Third-party pet insurance covers damages or injuries your pet causes to others, while fully comprehensive policies offer broader protection, including veterinary bills for illnesses and accidents. Choosing between third-party and fully comprehensive depends on your pet's health risk and your budget for potential medical expenses. Fully comprehensive plans provide peace of mind with extensive coverage but come at a higher premium compared to basic third-party options.

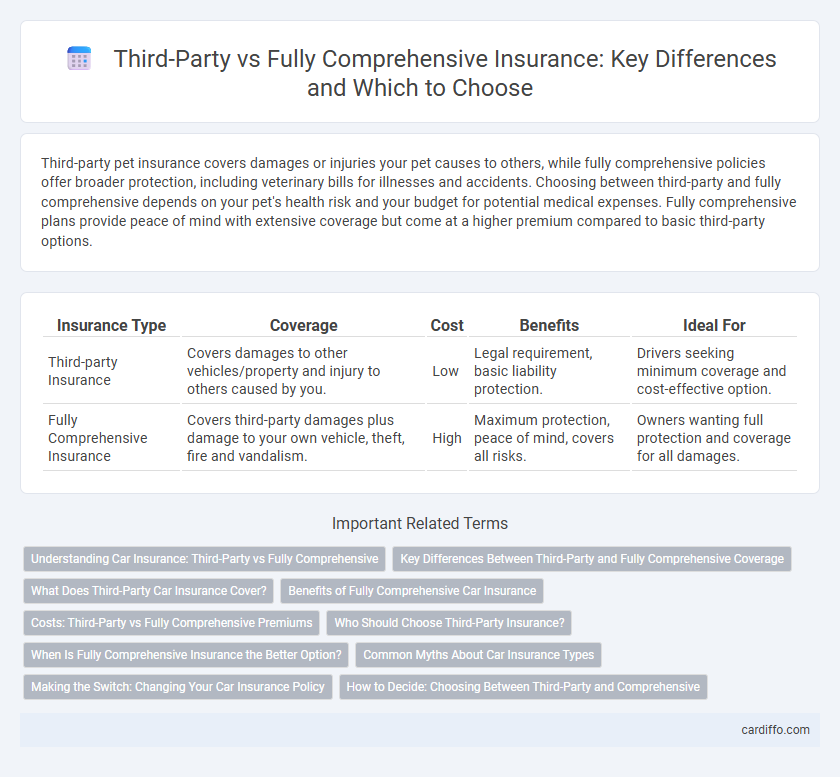

Table of Comparison

| Insurance Type | Coverage | Cost | Benefits | Ideal For |

|---|---|---|---|---|

| Third-party Insurance | Covers damages to other vehicles/property and injury to others caused by you. | Low | Legal requirement, basic liability protection. | Drivers seeking minimum coverage and cost-effective option. |

| Fully Comprehensive Insurance | Covers third-party damages plus damage to your own vehicle, theft, fire and vandalism. | High | Maximum protection, peace of mind, covers all risks. | Owners wanting full protection and coverage for all damages. |

Understanding Car Insurance: Third-Party vs Fully Comprehensive

Third-party car insurance covers damages and injuries you cause to others but excludes damage to your vehicle, making it the most basic and affordable option. Fully comprehensive insurance offers extensive protection by covering third-party liabilities along with repairs or replacement of your own car, theft, and damage from accidents, weather, or vandalism. Choosing between the two depends on factors like vehicle value, budget, and risk tolerance, with fully comprehensive providing peace of mind for new or high-value cars.

Key Differences Between Third-Party and Fully Comprehensive Coverage

Third-party insurance covers damages and injuries you cause to others, including their property, but excludes any damage to your own vehicle. Fully comprehensive insurance provides extensive protection, covering third-party liabilities, your vehicle's repair costs, theft, fire, and accidental damage. Choosing between these depends on factors like vehicle value, risk tolerance, and budget, with comprehensive offering broader security at a higher premium.

What Does Third-Party Car Insurance Cover?

Third-party car insurance covers damages and injuries you cause to other people, including their vehicles, property, and medical expenses, without covering your own vehicle. It provides legal liability protection if you are at fault in an accident, ensuring compensation for third parties involved. This type of insurance is often the minimum legal requirement for drivers, offering essential but limited financial protection compared to comprehensive policies.

Benefits of Fully Comprehensive Car Insurance

Fully comprehensive car insurance offers extensive coverage, protecting against damage to your vehicle, theft, fire, and third-party liabilities all in one policy. It provides peace of mind by covering repair costs regardless of fault, making it ideal for new or high-value cars. Policyholders benefit from additional perks such as personal accident cover, windscreen replacement, and roadside assistance, ensuring broader protection and support.

Costs: Third-Party vs Fully Comprehensive Premiums

Third-party insurance premiums are generally lower because they cover only damages to others, excluding the policyholder's vehicle and personal injuries. Fully comprehensive insurance premiums are higher due to extensive coverage, including damages to the insured vehicle, theft, fire, and personal injury protection. The cost difference reflects the broader risk coverage and claim potential associated with fully comprehensive policies.

Who Should Choose Third-Party Insurance?

Third-party insurance is ideal for budget-conscious drivers with older vehicles or low market value, as it provides basic coverage against damages to others without covering the policyholder's own losses. Drivers who rarely use their vehicles or live in low-risk areas may benefit from this cost-effective option while meeting legal requirements. Those seeking minimal premiums and willing to assume higher personal risk should consider third-party insurance over fully comprehensive plans.

When Is Fully Comprehensive Insurance the Better Option?

Fully comprehensive insurance is the better option when you own a new or high-value vehicle, providing extensive coverage against damage, theft, and third-party claims. It offers protection for both your car and others involved in an accident, minimizing financial risk for repairs and liability. Choosing fully comprehensive insurance ensures peace of mind in situations such as collision, vandalism, or natural disasters, where third-party policies offer limited or no protection.

Common Myths About Car Insurance Types

Many drivers mistakenly believe third-party insurance covers vehicle damage, but it only protects against liability for injuries or property damage to others. Fully comprehensive insurance includes coverage for the policyholder's own car, theft, and natural disasters, debunking the myth that it's solely for luxury vehicles. Another common misconception is that third-party insurance is always cheaper without exceptions; premiums can vary based on factors like driver history and vehicle type.

Making the Switch: Changing Your Car Insurance Policy

Switching from third-party to fully comprehensive car insurance enhances coverage by including damage to your own vehicle and theft protection, offering broader financial security. Before making the switch, compare premiums, policy terms, and coverage limits to ensure cost-effectiveness aligned with your driving needs. Notify your insurer about the change promptly to avoid lapses in coverage and secure updated documentation reflecting the new policy.

How to Decide: Choosing Between Third-Party and Comprehensive

Choosing between third-party and fully comprehensive insurance hinges on evaluating your vehicle's value, budget, and risk tolerance. Third-party insurance covers damages inflicted on others, making it cost-effective for older vehicles or minimal coverage needs, while comprehensive insurance offers broader protection, including theft and accidental damage, ideal for newer or high-value cars. Assessing factors such as coverage limits, premium costs, and potential out-of-pocket expenses helps tailor the choice to your specific financial and protection requirements.

Third-party vs Fully Comprehensive Infographic

cardiffo.com

cardiffo.com