Third Party, Fire and Theft (TPFT) | Third party liability plus vehicle fire damage and theft | Additional protection against fire and theft, affordable | Does not cover accidental damage to own vehicle | Drivers seeking basic extra protection beyond TPO |

Understanding Third Party Only Insurance

Third Party Only insurance provides coverage exclusively for damages or injuries caused to other people or their property, without covering the policyholder's own vehicle. This type of policy is the most basic and cost-effective option, ideal for drivers seeking minimum legal protection. Understanding that it excludes protection against fire, theft, or accidental damage helps policyholders make informed decisions about coverage needs.

What is Third Party, Fire and Theft Coverage?

Third Party, Fire and Theft coverage extends beyond standard Third Party insurance by including protection against fire damage and theft of the insured vehicle. This policy covers liabilities for injury or damage to other people's property, as well as compensates for loss or damage caused by fire or theft to the policyholder's car. It offers a cost-effective middle ground between basic Third Party insurance and comprehensive coverage, providing broader financial protection for vehicle owners.

Key Differences Between Third Party Only and Third Party, Fire and Theft

Third Party Only insurance covers damages and injuries caused to others in an accident, excluding any protection for your own vehicle. Third Party, Fire and Theft extends this by covering losses from fire damage or theft of your vehicle, offering broader financial protection. The key difference lies in the additional coverage for fire and theft risks, providing enhanced security beyond basic third party liabilities.

Coverage Scope: What’s Protected Under Each Policy?

Third Party Only insurance covers damages and injuries caused to other people and their property, excluding any damage to your own vehicle. Third Party, Fire and Theft extends this protection by also covering your car against fire damage and theft, offering broader financial security. Understanding the specific risks covered by each policy helps in selecting appropriate protection based on individual needs and vehicle value.

Cost Comparison: Third Party Only vs Third Party, Fire and Theft

Third Party Only insurance typically offers the lowest premium rates, making it the most cost-effective option for basic legal liability coverage. Third Party, Fire and Theft insurance incurs higher premiums due to extended protection, including coverage for vehicle damage from fire and theft. Policyholders balancing budget constraints and risk exposure often choose Third Party, Fire and Theft for enhanced security while managing moderate cost increases.

Pros and Cons of Third Party Only Insurance

Third Party Only insurance covers damages and injuries caused to others, making it the most affordable option but offering no protection for the policyholder's own vehicle. Its primary advantage is cost-effectiveness, especially for older cars or drivers seeking basic legal compliance, while its downside is the absence of coverage for theft, fire, or personal vehicle damage. This limited protection can result in significant out-of-pocket expenses if the insured vehicle is damaged or stolen.

Advantages and Disadvantages of Third Party, Fire and Theft

Third Party, Fire and Theft insurance offers enhanced coverage beyond basic Third Party Only by protecting against vehicle fire damage and theft, reducing potential financial losses from such incidents. This added protection often comes with higher premiums, which may not be cost-effective for older or low-value vehicles. Policyholders benefit from broader security, but should weigh the increased cost against the likelihood of fire or theft claims based on their vehicle's risk profile and location.

Which Policy Offers Better Value for Money?

Third Party, Fire and Theft insurance provides better value for money by covering not only third-party liability but also damages caused by fire and theft, offering broader protection than Third Party Only policies. While Third Party Only covers legal liabilities to others in case of accidents, Third Party, Fire and Theft reduces financial risk by including vehicle loss or damage from fire or theft. Policyholders seeking comprehensive coverage without the higher cost of fully comprehensive insurance often find Third Party, Fire and Theft the most cost-effective option.

Who Should Choose Each Insurance Type?

Drivers seeking the most affordable coverage with legal compliance typically opt for Third Party Only insurance, ideal for those with older vehicles or limited budgets. Third Party, Fire and Theft insurance suits owners wanting extra protection against fire damage and vehicle theft without paying for comprehensive coverage. Both options prioritize liability coverage, but the latter offers enhanced security for moderate-risk drivers or those in high-theft areas.

Making the Right Choice for Your Car Insurance Needs

Choosing between Third Party Only and Third Party, Fire and Theft car insurance depends on your budget and risk tolerance. Third Party Only covers damages you cause to others, while Third Party, Fire and Theft adds protection against vehicle fire damage and theft, offering broader security. Evaluating your vehicle's value and local crime rates helps in making the right choice for comprehensive financial protection.

Third Party Only vs Third Party, Fire and Theft Infographic

cardiffo.com

cardiffo.com