Gap insurance for pets covers the difference between the actual value of your pet and the amount your standard insurance policy reimburses, protecting you from unexpected out-of-pocket costs. Standard coverage typically handles routine veterinary expenses and emergencies but may exclude expenses like hereditary conditions or expensive surgeries. Choosing gap insurance ensures comprehensive financial protection that bridges coverage shortfalls often found in basic pet insurance plans.

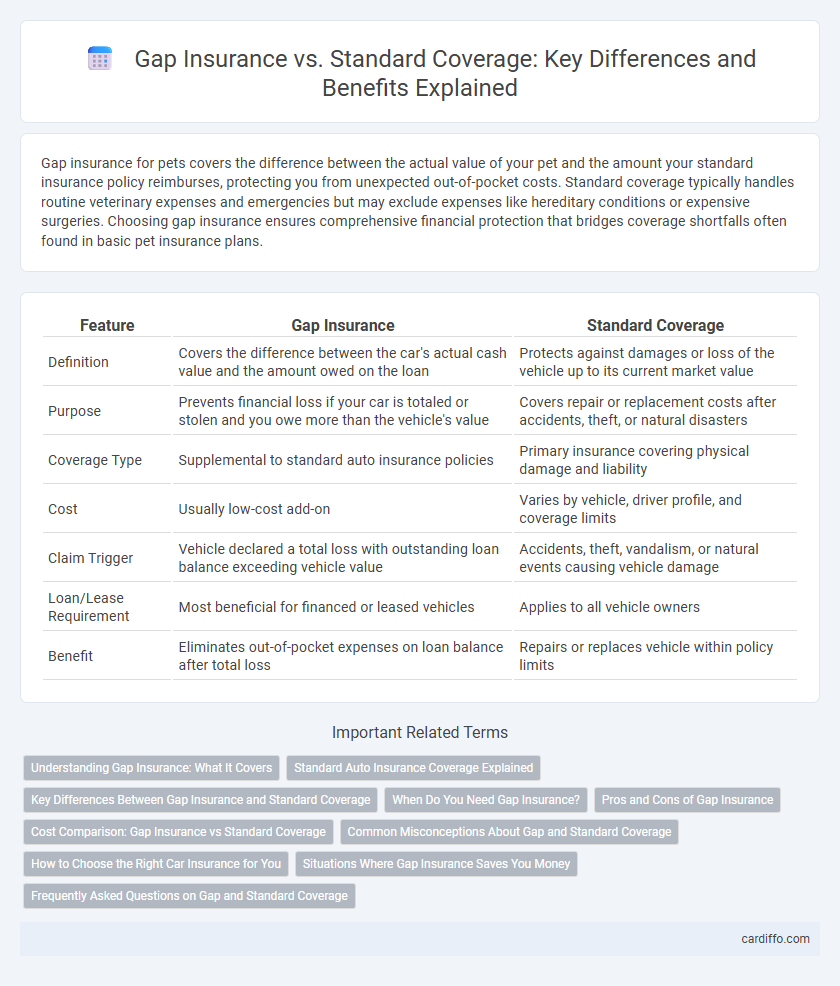

Table of Comparison

| Feature | Gap Insurance | Standard Coverage |

|---|---|---|

| Definition | Covers the difference between the car's actual cash value and the amount owed on the loan | Protects against damages or loss of the vehicle up to its current market value |

| Purpose | Prevents financial loss if your car is totaled or stolen and you owe more than the vehicle's value | Covers repair or replacement costs after accidents, theft, or natural disasters |

| Coverage Type | Supplemental to standard auto insurance policies | Primary insurance covering physical damage and liability |

| Cost | Usually low-cost add-on | Varies by vehicle, driver profile, and coverage limits |

| Claim Trigger | Vehicle declared a total loss with outstanding loan balance exceeding vehicle value | Accidents, theft, vandalism, or natural events causing vehicle damage |

| Loan/Lease Requirement | Most beneficial for financed or leased vehicles | Applies to all vehicle owners |

| Benefit | Eliminates out-of-pocket expenses on loan balance after total loss | Repairs or replaces vehicle within policy limits |

Understanding Gap Insurance: What It Covers

Gap insurance covers the difference between your car's actual cash value and the remaining balance on your auto loan or lease if your vehicle is declared a total loss. Standard coverage typically pays only the actual cash value, which may leave you responsible for the outstanding loan amount. Understanding gap insurance is crucial for borrowers with high loan-to-value ratios or rapidly depreciating vehicles to avoid financial shortfalls after an accident.

