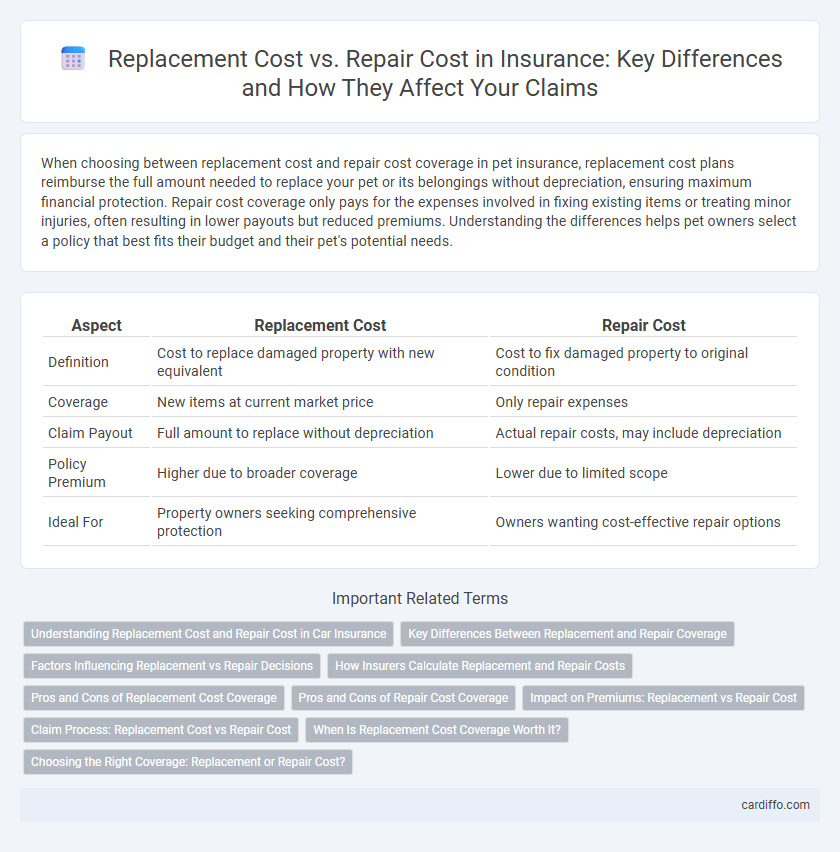

When choosing between replacement cost and repair cost coverage in pet insurance, replacement cost plans reimburse the full amount needed to replace your pet or its belongings without depreciation, ensuring maximum financial protection. Repair cost coverage only pays for the expenses involved in fixing existing items or treating minor injuries, often resulting in lower payouts but reduced premiums. Understanding the differences helps pet owners select a policy that best fits their budget and their pet's potential needs.

Table of Comparison

| Aspect | Replacement Cost | Repair Cost |

|---|---|---|

| Definition | Cost to replace damaged property with new equivalent | Cost to fix damaged property to original condition |

| Coverage | New items at current market price | Only repair expenses |

| Claim Payout | Full amount to replace without depreciation | Actual repair costs, may include depreciation |

| Policy Premium | Higher due to broader coverage | Lower due to limited scope |

| Ideal For | Property owners seeking comprehensive protection | Owners wanting cost-effective repair options |

Understanding Replacement Cost and Repair Cost in Car Insurance

Replacement cost in car insurance refers to the amount needed to purchase a new vehicle of similar make and model without depreciation deduction, ensuring full value recovery after a total loss. Repair cost covers expenses for fixing damages to the existing vehicle, including parts and labor, often subject to depreciation and policy limits. Understanding the distinction helps policyholders choose coverage options that best match their needs for accident recovery and financial protection.

Key Differences Between Replacement and Repair Coverage

Replacement cost coverage pays the full amount needed to replace damaged property with new items of similar kind and quality, without deducting for depreciation. Repair cost coverage reimburses only the expenses required to restore the damaged item to its pre-loss condition, often factoring in wear and tear. Understanding these differences helps policyholders choose the appropriate insurance to match their financial protection needs in case of property damage.

Factors Influencing Replacement vs Repair Decisions

Replacement cost and repair cost decisions in insurance depend heavily on factors such as the extent of property damage, the age and condition of the insured item, and current market prices for materials and labor. Policy limits, deductibles, and coverage terms also play critical roles in evaluating whether repairing or replacing an asset is economically viable. Evaluating potential depreciation and future risk exposure further influences the insurer's and policyholder's preferred approach to restoration or replacement.

How Insurers Calculate Replacement and Repair Costs

Insurers calculate replacement cost by determining the current market price to rebuild or replace an asset with materials of similar kind and quality, excluding depreciation. Repair cost is assessed based on the expenses required to restore the damaged property to its pre-loss condition, often involving labor, materials, and contractor fees. Actuaries use construction cost indexes, labor rates, and material prices to accurately estimate these values for underwriting and claim settlements.

Pros and Cons of Replacement Cost Coverage

Replacement cost coverage pays the full expense to replace damaged or destroyed property without depreciation deductions, ensuring policyholders receive funds to restore items to their original condition. It eliminates out-of-pocket expenses for repairs or replacement but typically comes with higher premiums compared to actual cash value coverage. The downside includes potential coverage limits that may not fully cover the price of newer or upgraded items, requiring careful policy evaluation to avoid gaps.

Pros and Cons of Repair Cost Coverage

Repair cost coverage typically offers lower premiums than replacement cost coverage, making it more affordable for many policyholders. It only reimburses the actual expenses needed to fix the damaged property, which can limit payouts if repairs are extensive or if the item is severely depreciated. The main drawback is potential underinsurance, as repair costs may not fully restore the property's original value or functionality after significant damage.

Impact on Premiums: Replacement vs Repair Cost

Replacement cost coverage often leads to higher insurance premiums because it pays the full amount to replace damaged property without deducting for depreciation, providing more comprehensive protection. Repair cost coverage usually results in lower premiums, as it only covers the expenses necessary to restore the item to its pre-damage condition, which can be less expensive than full replacement. Insurers price premiums based on the potential payout, making replacement cost policies more costly due to the greater financial risk involved.

Claim Process: Replacement Cost vs Repair Cost

The claim process for replacement cost insurance involves assessing the full cost to replace damaged property with new items of similar kind and quality, ensuring policyholders receive adequate compensation without depreciation deductions. In contrast, repair cost claims focus on covering expenses necessary to restore the damaged property to its original condition, often resulting in lower payouts limited to repair expenses only. Understanding these differences is crucial for accurately filing claims and maximizing insurance benefits during property damage settlements.

When Is Replacement Cost Coverage Worth It?

Replacement cost coverage is worth it when the cost to rebuild or replace damaged property significantly exceeds its current market value or depreciation-adjusted repair expenses. Homeowners with newer or high-value assets benefit most, as replacement cost ensures full restoration without out-of-pocket losses. Properties in areas prone to extensive damage, such as natural disasters, also justify replacement cost coverage to avoid underinsurance gaps.

Choosing the Right Coverage: Replacement or Repair Cost?

Choosing between replacement cost and repair cost coverage depends on the value and condition of your insured property, as replacement cost coverage reimburses the full cost to replace damaged items without depreciation, offering greater financial protection. Repair cost coverage pays only for fixing the damage, often resulting in lower premiums but potentially higher out-of-pocket expenses if the item cannot be fully restored. Evaluating your property's age, replacement expenses, and risk tolerance is crucial to selecting the most appropriate insurance coverage.

Replacement Cost vs Repair Cost Infographic

cardiffo.com

cardiffo.com