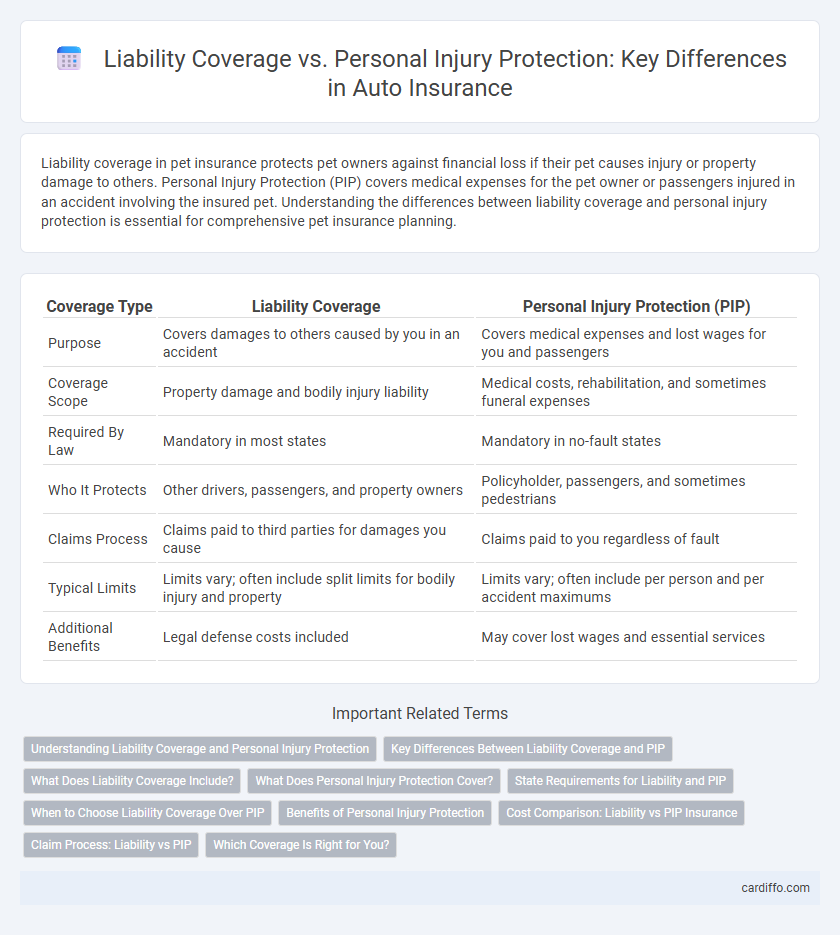

Liability coverage in pet insurance protects pet owners against financial loss if their pet causes injury or property damage to others. Personal Injury Protection (PIP) covers medical expenses for the pet owner or passengers injured in an accident involving the insured pet. Understanding the differences between liability coverage and personal injury protection is essential for comprehensive pet insurance planning.

Table of Comparison

| Coverage Type | Liability Coverage | Personal Injury Protection (PIP) |

|---|---|---|

| Purpose | Covers damages to others caused by you in an accident | Covers medical expenses and lost wages for you and passengers |

| Coverage Scope | Property damage and bodily injury liability | Medical costs, rehabilitation, and sometimes funeral expenses |

| Required By Law | Mandatory in most states | Mandatory in no-fault states |

| Who It Protects | Other drivers, passengers, and property owners | Policyholder, passengers, and sometimes pedestrians |

| Claims Process | Claims paid to third parties for damages you cause | Claims paid to you regardless of fault |

| Typical Limits | Limits vary; often include split limits for bodily injury and property | Limits vary; often include per person and per accident maximums |

| Additional Benefits | Legal defense costs included | May cover lost wages and essential services |

Understanding Liability Coverage and Personal Injury Protection

Liability coverage protects you financially by covering damages or injuries you cause to others in an accident, including property damage and medical expenses. Personal Injury Protection (PIP) covers your own medical expenses and lost wages regardless of fault, providing broader protection for bodily injuries sustained in an accident. Understanding the distinction helps ensure appropriate insurance that meets legal requirements and personal financial protection needs.

