The total loss threshold determines the point at which an insured vehicle is considered a total loss based on repair costs relative to its pre-accident value. Salvage value refers to the estimated residual worth of the damaged vehicle after a total loss declaration, often influencing the insurer's payout amount. Understanding the distinction between total loss threshold and salvage value is essential for policyholders to accurately assess claim settlements and vehicle recovery options.

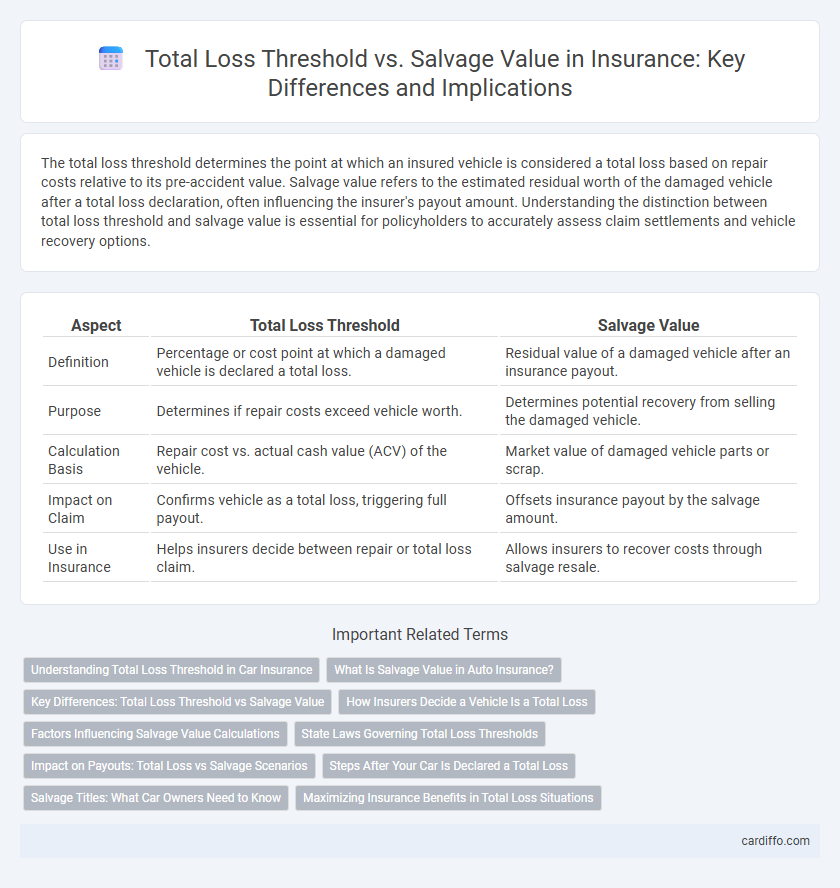

Table of Comparison

| Aspect | Total Loss Threshold | Salvage Value |

|---|---|---|

| Definition | Percentage or cost point at which a damaged vehicle is declared a total loss. | Residual value of a damaged vehicle after an insurance payout. |

| Purpose | Determines if repair costs exceed vehicle worth. | Determines potential recovery from selling the damaged vehicle. |

| Calculation Basis | Repair cost vs. actual cash value (ACV) of the vehicle. | Market value of damaged vehicle parts or scrap. |

| Impact on Claim | Confirms vehicle as a total loss, triggering full payout. | Offsets insurance payout by the salvage amount. |

| Use in Insurance | Helps insurers decide between repair or total loss claim. | Allows insurers to recover costs through salvage resale. |

Understanding Total Loss Threshold in Car Insurance

The total loss threshold in car insurance defines the maximum repair cost percentage relative to the vehicle's actual cash value before it is declared a total loss. When repair expenses exceed this threshold, insurers consider the car non-repairable and may pay the policyholder the vehicle's actual cash value minus any deductible. Understanding this threshold is crucial because it determines whether a damaged vehicle is repaired, salvaged, or deemed a total loss, directly impacting claim settlements and premium calculations.

What Is Salvage Value in Auto Insurance?

