Excess waiver eliminates the policyholder's financial responsibility for the excess payment after a claim, offering peace of mind and protection against unexpected costs. Voluntary excess is an amount the insured agrees to pay on top of the compulsory excess, reducing the insurance premium but increasing out-of-pocket expenses during a claim. Choosing between excess waiver and voluntary excess depends on balancing premium affordability with the ability to cover potential claim costs.

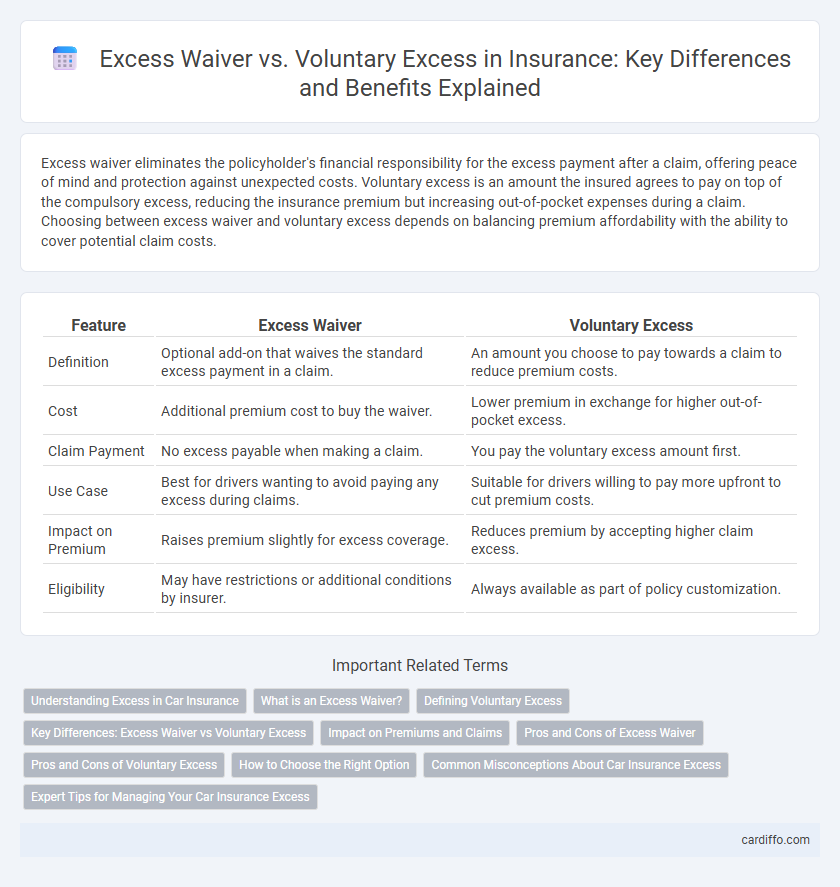

Table of Comparison

| Feature | Excess Waiver | Voluntary Excess |

|---|---|---|

| Definition | Optional add-on that waives the standard excess payment in a claim. | An amount you choose to pay towards a claim to reduce premium costs. |

| Cost | Additional premium cost to buy the waiver. | Lower premium in exchange for higher out-of-pocket excess. |

| Claim Payment | No excess payable when making a claim. | You pay the voluntary excess amount first. |

| Use Case | Best for drivers wanting to avoid paying any excess during claims. | Suitable for drivers willing to pay more upfront to cut premium costs. |

| Impact on Premium | Raises premium slightly for excess coverage. | Reduces premium by accepting higher claim excess. |

| Eligibility | May have restrictions or additional conditions by insurer. | Always available as part of policy customization. |

Understanding Excess in Car Insurance

Excess in car insurance represents the amount a policyholder must pay out of pocket before the insurer covers a claim. An Excess Waiver is an optional add-on that eliminates the policyholder's financial responsibility for the excess, often applicable in cases like windscreen repairs or key replacements. Voluntary Excess refers to the additional amount a policyholder agrees to pay on top of the compulsory excess, which can lower the premium but increases the out-of-pocket cost when making a claim.

