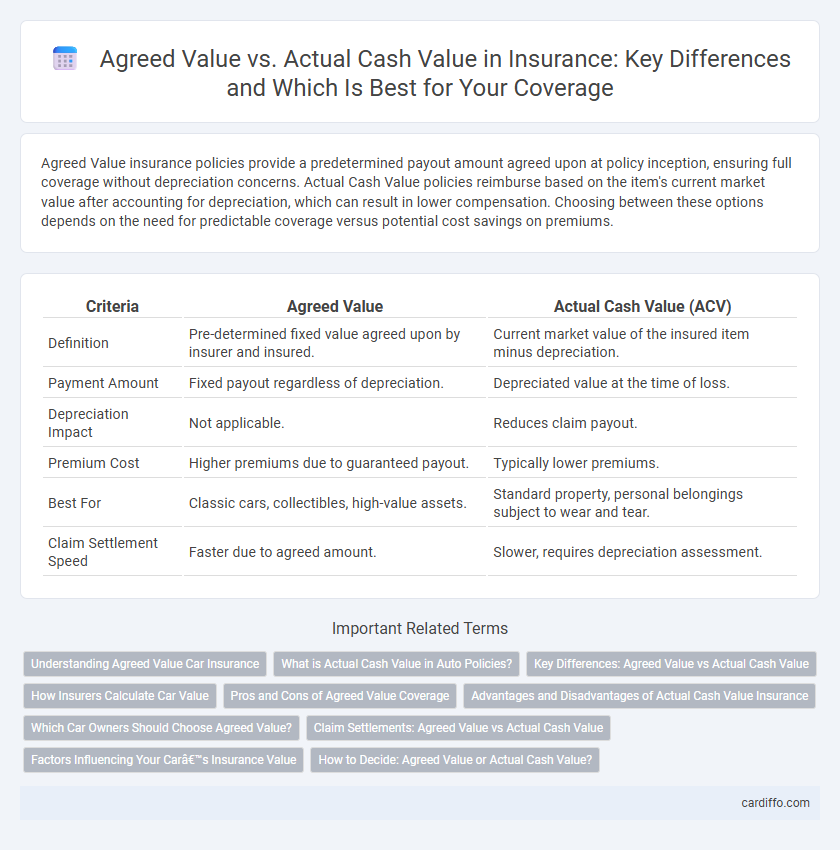

Agreed Value insurance policies provide a predetermined payout amount agreed upon at policy inception, ensuring full coverage without depreciation concerns. Actual Cash Value policies reimburse based on the item's current market value after accounting for depreciation, which can result in lower compensation. Choosing between these options depends on the need for predictable coverage versus potential cost savings on premiums.

Table of Comparison

| Criteria | Agreed Value | Actual Cash Value (ACV) |

|---|---|---|

| Definition | Pre-determined fixed value agreed upon by insurer and insured. | Current market value of the insured item minus depreciation. |

| Payment Amount | Fixed payout regardless of depreciation. | Depreciated value at the time of loss. |

| Depreciation Impact | Not applicable. | Reduces claim payout. |

| Premium Cost | Higher premiums due to guaranteed payout. | Typically lower premiums. |

| Best For | Classic cars, collectibles, high-value assets. | Standard property, personal belongings subject to wear and tear. |

| Claim Settlement Speed | Faster due to agreed amount. | Slower, requires depreciation assessment. |

Understanding Agreed Value Car Insurance

Agreed Value car insurance offers policyholders a predetermined payout amount in case of total loss, ensuring full compensation based on the vehicle's agreed worth at policy inception rather than market depreciation. This contrasts with Actual Cash Value coverage, which factors in depreciation, often resulting in a lower settlement. Understanding the benefits of Agreed Value coverage is essential for classic car owners and enthusiasts seeking reliable financial protection against depreciation risks.

What is Actual Cash Value in Auto Policies?

