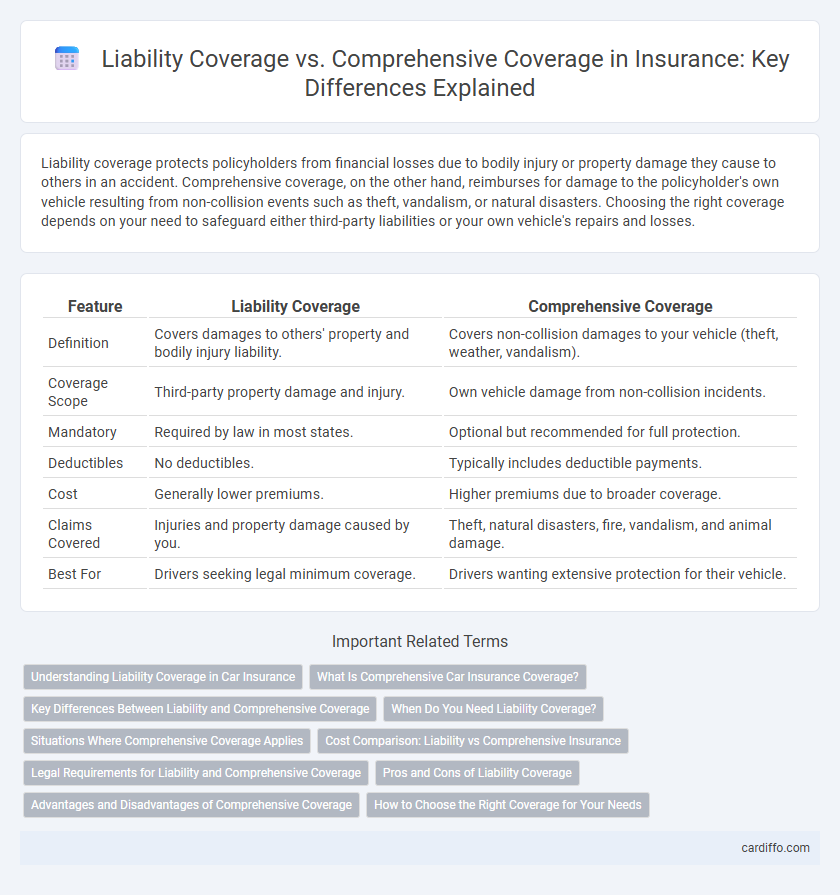

Liability coverage protects policyholders from financial losses due to bodily injury or property damage they cause to others in an accident. Comprehensive coverage, on the other hand, reimburses for damage to the policyholder's own vehicle resulting from non-collision events such as theft, vandalism, or natural disasters. Choosing the right coverage depends on your need to safeguard either third-party liabilities or your own vehicle's repairs and losses.

Table of Comparison

| Feature | Liability Coverage | Comprehensive Coverage |

|---|---|---|

| Definition | Covers damages to others' property and bodily injury liability. | Covers non-collision damages to your vehicle (theft, weather, vandalism). |

| Coverage Scope | Third-party property damage and injury. | Own vehicle damage from non-collision incidents. |

| Mandatory | Required by law in most states. | Optional but recommended for full protection. |

| Deductibles | No deductibles. | Typically includes deductible payments. |

| Cost | Generally lower premiums. | Higher premiums due to broader coverage. |

| Claims Covered | Injuries and property damage caused by you. | Theft, natural disasters, fire, vandalism, and animal damage. |

| Best For | Drivers seeking legal minimum coverage. | Drivers wanting extensive protection for their vehicle. |

Understanding Liability Coverage in Car Insurance

Liability coverage in car insurance protects you financially if you cause injury to others or damage their property in an accident. It typically includes bodily injury liability, covering medical expenses and lost wages, and property damage liability, paying for repairs or replacement of the other party's property. This coverage does not cover your own vehicle or injuries, which is why many drivers complement it with comprehensive coverage for broader protection.

