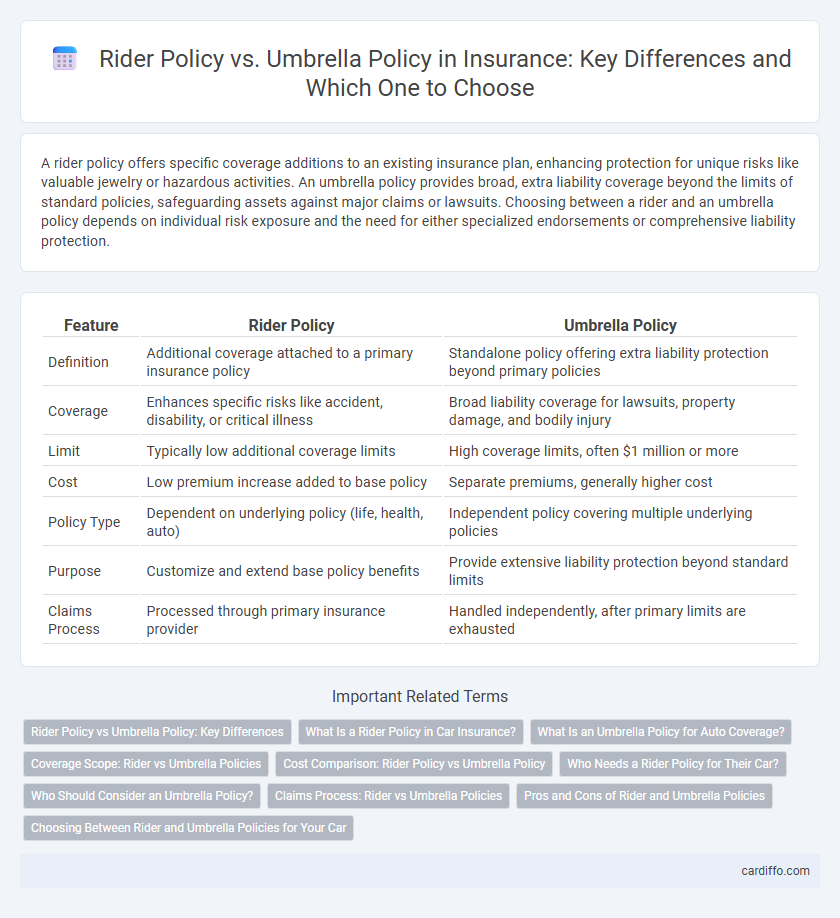

A rider policy offers specific coverage additions to an existing insurance plan, enhancing protection for unique risks like valuable jewelry or hazardous activities. An umbrella policy provides broad, extra liability coverage beyond the limits of standard policies, safeguarding assets against major claims or lawsuits. Choosing between a rider and an umbrella policy depends on individual risk exposure and the need for either specialized endorsements or comprehensive liability protection.

Table of Comparison

| Feature | Rider Policy | Umbrella Policy |

|---|---|---|

| Definition | Additional coverage attached to a primary insurance policy | Standalone policy offering extra liability protection beyond primary policies |

| Coverage | Enhances specific risks like accident, disability, or critical illness | Broad liability coverage for lawsuits, property damage, and bodily injury |

| Limit | Typically low additional coverage limits | High coverage limits, often $1 million or more |

| Cost | Low premium increase added to base policy | Separate premiums, generally higher cost |

| Policy Type | Dependent on underlying policy (life, health, auto) | Independent policy covering multiple underlying policies |

| Purpose | Customize and extend base policy benefits | Provide extensive liability protection beyond standard limits |

| Claims Process | Processed through primary insurance provider | Handled independently, after primary limits are exhausted |

Rider Policy vs Umbrella Policy: Key Differences

Rider policies provide specific coverage enhancements or additions to an existing insurance plan, such as health or life insurance, allowing customization for unique risks or needs. Umbrella policies offer broader liability protection beyond the limits of primary insurance policies, covering multiple areas like auto, home, and personal liability with higher coverage limits. Rider policies are limited to specific benefits tied to a base policy, whereas umbrella policies serve as an overarching layer of protection against large claims and lawsuits.

