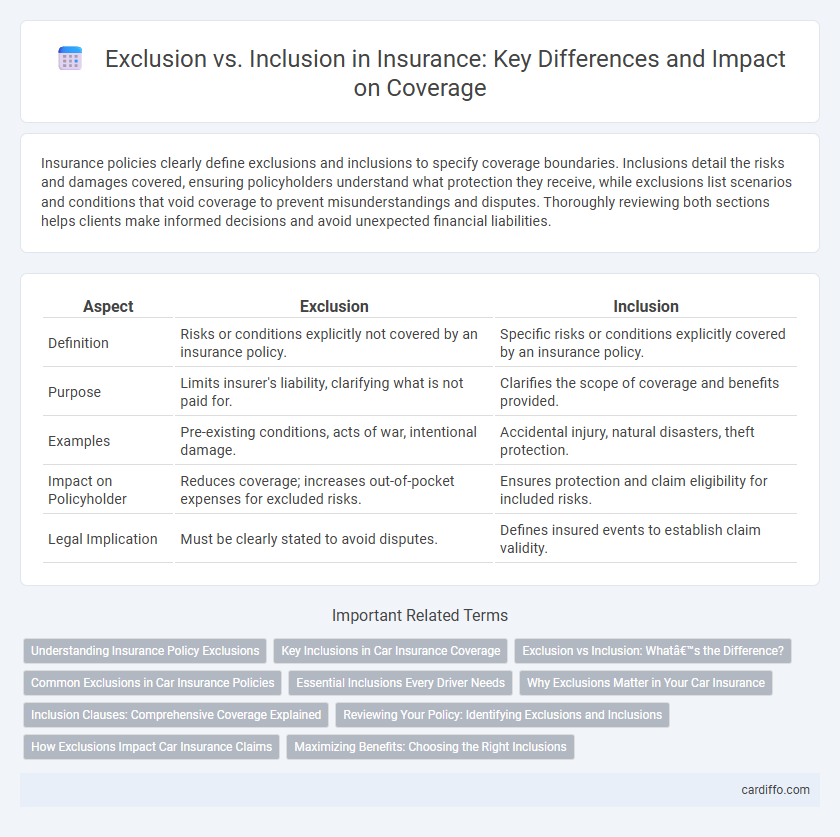

Insurance policies clearly define exclusions and inclusions to specify coverage boundaries. Inclusions detail the risks and damages covered, ensuring policyholders understand what protection they receive, while exclusions list scenarios and conditions that void coverage to prevent misunderstandings and disputes. Thoroughly reviewing both sections helps clients make informed decisions and avoid unexpected financial liabilities.

Table of Comparison

| Aspect | Exclusion | Inclusion |

|---|---|---|

| Definition | Risks or conditions explicitly not covered by an insurance policy. | Specific risks or conditions explicitly covered by an insurance policy. |

| Purpose | Limits insurer's liability, clarifying what is not paid for. | Clarifies the scope of coverage and benefits provided. |

| Examples | Pre-existing conditions, acts of war, intentional damage. | Accidental injury, natural disasters, theft protection. |

| Impact on Policyholder | Reduces coverage; increases out-of-pocket expenses for excluded risks. | Ensures protection and claim eligibility for included risks. |

| Legal Implication | Must be clearly stated to avoid disputes. | Defines insured events to establish claim validity. |

Understanding Insurance Policy Exclusions

Insurance policy exclusions define specific conditions, risks, or circumstances that are not covered under the contract, helping to limit the insurer's liability. Understanding these exclusions is crucial for policyholders to identify gaps in coverage and avoid unexpected financial losses. Clear knowledge of inclusion and exclusion clauses enables informed decisions when selecting insurance products suited to individual risk profiles.

Key Inclusions in Car Insurance Coverage

Key inclusions in car insurance coverage typically encompass liability protection for bodily injury and property damage, collision coverage for vehicle repairs after an accident, and comprehensive coverage safeguarding against theft, vandalism, and natural disasters. Medical payments or personal injury protection (PIP) offer coverage for medical expenses resulting from a car accident, regardless of fault. Understanding these core inclusions ensures policyholders receive essential financial protection and peace of mind on the road.

Exclusion vs Inclusion: What’s the Difference?

Exclusion and inclusion in insurance policies define the scope of coverage by specifying what is not covered versus what is covered. Exclusions are specific conditions, events, or circumstances explicitly omitted from protection, such as pre-existing medical conditions or certain natural disasters. Inclusions, conversely, detail the risks and perils the policy financially safeguards against, ensuring clear understanding of the insured's benefits and limitations.

Common Exclusions in Car Insurance Policies

Common exclusions in car insurance policies typically encompass damages caused by racing, intentional acts, and driving under the influence of alcohol or drugs. Coverage often excludes wear and tear, mechanical breakdowns, and damages resulting from using the vehicle for commercial purposes without proper endorsement. Understanding these exclusions helps policyholders avoid unexpected claim denials and ensures clarity on what incidents are covered under standard car insurance policies.

Essential Inclusions Every Driver Needs

Essential inclusions every driver needs in their insurance policy encompass liability coverage, collision coverage, and personal injury protection to ensure comprehensive financial protection. Liability coverage safeguards against costs from damages or injuries caused to others, while collision coverage addresses repair expenses for the driver's vehicle following an accident. Personal injury protection covers medical expenses and lost wages, delivering critical support in the event of bodily harm.

Why Exclusions Matter in Your Car Insurance

Exclusions in car insurance policies define specific scenarios or damages that are not covered, which directly impact the claims you can make and the financial risks you bear. Understanding these exclusions ensures you are aware of coverage limitations, preventing unexpected out-of-pocket expenses during accidents or repairs. Carefully reviewing exclusions alongside inclusions helps tailor your policy to suit your needs and avoid costly coverage gaps.

Inclusion Clauses: Comprehensive Coverage Explained

Inclusion clauses in insurance policies explicitly define the specific risks, events, or perils covered, enhancing the scope of protection provided to the insured. Comprehensive coverage typically incorporates broad inclusion clauses that protect against diverse risks such as theft, natural disasters, and accidents. Understanding these inclusions is essential for policyholders to ensure maximum protection and avoid unexpected coverage gaps.

Reviewing Your Policy: Identifying Exclusions and Inclusions

Reviewing your insurance policy requires a detailed examination of both exclusions and inclusions to understand coverage limits and potential gaps. Exclusions define specific risks or damages that the insurer will not cover, which can impact claim eligibility. Identifying inclusions ensures clarity on the protections provided, helping you tailor coverage to your needs and avoid unexpected out-of-pocket expenses.

How Exclusions Impact Car Insurance Claims

Exclusions in car insurance policies specify situations, damages, or conditions that are not covered, directly affecting claim approval and payout. Common exclusions such as intentional damage, racing, or driving under the influence can lead to claim denial, leaving policyholders financially responsible. Understanding specific exclusions ensures accurate risk management and avoids unexpected out-of-pocket expenses during the claim process.

Maximizing Benefits: Choosing the Right Inclusions

Selecting the right inclusions in an insurance policy maximizes benefits by ensuring critical risks are covered while minimizing uncovered exposures. Inclusions specify the exact protections and services provided, making it essential to tailor them to individual needs for comprehensive coverage. A strategic focus on key inclusions enhances claim eligibility and optimizes the overall value of the insurance plan.

Exclusion vs Inclusion Infographic

cardiffo.com

cardiffo.com