Telematics-based insurance uses real-time data from devices to assess pet activity and health, enabling personalized premium adjustments and proactive care recommendations. Traditional underwriting relies on static factors like breed, age, and medical history, often resulting in less precise risk evaluation. Incorporating telematics enhances accuracy in pricing and promotes better health outcomes through continuous monitoring.

Table of Comparison

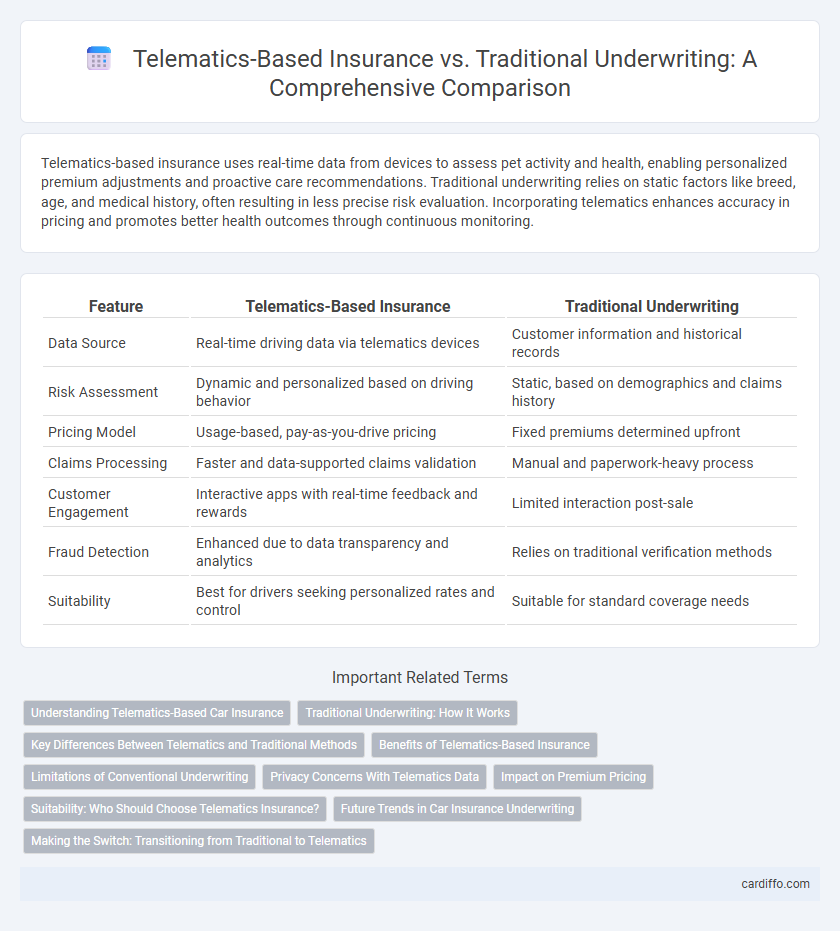

| Feature | Telematics-Based Insurance | Traditional Underwriting |

|---|---|---|

| Data Source | Real-time driving data via telematics devices | Customer information and historical records |

| Risk Assessment | Dynamic and personalized based on driving behavior | Static, based on demographics and claims history |

| Pricing Model | Usage-based, pay-as-you-drive pricing | Fixed premiums determined upfront |

| Claims Processing | Faster and data-supported claims validation | Manual and paperwork-heavy process |

| Customer Engagement | Interactive apps with real-time feedback and rewards | Limited interaction post-sale |

| Fraud Detection | Enhanced due to data transparency and analytics | Relies on traditional verification methods |

| Suitability | Best for drivers seeking personalized rates and control | Suitable for standard coverage needs |

Understanding Telematics-Based Car Insurance

Telematics-based car insurance utilizes real-time data from vehicle sensors and GPS to assess driving behavior, enabling personalized premiums based on factors like speed, braking patterns, and mileage. This approach contrasts with traditional underwriting, which relies on static information such as age, driving history, and credit scores collected at policy inception. By leveraging telematics, insurers improve risk accuracy and offer incentives for safer driving, potentially lowering costs and enhancing customer engagement.