What is an Excess Waiver?

An Excess Waiver is an insurance add-on that eliminates or reduces the policyholder's financial responsibility for the excess amount payable after a claim. It provides peace of mind by covering the excess fees that would otherwise be deducted from claim settlements, effectively minimizing out-of-pocket expenses. Excess Waivers are commonly offered in motor and home insurance policies to enhance customer protection against unexpected costs.

Defining Voluntary Excess

Voluntary excess is the chosen amount a policyholder agrees to pay out of pocket when making an insurance claim, reducing the insurer's payout. This deductible is selected to lower premium costs, giving the policyholder control over their insurance expenses. Understanding voluntary excess helps balance upfront costs with potential claim payouts in insurance policies.

Key Differences: Excess Waiver vs Voluntary Excess

Excess Waiver eliminates the policyholder's liability to pay the excess amount after a claim, offering full coverage without out-of-pocket expenses. Voluntary Excess requires the insured to pay a chosen additional amount on top of the compulsory excess, reducing the premium but increasing personal cost during a claim. The key difference lies in risk assumption: Excess Waiver transfers all excess costs to the insurer, while Voluntary Excess shifts part of the risk back to the policyholder.

Impact on Premiums and Claims

Excess waiver eliminates the policyholder's obligation to pay the excess in the event of a claim, often leading to higher premiums due to increased insurer risk. Voluntary excess requires the policyholder to pay an agreed amount above the compulsory excess, which typically lowers premiums by reducing the insurer's financial exposure. Choosing between these options affects claim payouts and premium costs, with excess waiver providing greater upfront security and voluntary excess offering cost savings with higher out-of-pocket risk.

Pros and Cons of Excess Waiver

Excess Waiver eliminates the policyholder's financial responsibility for the excess amount after a claim, providing peace of mind and encouraging more frequent claims without extra out-of-pocket costs. This option often results in higher premium costs compared to standard policies due to the insurer assuming greater risk. However, it simplifies claim settlements and can be cost-effective for those who anticipate multiple claims or expensive damages, while it may be unnecessary and costly for low-risk drivers.

Pros and Cons of Voluntary Excess

Voluntary Excess in insurance offers policyholders lower premium costs by agreeing to pay more out-of-pocket in the event of a claim, which can improve affordability for budget-conscious consumers. However, choosing a high voluntary excess increases financial risk during a claim, potentially leading to significant immediate expenses that might outweigh the premium savings. It is essential to balance the cost savings against potential out-of-pocket payments to ensure the excess level aligns with the policyholder's financial capacity and risk tolerance.

How to Choose the Right Option

Choosing between an Excess Waiver and Voluntary Excess depends on your risk tolerance and financial capability to cover out-of-pocket costs after a claim. Opt for an Excess Waiver if you prefer peace of mind by eliminating the need to pay any excess, especially when claims are likely. Select Voluntary Excess to lower your premium, ensuring you have sufficient savings to cover the higher deductible in case of an accident.

Common Misconceptions About Car Insurance Excess

Common misconceptions about car insurance excess often confuse excess waiver with voluntary excess, though they serve distinct purposes. Excess waiver is an optional add-on that removes the policyholder's financial responsibility for the excess in a claim, while voluntary excess is an additional amount chosen by the driver to reduce premiums but increases their out-of-pocket cost during a claim. Understanding the difference is crucial, as excess waivers can lead to no excess payment on approved claims, whereas voluntary excess always requires payment by the insured when a claim is made.

Expert Tips for Managing Your Car Insurance Excess

Expert tips for managing your car insurance excess include carefully evaluating the difference between an excess waiver and voluntary excess to optimize your premium costs. An excess waiver removes your obligation to pay the excess in specific claims, while voluntary excess is an additional amount you agree to pay, lowering your premium but increasing your out-of-pocket cost after a claim. Assess your driving habits, claim history, and financial comfort to choose the best balance between risk and savings when selecting excess options.

Excess Waiver vs Voluntary Excess Infographic

cardiffo.com

cardiffo.com