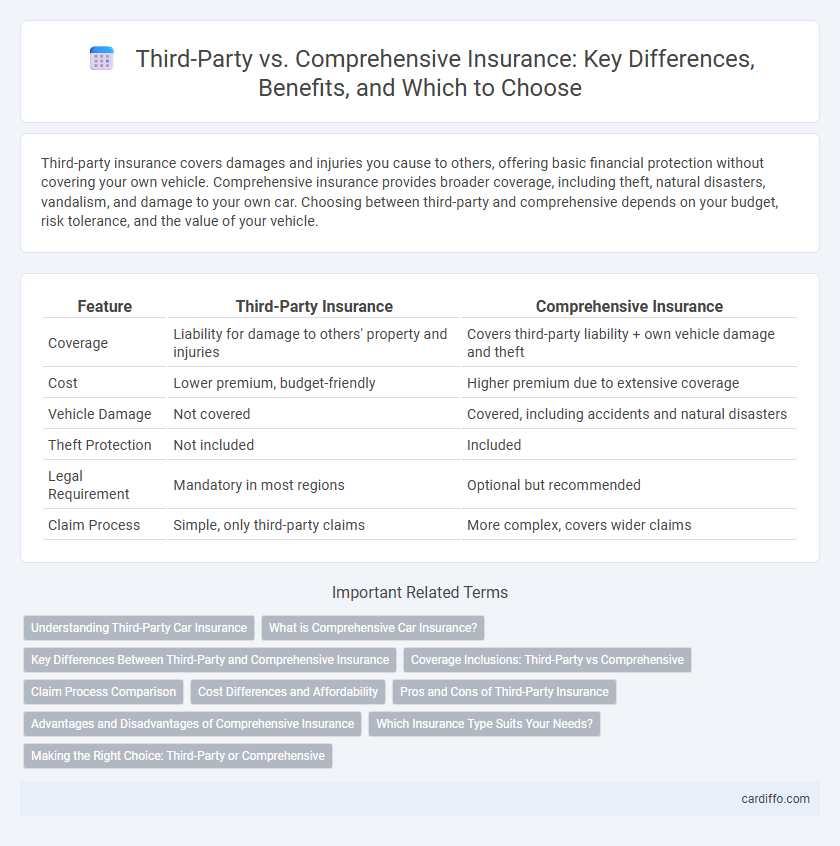

Third-party insurance covers damages and injuries you cause to others, offering basic financial protection without covering your own vehicle. Comprehensive insurance provides broader coverage, including theft, natural disasters, vandalism, and damage to your own car. Choosing between third-party and comprehensive depends on your budget, risk tolerance, and the value of your vehicle.

Table of Comparison

| Feature | Third-Party Insurance | Comprehensive Insurance |

|---|---|---|

| Coverage | Liability for damage to others' property and injuries | Covers third-party liability + own vehicle damage and theft |

| Cost | Lower premium, budget-friendly | Higher premium due to extensive coverage |

| Vehicle Damage | Not covered | Covered, including accidents and natural disasters |

| Theft Protection | Not included | Included |

| Legal Requirement | Mandatory in most regions | Optional but recommended |

| Claim Process | Simple, only third-party claims | More complex, covers wider claims |

Understanding Third-Party Car Insurance

Third-party car insurance primarily covers damages and injuries caused to others in an accident where the insured driver is at fault, offering liability protection without covering your own vehicle. This insurance type is often more affordable, making it a popular choice for budget-conscious drivers or those with older cars. Understanding the limitations and legal requirements of third-party coverage is essential to ensure adequate protection and compliance on the road.

What is Comprehensive Car Insurance?

Comprehensive car insurance provides extensive coverage beyond third-party liability, protecting against damage to your own vehicle from incidents such as theft, vandalism, natural disasters, and accidental damage. This type of insurance covers a wide range of risks, offering financial protection for repairs or replacement, regardless of fault in an accident. Drivers seeking broad protection often choose comprehensive policies to safeguard their investment and ensure peace of mind on the road.

Key Differences Between Third-Party and Comprehensive Insurance

Third-party insurance covers damages and injuries you cause to others, including property damage and bodily injury, while comprehensive insurance offers broader protection by covering your vehicle against theft, vandalism, natural disasters, and accidental damage in addition to third-party liabilities. Third-party insurance is typically cheaper but provides limited coverage, making it suitable for older or lower-value vehicles. Comprehensive insurance, though more expensive, ensures extensive financial protection by covering both third-party claims and losses to your own vehicle.

Coverage Inclusions: Third-Party vs Comprehensive

Third-party insurance primarily covers damages and injuries caused to others in an accident, including property damage and bodily injury liability but excludes coverage for the policyholder's own vehicle. Comprehensive insurance offers broader protection by covering third-party liabilities as well as damages to the policyholder's vehicle from non-collision events such as theft, fire, vandalism, natural disasters, and animal collisions. This extensive coverage ensures financial security against various risks beyond just accidents involving other parties.

Claim Process Comparison

Third-party insurance claims typically involve a straightforward process where only damages to the other party are assessed, resulting in faster settlements. Comprehensive insurance claims cover a broader range of incidents, including theft, fire, and self-inflicted damages, which often require more detailed documentation and inspections. The complexity of comprehensive claims can lead to longer processing times but offers more extensive coverage and financial protection.

Cost Differences and Affordability

Third-party insurance generally offers the most affordable option, covering damages or injuries caused to others without including protection for the policyholder's own vehicle. Comprehensive insurance, while more expensive, provides extensive coverage, including theft, natural disasters, and damage to the insured's car, justifying the higher premium. Cost differences between these policies depend on risk factors, vehicle value, and coverage scope, making third-party ideal for budget-conscious drivers and comprehensive suitable for those seeking broader protection.

Pros and Cons of Third-Party Insurance

Third-party insurance offers a cost-effective option by covering liabilities for damages and injuries to others but excludes protection for the policyholder's own vehicle and property. It is beneficial for low-risk drivers or older cars with limited value, providing legal compliance at a lower premium. However, the lack of coverage for theft, fire, or personal damages may result in significant out-of-pocket expenses in the event of an accident or unforeseen incidents.

Advantages and Disadvantages of Comprehensive Insurance

Comprehensive insurance offers extensive coverage, protecting against theft, vandalism, natural disasters, and accidental damage, which third-party insurance does not include. Its advantage lies in providing peace of mind with broader protection, but it comes at a higher premium cost and may include deductibles. While comprehensive insurance reduces financial risk, policyholders should assess if the higher expense aligns with their vehicle's value and usage.

Which Insurance Type Suits Your Needs?

Third-party insurance covers damages and injuries you cause to others, making it a cost-effective option for budget-conscious drivers. Comprehensive insurance provides broader protection, including theft, fire, and natural disasters, ideal for those with newer or high-value vehicles. Assess your vehicle's value, driving habits, and risk tolerance to determine which insurance type aligns best with your coverage needs.

Making the Right Choice: Third-Party or Comprehensive

Choosing between third-party and comprehensive car insurance depends on risk tolerance, budget, and vehicle value; third-party covers damages to others only, while comprehensive protects against theft, vandalism, and natural disasters. For newer or expensive vehicles, comprehensive insurance offers broader financial security and peace of mind. Evaluating personal driving habits and potential liabilities ensures selecting the policy that balances cost with adequate protection.

Third-Party vs Comprehensive Infographic

cardiffo.com

cardiffo.com