Traditional Underwriting: How It Works

Traditional underwriting in insurance involves assessing risk through demographic data, credit scores, and historical claims to determine premium rates. Underwriters evaluate factors like age, occupation, and driving history, relying on standardized risk classification tables. This method emphasizes statistical data and subjective judgment to predict potential losses and set coverage terms.

Key Differences Between Telematics and Traditional Methods

Telematics-based insurance utilizes real-time driving data collected from devices or smartphone apps to assess risk more accurately, while traditional underwriting relies on historical data such as credit scores, claims history, and demographic factors. Telematics enables personalized premiums based on actual driving behavior, promoting safer driving habits and potentially lowering costs. In contrast, traditional methods apply broader risk categories and may not reflect individual driving patterns, resulting in less precise pricing.

Benefits of Telematics-Based Insurance

Telematics-based insurance leverages real-time driving data to offer personalized premiums, rewarding safe driving behaviors and encouraging risk reduction. This approach enhances accuracy in risk assessment compared to traditional underwriting, which relies on historical data and broad demographic factors. As a result, policyholders benefit from potentially lower costs, improved claims processing, and greater transparency in their insurance coverage.

Limitations of Conventional Underwriting

Conventional underwriting relies heavily on static data such as age, gender, and historical claims, often leading to generalized risk assessments that may not accurately reflect individual driving behavior. This traditional approach lacks real-time data integration, resulting in limited personalization and potential discrimination against safe drivers with higher-risk profiles. Consequently, it can miss opportunities for precise risk evaluation and cost savings that telematics-based insurance models offer through continuous monitoring of actual driving patterns.

Privacy Concerns With Telematics Data

Telematics-based insurance leverages real-time driving data collected via GPS and onboard diagnostics to tailor premiums but raises significant privacy concerns due to extensive personal data tracking. Unlike traditional underwriting, which relies on historical and demographic information, telematics exposes granular behavior patterns that may be vulnerable to misuse or unauthorized access. Ensuring robust data encryption and transparent consent policies is critical to mitigate potential privacy risks and maintain customer trust in telematics insurance models.

Impact on Premium Pricing

Telematics-based insurance leverages real-time driving data to create personalized risk profiles, resulting in more accurate and often lower premium pricing compared to traditional underwriting methods, which rely on historical and demographic information. This dynamic pricing model rewards safe driving behaviors by adjusting premiums based on actual driving patterns rather than static risk factors. Insurers benefit from reduced claim costs and improved risk assessment accuracy, broadening access to fair-priced policies.

Suitability: Who Should Choose Telematics Insurance?

Telematics-based insurance is most suitable for safe, low-mileage drivers who prefer personalized premiums reflecting their actual driving behavior. Traditional underwriting remains ideal for those with inconsistent driving patterns or limited access to telematics devices. Choosing telematics insurance benefits tech-savvy individuals seeking cost savings through improved driving habits.

Future Trends in Car Insurance Underwriting

Telematics-based insurance leverages real-time driving data from connected devices to personalize premiums, enhancing risk assessment accuracy compared to traditional underwriting methods relying on static historical data. Emerging trends indicate a shift toward greater integration of AI and machine learning to analyze telematics data, enabling dynamic pricing models and predictive risk management. The future of car insurance underwriting emphasizes continuous monitoring and behavioral analysis, driving improved customer engagement and fraud reduction.

Making the Switch: Transitioning from Traditional to Telematics

Transitioning from traditional underwriting to telematics-based insurance requires integrating real-time data collection through IoT devices that monitor driving behavior, enabling personalized risk assessment and dynamic premium adjustments. Insurers must invest in data analytics infrastructure to process telematics data securely, ensuring compliance with regulations such as GDPR and HIPAA. Educating customers on privacy safeguards and the benefits of usage-based insurance fosters trust and accelerates adoption of telematics policies.

Telematics-Based Insurance vs Traditional Underwriting Infographic

cardiffo.com

cardiffo.com