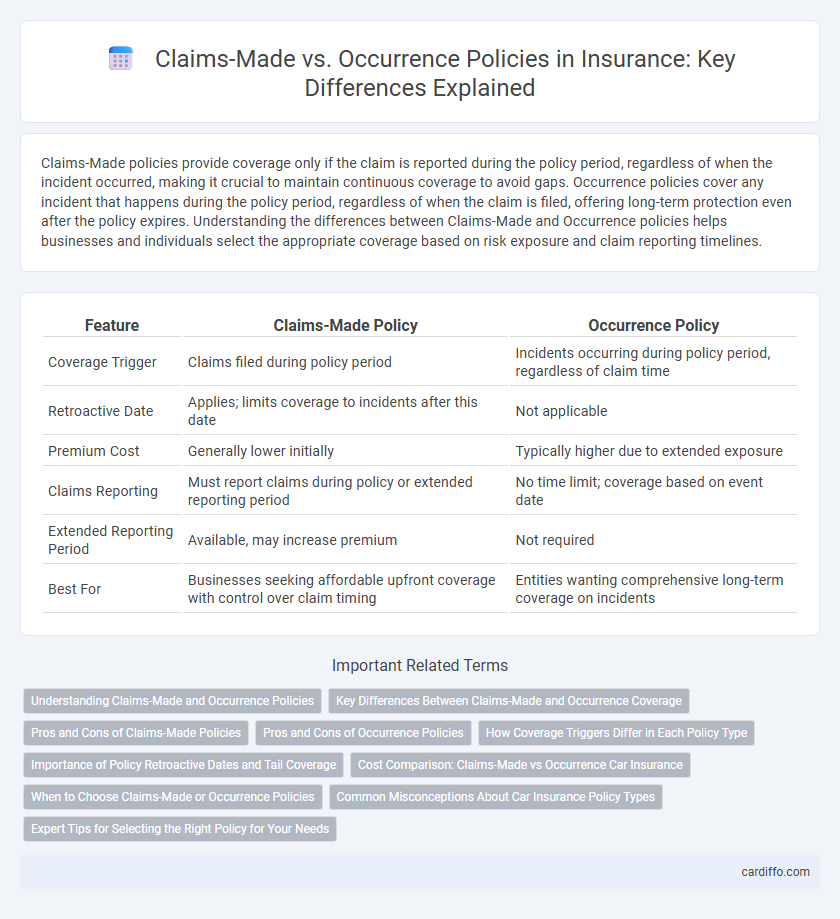

Claims-Made policies provide coverage only if the claim is reported during the policy period, regardless of when the incident occurred, making it crucial to maintain continuous coverage to avoid gaps. Occurrence policies cover any incident that happens during the policy period, regardless of when the claim is filed, offering long-term protection even after the policy expires. Understanding the differences between Claims-Made and Occurrence policies helps businesses and individuals select the appropriate coverage based on risk exposure and claim reporting timelines.

Table of Comparison

| Feature | Claims-Made Policy | Occurrence Policy |

|---|---|---|

| Coverage Trigger | Claims filed during policy period | Incidents occurring during policy period, regardless of claim time |

| Retroactive Date | Applies; limits coverage to incidents after this date | Not applicable |

| Premium Cost | Generally lower initially | Typically higher due to extended exposure |

| Claims Reporting | Must report claims during policy or extended reporting period | No time limit; coverage based on event date |

| Extended Reporting Period | Available, may increase premium | Not required |

| Best For | Businesses seeking affordable upfront coverage with control over claim timing | Entities wanting comprehensive long-term coverage on incidents |

Understanding Claims-Made and Occurrence Policies

Claims-Made policies cover claims only if the incident is reported during the active policy period, requiring continuous coverage for protection against delayed claims. Occurrence policies provide coverage for incidents that occur during the policy period, regardless of when the claim is reported, offering long-term security. Understanding the differences helps policyholders choose suitable insurance based on their risk exposure and claims reporting needs.