Actual Cash Value (ACV) in auto insurance policies refers to the amount an insurer pays for a vehicle based on its current market value, considering depreciation and wear and tear. This valuation method deducts factors such as age, mileage, and condition from the original purchase price to reflect the car's realistic worth at the time of loss. ACV contrasts with Agreed Value policies, which pay a pre-determined amount agreed upon by the insurer and policyholder regardless of depreciation.

Key Differences: Agreed Value vs Actual Cash Value

Agreed Value insurance offers a predetermined payout amount agreed upon by both insurer and insured at policy inception, ensuring full coverage without depreciation deductions in case of a claim. Actual Cash Value (ACV) insurance calculates compensation based on the replacement cost minus depreciation, reflecting the item's depreciated market value at the time of loss. Choosing Agreed Value provides certainty and protection against fluctuating market values, while Actual Cash Value provides lower premiums but potential gaps between claim payments and replacement costs.

How Insurers Calculate Car Value

Insurers calculate car value using two primary methods: Agreed Value and Actual Cash Value (ACV). Agreed Value is determined by a preset amount agreed upon in the policy before a loss, ensuring the insured receives that exact sum without depreciation considerations. In contrast, ACV reflects the vehicle's market value at the time of loss, factoring in depreciation, mileage, condition, and market trends to establish a fair payout.

Pros and Cons of Agreed Value Coverage

Agreed Value coverage guarantees a fixed payout amount determined at the policy's inception, offering certainty and protection against depreciation, which is especially beneficial for classic cars or valuable assets. This coverage avoids disputes during claims by establishing a predetermined settlement amount, but it often comes with higher premiums compared to Actual Cash Value policies. However, if the asset's market value decreases significantly, the insurer may overpay, potentially leading to increased costs for policyholders.

Advantages and Disadvantages of Actual Cash Value Insurance

Actual Cash Value (ACV) insurance offers the advantage of lower premium costs by reimbursing policyholders for the depreciated value of damaged or stolen property, reflecting wear and age. A significant disadvantage is that ACV payments may not fully cover replacement costs, potentially leaving insured parties responsible for out-of-pocket expenses. This valuation method provides a more immediate settlement but can result in financial shortfalls during major claims compared to replacement cost policies.

Which Car Owners Should Choose Agreed Value?

Car owners with classic, vintage, or high-value vehicles should choose Agreed Value insurance to ensure full coverage based on a predetermined amount agreed upon at the policy's inception. This option protects against depreciation and provides financial security if the car is totaled or stolen. Agreed Value is ideal for those seeking predictable settlement amounts without the uncertainty of market fluctuations inherent in Actual Cash Value policies.

Claim Settlements: Agreed Value vs Actual Cash Value

Claim settlements in insurance often differ significantly between Agreed Value and Actual Cash Value policies. Agreed Value policies guarantee a predetermined payout amount specified in the contract, ensuring full reimbursement regardless of depreciation or market fluctuations. Actual Cash Value policies reimburse the insured based on the asset's depreciation at the time of loss, resulting in lower claim payouts that reflect the item's current market value rather than its original or insured value.

Factors Influencing Your Car’s Insurance Value

Factors influencing your car's insurance value include its age, mileage, condition, and market demand, which affect whether agreed value or actual cash value (ACV) coverage is more suitable. Agreed value policies provide a predetermined payout based on a mutually accepted value, beneficial for classic or collector cars with stable or appreciating worth. ACV policies consider depreciation, offering coverage based on the car's current market value, which can fluctuate with usage, wear, and external market conditions.

How to Decide: Agreed Value or Actual Cash Value?

Choosing between Agreed Value and Actual Cash Value depends on the item's depreciation and replacement cost accuracy. Agreed Value ensures a fixed payout based on a predetermined amount, ideal for unique, collectible, or vintage items. Actual Cash Value suits standard property with fluctuating market values, reflecting replacement cost minus depreciation at the time of loss.

Agreed Value vs Actual Cash Value Infographic

cardiffo.com

cardiffo.com