Salvage value in auto insurance refers to the estimated worth of a vehicle after it has been declared a total loss due to damage or accident. It is the amount an insurer expects to recover by selling the damaged vehicle or its parts, influencing the payout to the policyholder. Determining salvage value helps insurers balance claim costs with potential recovery, impacting total loss settlements.

Key Differences: Total Loss Threshold vs Salvage Value

Total loss threshold defines the damage level at which an insurer declares a vehicle a total loss, typically expressed as a percentage of its pre-accident value, while salvage value refers to the estimated worth of the damaged vehicle if sold for parts or repair. The key difference lies in their role: total loss threshold determines insurance payout decisions, whereas salvage value influences the insurer's recovery after a claim settlement. Understanding both metrics is essential for assessing claim outcomes and vehicle disposition in insurance processes.

How Insurers Decide a Vehicle Is a Total Loss

Insurers determine a vehicle is a total loss when repair costs exceed the total loss threshold, typically a percentage of the vehicle's actual cash value, often ranging from 60% to 80%. The salvage value, representing the estimated worth of the damaged vehicle's components, influences this decision by offsetting potential recovery from selling the vehicle's remains. Evaluating both the repair estimate and salvage value ensures an economically sound outcome, balancing claim payout with restitution from the salvage process.

Factors Influencing Salvage Value Calculations

Factors influencing salvage value calculations include the vehicle's pre-accident condition, market demand for parts, and repair costs relative to its current value. Insurance companies assess salvage value by evaluating the anticipated resale price of damaged components and materials after a total loss declaration. Geographic location and availability of recycling facilities also impact the salvage value, affecting overall claim settlements.

State Laws Governing Total Loss Thresholds

State laws governing total loss thresholds vary significantly, establishing the percentage of vehicle damage relative to its pre-accident value that qualifies it as a total loss. These thresholds often range from 50% to 80%, directly impacting insurance claim settlements and repair decisions. Salvage value, the estimated worth of a damaged vehicle deemed a total loss, is also regulated to ensure accurate compensation and proper disposal or resale processes.

Impact on Payouts: Total Loss vs Salvage Scenarios

Total loss threshold determines when an insurer deems a vehicle irreparable, directly influencing the payout amount by covering the vehicle's pre-accident value rather than repair costs. Salvage value represents the estimated worth of a damaged vehicle sold for parts or scrap, which insurers deduct from the total loss payout to calculate the final reimbursement. Understanding the interplay between total loss thresholds and salvage values is essential for accurate claim settlements and optimizing policyholder compensation.

Steps After Your Car Is Declared a Total Loss

After your car is declared a total loss, the insurance company calculates the actual cash value (ACV) based on market conditions and compares it to the total loss threshold, which varies by state but typically ranges from 50% to 80% of the vehicle's pre-accident value. If the repair costs exceed this threshold, the insurer pays you the ACV minus any deductible and takes ownership of the salvage vehicle. The salvage value represents the amount the insurer expects to recover by selling the damaged car to salvage yards or at auction, influencing your settlement but not the total loss payout itself.

Salvage Titles: What Car Owners Need to Know

Salvage titles indicate a vehicle has been significantly damaged and deemed a total loss by an insurance company, typically when repair costs exceed the total loss threshold, often around 70-75% of the car's value. Car owners with a salvage title must understand that these vehicles usually have reduced market value and may face limitations on registration and insurance coverage. Knowing the difference between total loss threshold and salvage value helps owners make informed decisions about repairs, resale, and potential safety concerns.

Maximizing Insurance Benefits in Total Loss Situations

Maximizing insurance benefits in total loss situations requires understanding the total loss threshold, which is the damage extent at which repair costs exceed the vehicle's actual cash value, leading insurers to declare it a total loss. The salvage value, representing the estimated worth of a damaged vehicle's remnants, directly impacts the insurance payout by reducing the insurer's total loss liability. Policyholders should negotiate based on accurate assessments of both the total loss threshold and salvage value to optimize their compensation and facilitate vehicle replacement.

Total loss threshold vs Salvage value Infographic

cardiffo.com

cardiffo.com