What Is a Rider Policy in Car Insurance?

A rider policy in car insurance is an additional coverage added to the base auto insurance policy to enhance protection for specific risks or situations not covered under the standard policy. Common rider options include coverage for rental reimbursement, roadside assistance, and custom equipment protection, allowing policyholders to tailor their insurance to individual needs. This customization helps fill gaps in the primary policy and provides extra financial security in unique circumstances.

What Is an Umbrella Policy for Auto Coverage?

An umbrella policy for auto coverage provides extra liability protection beyond the limits of standard auto insurance, covering claims that exceed primary policy limits. It helps protect assets and future earnings from major claims or lawsuits, including bodily injury, property damage, and legal defense costs. This type of policy is especially valuable for individuals with significant assets or higher risk exposure, offering broader coverage at an affordable cost.

Coverage Scope: Rider vs Umbrella Policies

Rider policies provide targeted coverage by adding specific protections or enhancements to an existing base insurance policy, such as life, health, or auto insurance, often tailored to individual needs and circumstances. Umbrella policies offer broad, overarching liability coverage that extends beyond the limits of standard policies, safeguarding against large claims or lawsuits affecting multiple insured assets. The scope of coverage in rider policies is limited and specialized, whereas umbrella policies deliver a wide-ranging safety net for comprehensive liability risks.

Cost Comparison: Rider Policy vs Umbrella Policy

Rider policies typically cost less than umbrella policies due to their limited coverage extension on existing insurance, ranging from $25 to $200 annually. Umbrella policies provide broader liability protection beyond standard policies and can cost between $150 and $300 per year for the first $1 million of coverage. Understanding these cost differences helps consumers balance budget constraints with the level of liability protection needed.

Who Needs a Rider Policy for Their Car?

Drivers seeking customized coverage for specific risks like rental reimbursement, roadside assistance, or coverage for aftermarket parts need a rider policy for their car. This policy enhances standard auto insurance by providing targeted protection tailored to unique vehicle features or personal requirements. High-value car owners and those frequently driving in high-risk areas benefit most from adding rider policies to their existing insurance.

Who Should Consider an Umbrella Policy?

High-net-worth individuals, business owners, and those with significant assets or potential liabilities should consider an umbrella policy to ensure extra liability protection beyond standard home, auto, or renters insurance limits. Professionals exposed to lawsuits, such as doctors, lawyers, and landlords, benefit from umbrella coverage to safeguard personal wealth from expensive legal claims and settlements. Families seeking peace of mind with extended liability coverage against major accidents or unforeseen events may find umbrella policies an essential component of comprehensive risk management.

Claims Process: Rider vs Umbrella Policies

Rider policies are amendments to existing insurance, allowing claims to be processed under the primary policy's terms and often result in faster settlements due to integrated coverage. Umbrella policies provide extra liability protection beyond underlying policies, requiring claims to be filed first with the base insurance before the umbrella coverage activates. Understanding the claims process distinction is crucial for policyholders to effectively navigate claim submissions and ensure comprehensive protection.

Pros and Cons of Rider and Umbrella Policies

Rider policies offer tailored coverage enhancements attached to an existing insurance plan, providing cost-effective and specific protection but limited to the base policy's limits and terms. Umbrella policies extend liability coverage beyond standard policy limits, offering broader protection across multiple policies with high coverage caps but typically come with higher premiums and eligibility requirements. Selecting between rider and umbrella policies depends on the need for specialized add-ons versus comprehensive liability protection with greater financial security.

Choosing Between Rider and Umbrella Policies for Your Car

Rider policies provide specific, customizable coverage additions to your existing car insurance, ideal for enhancing protection on particular risks such as custom parts or rental reimbursement. Umbrella policies offer broader liability coverage beyond the limits of your auto insurance, protecting against major claims that could impact your overall assets. Choosing between rider and umbrella policies depends on whether you need targeted add-ons or comprehensive liability protection for your car.

Rider Policy vs Umbrella Policy Infographic

cardiffo.com

cardiffo.com