Telematics insurance uses real-time data from devices to assess driving behavior and personalize premiums, offering potentially lower costs for safe drivers. Traditional insurance relies on historical data and general risk factors, often leading to less individualized pricing. Telematics provides more accurate risk assessment by monitoring actual driving patterns, enhancing fairness and encouraging safer habits.

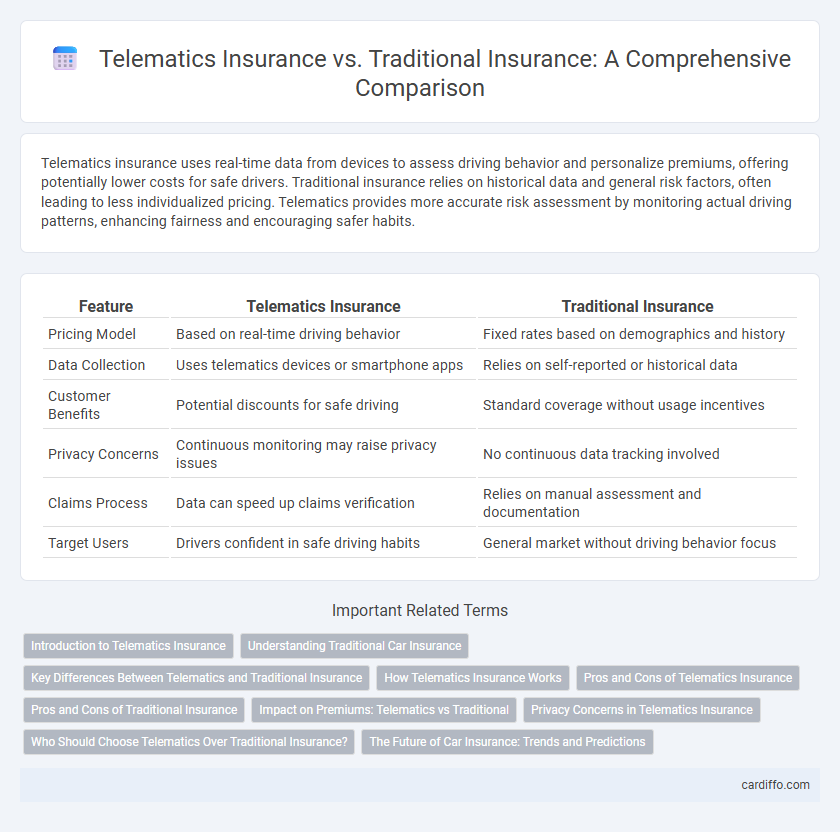

Table of Comparison

| Feature | Telematics Insurance | Traditional Insurance |

|---|---|---|

| Pricing Model | Based on real-time driving behavior | Fixed rates based on demographics and history |

| Data Collection | Uses telematics devices or smartphone apps | Relies on self-reported or historical data |

| Customer Benefits | Potential discounts for safe driving | Standard coverage without usage incentives |

| Privacy Concerns | Continuous monitoring may raise privacy issues | No continuous data tracking involved |

| Claims Process | Data can speed up claims verification | Relies on manual assessment and documentation |

| Target Users | Drivers confident in safe driving habits | General market without driving behavior focus |

Introduction to Telematics Insurance

Telematics insurance uses data from in-vehicle devices to monitor driving behavior and adjust premiums based on individual risk profiles. Unlike traditional insurance, which relies on generalized statistical models, telematics offers personalized pricing driven by real-time data such as speed, acceleration, braking patterns, and mileage. This technology enhances risk assessment accuracy and incentivizes safer driving habits.

Understanding Traditional Car Insurance

Traditional car insurance relies on factors such as driving history, age, vehicle type, and location to determine premiums, often leading to generalized risk assessments. This model typically uses static data collected from insurance applications and past claims without real-time monitoring of driving behavior. Consequently, policyholders with safe driving habits may not always benefit from lower rates compared to telematics-based insurance that adapts premiums based on actual driving patterns.

Key Differences Between Telematics and Traditional Insurance

Telematics insurance uses real-time driving data collected through devices or smartphone apps to personalize premiums based on individual behavior, while traditional insurance relies primarily on historical data such as age, location, and driving history. Telematics enables dynamic pricing and incentivizes safer driving habits through rewards or discounts, whereas traditional insurance offers fixed rates that adjust only during policy renewals. Claims processing in telematics can be faster and more accurate due to detailed trip data, contrasting with the often slower, documentation-heavy procedures in traditional insurance.

How Telematics Insurance Works

Telematics insurance utilizes a device or smartphone app to collect real-time data on driving behavior, such as speed, braking patterns, and mileage, enabling personalized risk assessment. This data is transmitted to insurers who analyze it to offer tailored premiums based on actual driving habits, promoting safer driving practices. Unlike traditional insurance, which relies on demographic factors and historical claims, telematics insurance provides dynamic pricing and feedback that can lead to potential cost savings for low-risk drivers.

Pros and Cons of Telematics Insurance

Telematics insurance offers personalized premium rates based on real-time driving behavior, promoting safer driving habits and potentially lowering costs for low-risk drivers. However, it raises privacy concerns due to continuous data tracking and may result in higher premiums for drivers with inconsistent driving patterns. Traditional insurance provides predictable rates without data monitoring but lacks the customization and potential savings that telematics-based policies offer.

Pros and Cons of Traditional Insurance

Traditional insurance offers predictable premiums based on demographic and historical data, providing stability for customers with consistent driving habits. It may lack personalized risk assessment, often resulting in higher costs for safe drivers and limited incentives for improved driving behavior. Claims processing in traditional insurance can be slower due to manual evaluations, contrasting with the real-time data benefits of telematics insurance.

Impact on Premiums: Telematics vs Traditional

Telematics insurance adjusts premiums based on real-time driving behavior, rewarding safe driving with lower rates and potentially reducing costs by up to 30%. Traditional insurance calculates premiums primarily on historical data such as age, location, and driving record, leading to less personalized pricing. The dynamic nature of telematics promotes greater premium accuracy and encourages safer driving habits, contrasting with the fixed and often generalized approach of traditional insurance.

Privacy Concerns in Telematics Insurance

Telematics insurance raises significant privacy concerns due to the continuous collection of detailed driving data such as speed, location, and braking patterns, which can be perceived as invasive compared to traditional insurance methods that rely primarily on historical claims and demographic information. Insurers using telematics must ensure robust data protection measures and transparent usage policies to prevent misuse or unauthorized access to sensitive personal information. Consumers remain cautious about how their driving behavior data is stored, shared, and potentially used beyond premium calculations, emphasizing the need for stringent regulatory oversight.

Who Should Choose Telematics Over Traditional Insurance?

Drivers seeking personalized premiums based on actual driving behavior should choose telematics insurance over traditional insurance, as it rewards safe driving with lower rates. Young or inexperienced drivers benefit from telematics policies because usage-based data can lead to more affordable coverage compared to standard risk assessments. Fleet operators and urban commuters also find telematics insurance advantageous for optimizing costs and monitoring driver performance in real time.

The Future of Car Insurance: Trends and Predictions

Telematics insurance leverages real-time data collected from driving behavior, promoting personalized premiums and enhanced risk assessment compared to traditional insurance models. Emerging trends indicate a shift towards AI-driven analytics and integrated IoT devices, which will further refine policy customization and claims processing. Predictions suggest telematics will become the industry standard as consumers demand more transparent, usage-based insurance solutions with predictive risk management capabilities.

Telematics Insurance vs Traditional Insurance Infographic

cardiffo.com

cardiffo.com