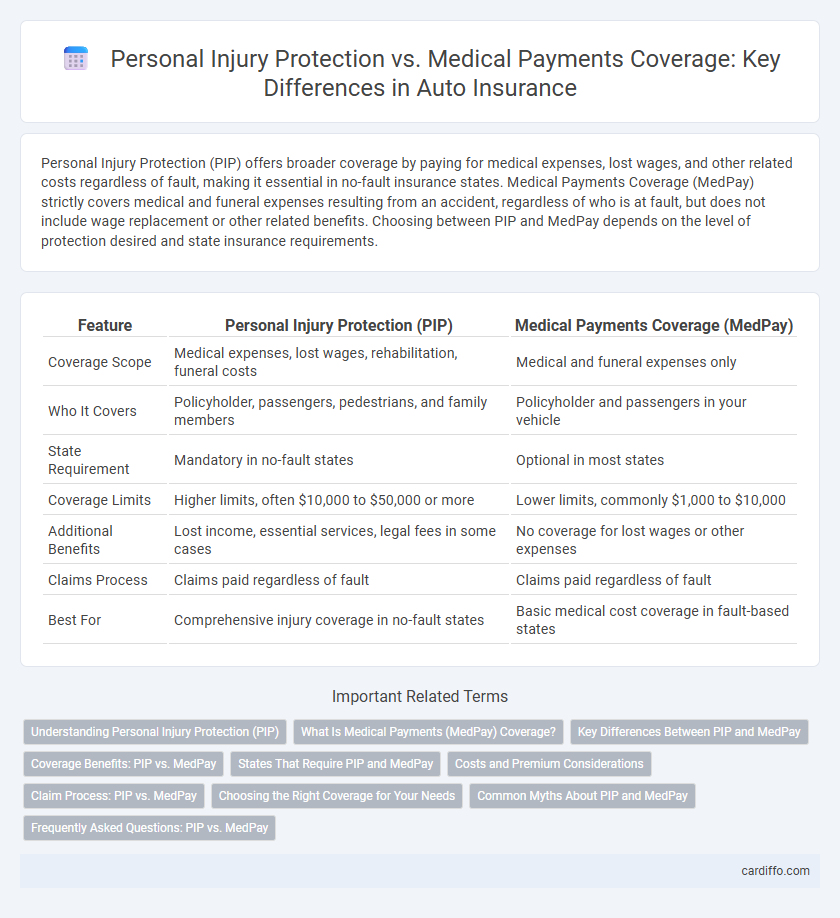

Personal Injury Protection (PIP) offers broader coverage by paying for medical expenses, lost wages, and other related costs regardless of fault, making it essential in no-fault insurance states. Medical Payments Coverage (MedPay) strictly covers medical and funeral expenses resulting from an accident, regardless of who is at fault, but does not include wage replacement or other related benefits. Choosing between PIP and MedPay depends on the level of protection desired and state insurance requirements.

Table of Comparison

| Feature | Personal Injury Protection (PIP) | Medical Payments Coverage (MedPay) |

|---|---|---|

| Coverage Scope | Medical expenses, lost wages, rehabilitation, funeral costs | Medical and funeral expenses only |

| Who It Covers | Policyholder, passengers, pedestrians, and family members | Policyholder and passengers in your vehicle |

| State Requirement | Mandatory in no-fault states | Optional in most states |

| Coverage Limits | Higher limits, often $10,000 to $50,000 or more | Lower limits, commonly $1,000 to $10,000 |

| Additional Benefits | Lost income, essential services, legal fees in some cases | No coverage for lost wages or other expenses |

| Claims Process | Claims paid regardless of fault | Claims paid regardless of fault |

| Best For | Comprehensive injury coverage in no-fault states | Basic medical cost coverage in fault-based states |

Understanding Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is a type of auto insurance coverage designed to pay for medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. PIP often includes coverage for rehabilitation services, funeral expenses, and essential household services, offering broader protection than Medical Payments Coverage, which primarily focuses on medical bills. Understanding PIP is crucial for ensuring comprehensive financial protection after an auto accident and maximizing available benefits under state-specific no-fault insurance laws.

What Is Medical Payments (MedPay) Coverage?