Key Differences Between Liability Coverage and PIP

Liability coverage primarily protects the insured driver by covering damages and injuries they cause to others in an accident, including property damage and bodily injury. Personal Injury Protection (PIP) covers the insured and passengers' medical expenses, lost wages, and other personal costs regardless of fault. The key difference lies in liability coverage focusing on third-party claims, while PIP ensures immediate medical and financial support for the insured party and passengers.

What Does Liability Coverage Include?

Liability coverage primarily includes bodily injury and property damage protection, covering medical expenses, lost wages, and legal fees if you're at fault in an accident. It also protects against damages caused to other people's vehicles, buildings, or personal property. This coverage does not extend to your own injuries or vehicle repairs.

What Does Personal Injury Protection Cover?

Personal Injury Protection (PIP) covers medical expenses, lost wages, and essential services resulting from injuries sustained in a covered accident, regardless of fault. Unlike Liability Coverage, which protects against damages you cause to others, PIP focuses on your own medical costs and related financial losses. It often includes coverage for rehabilitation, funeral expenses, and sometimes even childcare or household services during recovery.

State Requirements for Liability and PIP

Liability coverage is mandated by law in nearly every state to protect drivers against costs arising from bodily injury or property damage caused to others in an accident. Personal Injury Protection (PIP) requirements vary significantly, with some states enforcing "no-fault" insurance laws requiring PIP to cover medical expenses regardless of fault. Understanding state-specific minimum liability limits and whether PIP is compulsory is essential for compliance and optimal financial protection.

When to Choose Liability Coverage Over PIP

Choose liability coverage over personal injury protection (PIP) when seeking to safeguard against financial losses from bodily injury or property damage you cause to others in an accident. Liability coverage is essential for meeting state minimum insurance requirements and protecting your assets from lawsuits. Opt for liability coverage if you have adequate health insurance and want to prioritize coverage for damages caused to third parties rather than your own medical expenses.

Benefits of Personal Injury Protection

Personal Injury Protection (PIP) offers comprehensive coverage that pays for medical expenses, lost wages, and essential services regardless of fault, ensuring timely financial support after an accident. Unlike Liability Coverage, which only pays for damages you cause to others, PIP protects policyholders and passengers, providing faster access to care and minimizing out-of-pocket costs. This benefit is crucial in no-fault states, where PIP streamlines claims processing and enhances overall injury recovery support.

Cost Comparison: Liability vs PIP Insurance

Liability coverage typically offers lower premiums compared to Personal Injury Protection (PIP) insurance due to its limited scope, covering only bodily injury and property damage to others. In contrast, PIP insurance, often mandated in no-fault states, includes medical expenses, lost wages, and other personal injury costs, resulting in higher monthly premiums. Evaluating state requirements and individual risk factors is essential for cost-effective decision-making between liability and PIP coverage.

Claim Process: Liability vs PIP

The claim process for Liability Coverage involves proving fault and submitting evidence to the at-fault party's insurance company, which then assesses damages and negotiates settlements based on the insured's legal responsibility. Personal Injury Protection (PIP) claims are processed directly through the claimant's own insurance provider, allowing quicker access to medical benefits and lost wage reimbursements regardless of fault. PIP limits often dictate the extent of coverage payout, while liability claims may require prolonged investigations to establish fault and damage amounts.

Which Coverage Is Right for You?

Liability coverage protects you from financial responsibility if you cause injury or property damage to others in an accident, making it essential for drivers who want to comply with state laws and avoid costly lawsuits. Personal Injury Protection (PIP) covers your medical expenses and lost wages regardless of fault, ideal for those seeking comprehensive health and income support after an accident. Choosing the right coverage depends on your state's requirements, your health insurance status, and your financial ability to handle medical or legal costs following a collision.

Liability Coverage vs Personal Injury Protection Infographic

cardiffo.com

cardiffo.com