Standard Auto Insurance Coverage Explained

Standard auto insurance coverage typically includes liability, collision, and comprehensive protections, covering damages to others, your vehicle, and non-collision-related incidents respectively. Liability insurance is mandatory in most states, protecting you financially against injuries or property damage you cause to others. Collision and comprehensive coverage pay for repairs or replacement of your car due to accidents, theft, vandalism, or natural disasters, offering broad protection beyond basic legal requirements.

Key Differences Between Gap Insurance and Standard Coverage

Gap insurance covers the difference between the actual cash value of a vehicle and the remaining loan or lease balance in case of total loss, while standard coverage reimburses the vehicle's market value at the time of the claim. Gap insurance is crucial for new car buyers or lessees who owe more than the car's depreciated worth, whereas standard coverage typically suffices for owners with low or no outstanding loans. Understanding these distinctions helps in selecting appropriate protection levels that align with financial liability and risk exposure.

When Do You Need Gap Insurance?

Gap insurance is essential when your vehicle's loan balance exceeds its market value, protecting you from financial loss if the car is totaled or stolen. Standard coverage typically reimburses only the car's current worth, which may leave you responsible for the remaining loan balance. Drivers with high loan-to-value ratios, lease contracts, or rapid depreciation schedules benefit most from gap insurance.

Pros and Cons of Gap Insurance

Gap insurance covers the difference between a vehicle's actual cash value and the remaining loan balance, offering crucial financial protection if the car is totaled or stolen. Standard coverage typically reimburses only the current market value, which may leave owners responsible for paying off the full loan amount. While gap insurance increases upfront costs, it prevents significant out-of-pocket expenses during total loss scenarios, making it especially beneficial for drivers with high loan balances or rapidly depreciating vehicles.

Cost Comparison: Gap Insurance vs Standard Coverage

Gap insurance typically costs between $20 and $40 per year, providing affordable coverage that bridges the difference between a vehicle's actual cash value and the outstanding loan balance. Standard coverage premiums vary widely based on factors like vehicle type, driver history, and coverage limits, often ranging from hundreds to thousands of dollars annually. The relatively low cost of gap insurance offers significant financial protection for loan or lease holders, supplementing standard coverage without substantially increasing overall insurance expenses.

Common Misconceptions About Gap and Standard Coverage

Gap insurance is often misunderstood as redundant when standard coverage is in place, but it specifically covers the difference between the vehicle's actual cash value and the remaining loan balance if totaled. Many assume standard coverage fully compensates for loan payoff, yet it typically only reimburses the depreciated market value, leaving owners liable for any outstanding loan amount. Clarifying these distinctions helps policyholders avoid unexpected out-of-pocket expenses after a total loss.

How to Choose the Right Car Insurance for You

Gap insurance covers the difference between your car's actual cash value and the remaining loan balance in case of total loss, ideal for new or leased vehicles with high depreciation rates. Standard coverage provides liability, collision, and comprehensive protection based on your vehicle's current market value and legal requirements. To choose the right car insurance, evaluate your loan balance, vehicle depreciation, budget, and risk tolerance to determine if gap coverage supplements your standard policy effectively.

Situations Where Gap Insurance Saves You Money

Gap insurance saves you money in situations where your vehicle is totaled or stolen and your standard coverage pays only the current market value, which may be less than the amount owed on your loan or lease. This coverage bridges the financial gap by covering the difference, preventing out-of-pocket expenses for loan balances or lease obligations. Gap insurance is particularly beneficial for new cars, high depreciation rates, and long-term financing agreements where standard insurance limits do not fully cover outstanding debt.

Frequently Asked Questions on Gap and Standard Coverage

Gap insurance covers the difference between your vehicle's actual cash value and the remaining loan balance if your car is totaled or stolen, while standard auto insurance covers damages or liability up to your policy limits. Common questions include whether gap insurance is necessary if you have a low down payment or long loan term, and how it integrates with comprehensive and collision coverage under standard plans. Policyholders often inquire about cost differences, claim processes, and situations where gap insurance provides crucial financial protection beyond standard coverage limits.

Gap Insurance vs Standard Coverage Infographic

cardiffo.com

cardiffo.com