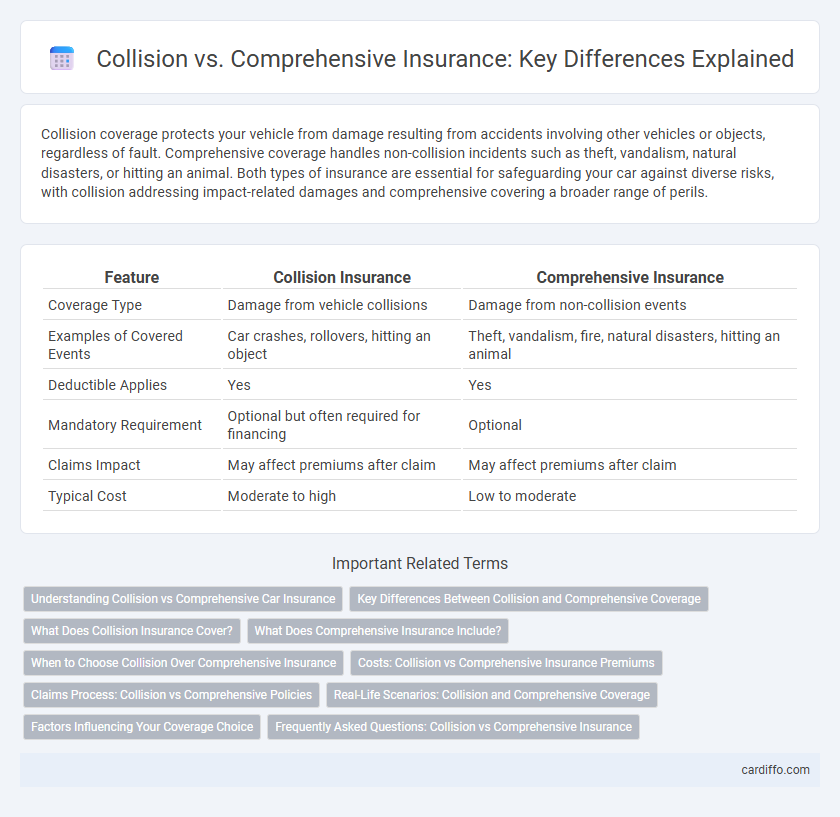

Collision coverage protects your vehicle from damage resulting from accidents involving other vehicles or objects, regardless of fault. Comprehensive coverage handles non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. Both types of insurance are essential for safeguarding your car against diverse risks, with collision addressing impact-related damages and comprehensive covering a broader range of perils.

Table of Comparison

| Feature | Collision Insurance | Comprehensive Insurance |

|---|---|---|

| Coverage Type | Damage from vehicle collisions | Damage from non-collision events |

| Examples of Covered Events | Car crashes, rollovers, hitting an object | Theft, vandalism, fire, natural disasters, hitting an animal |

| Deductible Applies | Yes | Yes |

| Mandatory Requirement | Optional but often required for financing | Optional |

| Claims Impact | May affect premiums after claim | May affect premiums after claim |

| Typical Cost | Moderate to high | Low to moderate |

Understanding Collision vs Comprehensive Car Insurance

Collision car insurance covers damage to your vehicle resulting from a collision with another car or object, providing essential protection for accidents on the road. Comprehensive car insurance protects against non-collision events such as theft, vandalism, natural disasters, and animal collisions, offering broader coverage beyond traffic incidents. Understanding the differences between collision and comprehensive insurance helps drivers choose the right policy to safeguard their vehicle against various risks.

Key Differences Between Collision and Comprehensive Coverage

Collision coverage insures damages to your vehicle resulting from a collision with another car or object, regardless of fault, while comprehensive coverage protects against non-collision-related incidents such as theft, vandalism, natural disasters, and animal strikes. Collision claims typically involve repairs due to impact, whereas comprehensive claims address a broader range of risks including weather damage and windshield cracks. Policy premiums vary based on factors like vehicle value, driving history, and coverage limits, with comprehensive often being less expensive than collision coverage.

What Does Collision Insurance Cover?

Collision insurance covers damage to your vehicle resulting from a collision with another car, object, or as a result of flipping over. It pays for repairs or replacement costs regardless of who is at fault in the accident. This coverage is essential for protecting your vehicle from sudden impacts and accidents on the road.

What Does Comprehensive Insurance Include?

Comprehensive insurance covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, fire, falling objects, and animal strikes. It also includes protection against windshield damage and weather-related incidents like hail or flooding. This type of coverage complements collision insurance by addressing a wider range of risks not involving vehicle-to-vehicle impact.

When to Choose Collision Over Comprehensive Insurance

Choose collision insurance when your vehicle is at higher risk of sustaining damage from accidents involving other vehicles or objects, such as collisions, rollovers, or hitting a guardrail. Comprehensive insurance is better suited for non-collision incidents like theft, vandalism, natural disasters, or animals striking your car. Opt for collision coverage if you drive frequently in heavy traffic or high-risk areas where accident damages are more likely and repair costs may be substantial.

Costs: Collision vs Comprehensive Insurance Premiums

Collision insurance premiums are generally higher because they cover damages to your vehicle resulting from accidents with other vehicles or objects, reflecting the higher risk and repair costs associated with collisions. Comprehensive insurance premiums tend to be lower since they protect against non-collision incidents, such as theft, vandalism, or natural disasters, which are statistically less frequent but still significant. The overall cost difference also depends on factors like vehicle value, location, and driving history, impacting both collision and comprehensive insurance rates.

Claims Process: Collision vs Comprehensive Policies

Collision insurance claims typically involve repairs or replacements after accidents with other vehicles or objects, requiring thorough documentation such as police reports and repair estimates. Comprehensive insurance claims address non-collision damages like theft, vandalism, or natural disasters, often demanding evidence like photographs and incident reports. Both processes prioritize prompt filing and detailed records to ensure smooth claim approvals and timely settlements.

Real-Life Scenarios: Collision and Comprehensive Coverage

Collision coverage protects your vehicle from damage resulting from accidents with other vehicles or objects, such as hitting a guardrail or another car in a parking lot. Comprehensive coverage addresses non-collision-related incidents including theft, vandalism, natural disasters, and falling objects like tree branches. Choosing both coverages ensures protection in real-life scenarios ranging from car accidents to weather damage and theft, minimizing out-of-pocket repair costs.

Factors Influencing Your Coverage Choice

Factors influencing your choice between collision and comprehensive insurance include the value and age of your vehicle, your driving habits, and the risks specific to your location such as theft rates or weather conditions. Collision insurance primarily covers damages from accidents with other vehicles or objects, while comprehensive insurance protects against non-collision events like theft, vandalism, or natural disasters. Evaluating your deductible, premium costs, and potential out-of-pocket expenses helps optimize your coverage for financial protection and peace of mind.

Frequently Asked Questions: Collision vs Comprehensive Insurance

Collision insurance covers damage to your vehicle resulting from a collision with another car or object, while comprehensive insurance protects against non-collision incidents such as theft, vandalism, fire, or natural disasters. Many drivers ask if they need both types of coverage, and the answer depends on factors like vehicle value, loan requirements, and personal risk tolerance. Understanding the distinctions helps policyholders make informed decisions about which coverage best suits their needs and financial protection.

Collision vs Comprehensive Infographic

cardiffo.com

cardiffo.com