Medical Payments (MedPay) coverage is an auto insurance add-on that covers medical expenses for the policyholder and passengers regardless of fault in an accident. It typically pays for hospital visits, surgeries, X-rays, and funeral costs up to the policy limit, providing quick access to funds without needing to establish liability. MedPay coverage complements Personal Injury Protection (PIP) but is generally more limited, as it does not cover lost wages or rehabilitation services.

Key Differences Between PIP and MedPay

Personal Injury Protection (PIP) provides broader coverage than Medical Payments (MedPay) by covering not only medical expenses but also lost wages, rehabilitation costs, and essential services after an accident, regardless of fault. MedPay strictly covers reasonable medical and funeral expenses for policyholders and passengers, with no benefits for lost income or other non-medical costs. PIP is mandated in no-fault states, offering more comprehensive protection, while MedPay is optional and generally supplements liability insurance.

Coverage Benefits: PIP vs. MedPay

Personal Injury Protection (PIP) offers extensive coverage including medical expenses, lost wages, rehabilitation costs, and sometimes even death benefits, providing broader financial protection after an accident. Medical Payments Coverage (MedPay) strictly covers immediate medical and funeral expenses regardless of fault but does not extend to lost income or additional damages. PIP's comprehensive benefits make it essential in no-fault states, while MedPay serves as a supplementary or minimalist medical coverage option.

States That Require PIP and MedPay

Personal Injury Protection (PIP) is mandated in no-fault insurance states such as Florida, New York, and Michigan, covering medical expenses regardless of fault. Medical Payments Coverage (MedPay) is optional in most states but required in a few like Hawaii and New Jersey, providing limited medical cost reimbursement. Understanding state-specific mandates for PIP and MedPay ensures compliance and appropriate coverage in auto insurance policies.

Costs and Premium Considerations

Personal Injury Protection (PIP) typically involves higher premiums due to its broader coverage, including lost wages and rehabilitation, whereas Medical Payments Coverage (MedPay) offers more limited benefits and generally results in lower costs. Insurers calculate PIP premiums based on factors like state requirements and coverage limits, making it a pricier option for comprehensive injury expenses. MedPay premiums remain comparatively affordable because they cover only immediate medical expenses without wage loss or additional services.

Claim Process: PIP vs. MedPay

Personal Injury Protection (PIP) claims typically require detailed documentation of medical treatment, lost wages, and accident-related expenses, enabling direct payment for a broad range of injury-related costs. Medical Payments Coverage (MedPay) claims involve submitting bills and proof of payment for immediate medical expenses, with a simpler, faster approval process but limited to medical costs only. Insurance companies processing PIP claims often involve more extensive investigations, while MedPay claims prioritize quick reimbursement for emergency medical care without wage loss or other non-medical expenses.

Choosing the Right Coverage for Your Needs

Personal Injury Protection (PIP) offers broader coverage including medical expenses, lost wages, and rehabilitation costs, making it ideal for individuals seeking comprehensive protection after an accident. Medical Payments Coverage (MedPay) is typically limited to medical and funeral expenses regardless of fault, suited for those needing basic medical cost coverage. Evaluating your financial situation, state requirements, and the extent of protection desired is crucial when choosing between PIP and MedPay.

Common Myths About PIP and MedPay

Personal Injury Protection (PIP) and Medical Payments (MedPay) coverage are often misunderstood, with common myths suggesting PIP covers only medical expenses while MedPay also includes lost wages, which is incorrect. PIP typically provides broader benefits including medical costs, lost income, and essential services, whereas MedPay strictly covers medical and funeral expenses regardless of fault. Misconceptions often lead policyholders to underutilize these coverages, missing crucial financial protection in auto accidents.

Frequently Asked Questions: PIP vs. MedPay

Personal Injury Protection (PIP) and Medical Payments Coverage (MedPay) both cover medical expenses after an accident but differ in scope and requirements. PIP includes benefits such as lost wages, rehabilitation costs, and sometimes coverage for passengers, while MedPay strictly pays for medical and funeral expenses regardless of fault. Most states that require PIP mandate it as part of auto insurance, whereas MedPay is usually optional and offers more limited financial protection.

Personal Injury Protection vs Medical Payments Coverage Infographic

cardiffo.com

cardiffo.com