Key Differences Between Claims-Made and Occurrence Coverage

Claims-made policies provide coverage only for claims reported during the policy period, regardless of when the incident occurred, while occurrence policies cover incidents that happen during the policy period, even if the claim is filed later. Claims-made policies often require purchasing tail coverage to protect against future claims, whereas occurrence policies inherently cover claims filed after policy expiration. Understanding these distinctions is crucial for selecting appropriate professional liability or malpractice insurance.

Pros and Cons of Claims-Made Policies

Claims-made policies offer the advantage of lower initial premiums and provide coverage for claims reported during the policy period, which is beneficial for businesses seeking cost-effective protection. However, these policies require careful management of retroactive dates and continuous coverage to avoid gaps, as claims filed after the policy ends are not covered. The complexity of tracking past coverage and the potential for higher costs upon policy renewal are notable drawbacks compared to occurrence policies.

Pros and Cons of Occurrence Policies

Occurrence policies provide coverage for incidents that happen during the policy period, regardless of when the claim is filed, offering long-term protection and peace of mind. They typically result in fewer coverage gaps compared to claims-made policies, but their premiums can be higher due to extended liability exposure. Occurrence policies may also be less flexible and harder to obtain for certain high-risk professions, potentially leading to increased upfront costs.

How Coverage Triggers Differ in Each Policy Type

Claims-Made policies trigger coverage when a claim is reported during the policy period, regardless of when the incident occurred, requiring continuous coverage for ongoing protection. Occurrence policies activate coverage based on when the insured event happens, providing protection for incidents during the policy period regardless of when the claim is filed. Understanding these triggers is crucial for risk management and selecting appropriate retroactive dates or tail coverage.

Importance of Policy Retroactive Dates and Tail Coverage

Policy retroactive dates are crucial in claims-made insurance policies as they define the earliest point in time at which an incident can occur and still be covered, ensuring protection for past acts within the policy period. Tail coverage extends reporting periods beyond policy expiration, allowing claims to be reported for incidents that occurred during the original policy term but arise afterward. Understanding retroactive dates and securing tail coverage prevents coverage gaps and unexpected liabilities for policyholders.

Cost Comparison: Claims-Made vs Occurrence Car Insurance

Claims-made car insurance policies typically have lower initial premiums compared to occurrence policies but may incur higher costs over time due to tail coverage and reporting requirements. Occurrence policies provide coverage for incidents that happen during the policy period regardless of when the claim is filed, often resulting in higher upfront premiums but more predictable long-term expenses. Cost comparison between claims-made and occurrence car insurance depends on factors like coverage duration, risk exposure, and the insured's long-term claims history.

When to Choose Claims-Made or Occurrence Policies

Claims-made policies are ideal for businesses seeking coverage for claims reported during the policy period, especially when risk exposures are easier to track in real time, while occurrence policies provide coverage for incidents occurring during the policy period regardless of when the claim is filed. Choose claims-made policies if you want lower initial premiums and the ability to tailor coverage to ongoing risk management, making it suitable for industries with evolving liabilities. Occurrence policies suit companies preferring long-term protection without concerns about reporting delays, often chosen by professions with latent claims such as healthcare or construction.

Common Misconceptions About Car Insurance Policy Types

Many policyholders mistakenly believe that Claims-Made and Occurrence car insurance policies offer identical coverage periods, but Claims-Made policies only cover incidents reported during the active policy period. Occurrence policies provide protection for incidents that happen during the policy term, regardless of when the claim is filed, offering long-term security. Understanding these distinctions is crucial for drivers aiming to avoid gaps in coverage or unexpected premium costs.

Expert Tips for Selecting the Right Policy for Your Needs

Claims-made policies cover claims filed during the policy period regardless of when the incident occurred, ideal for businesses seeking lower premiums and extended tail coverage options. Occurrence policies provide coverage for any incident that happens during the policy period, offering long-term protection even if claims are made after the policy expires. Experts recommend evaluating your risk exposure, potential for long-tail claims, and budget constraints to determine whether a claims-made or occurrence policy aligns best with your liability coverage needs.

Claims-Made vs Occurrence Policy Infographic

cardiffo.com

cardiffo.com