What Is Comprehensive Car Insurance Coverage?

Comprehensive car insurance coverage protects against non-collision-related damages such as theft, vandalism, natural disasters, and falling objects. Unlike liability coverage, which only covers damages you cause to others, comprehensive insurance covers damage to your own vehicle regardless of fault. This type of policy is essential for mitigating financial loss from unforeseen events beyond accidents.

Key Differences Between Liability and Comprehensive Coverage

Liability coverage protects against damages and injuries you cause to others in accidents, covering bodily injury and property damage but not your own vehicle. Comprehensive coverage reimburses for non-collision-related damages to your vehicle, including theft, vandalism, natural disasters, and hitting an animal. Key differences include the scope of protection, with liability focusing on third-party claims and comprehensive addressing a wide range of physical damages to your own car.

When Do You Need Liability Coverage?

Liability coverage is essential when you are responsible for causing injury or property damage to others in an accident, as it covers medical expenses, legal fees, and repair costs. This coverage is mandatory in most states to protect drivers from financial loss due to third-party claims. Comprehensive coverage is optional and primarily protects your own vehicle from non-collision events like theft, vandalism, or natural disasters.

Situations Where Comprehensive Coverage Applies

Comprehensive coverage applies in situations involving non-collision events such as theft, vandalism, natural disasters like floods or hailstorms, falling objects, and animal-related damage. It protects against losses not caused by accidents, including fire damage or glass breakage. Unlike liability coverage, which addresses bodily injury or property damage to others, comprehensive coverage safeguards the insured vehicle from a wider range of risks beyond collisions.

Cost Comparison: Liability vs Comprehensive Insurance

Liability insurance typically costs significantly less than comprehensive coverage, with average premiums approximately 30-50% lower depending on the driver's location and history. Comprehensive insurance encompasses broader protection, including theft, vandalism, and natural disasters, which increases its monthly premium but reduces potential out-of-pocket expenses in rare events. Choosing between the two depends on factors like vehicle value, risk tolerance, and budget constraints, where liability offers affordable basic protection and comprehensive provides extensive coverage at a higher cost.

Legal Requirements for Liability and Comprehensive Coverage

Liability coverage is legally required in most states to protect drivers against financial responsibility for injuries and damages caused to others in an accident. Comprehensive coverage is optional and provides protection for non-collision-related damages such as theft, vandalism, or natural disasters. Understanding state-specific mandates and vehicle value can guide decisions on combining liability with comprehensive coverage for optimal financial security.

Pros and Cons of Liability Coverage

Liability coverage offers essential protection against legal and medical expenses if you cause injury or property damage to others, making it an affordable option for basic car insurance needs. However, it does not cover damages to your own vehicle or losses from theft, vandalism, or natural disasters, which limits its scope of protection. Choosing liability coverage is cost-effective but leaves you financially vulnerable to repairs and replacements after incidents that are not your fault.

Advantages and Disadvantages of Comprehensive Coverage

Comprehensive coverage offers protection against non-collision-related damages such as theft, vandalism, and natural disasters, reducing out-of-pocket expenses in unexpected situations. It generally has higher premiums compared to liability coverage and may include deductibles that increase initial costs. However, this coverage is advantageous for owners of newer or high-value vehicles who seek extensive protection beyond third-party liability.

How to Choose the Right Coverage for Your Needs

Choosing the right insurance coverage involves assessing your vehicle usage, risk tolerance, and financial protection goals. Liability coverage protects against damages or injuries you cause to others, making it essential for legal compliance and cost-effective risk management, especially if you have an older vehicle. Comprehensive coverage offers broader protection by covering non-collision-related damages like theft, vandalism, and natural disasters, ideal for newer or high-value vehicles requiring extensive risk mitigation.

Liability coverage vs Comprehensive coverage Infographic

cardiffo.com

cardiffo.com