Third-party insurance provides coverage for damages and injuries caused to others in an accident, offering essential financial protection with lower premiums. Full coverage insurance combines third-party liability with comprehensive and collision coverage, protecting both the policyholder's vehicle and other parties involved. Choosing between third-party and full coverage depends on factors like budget, vehicle value, and risk tolerance.

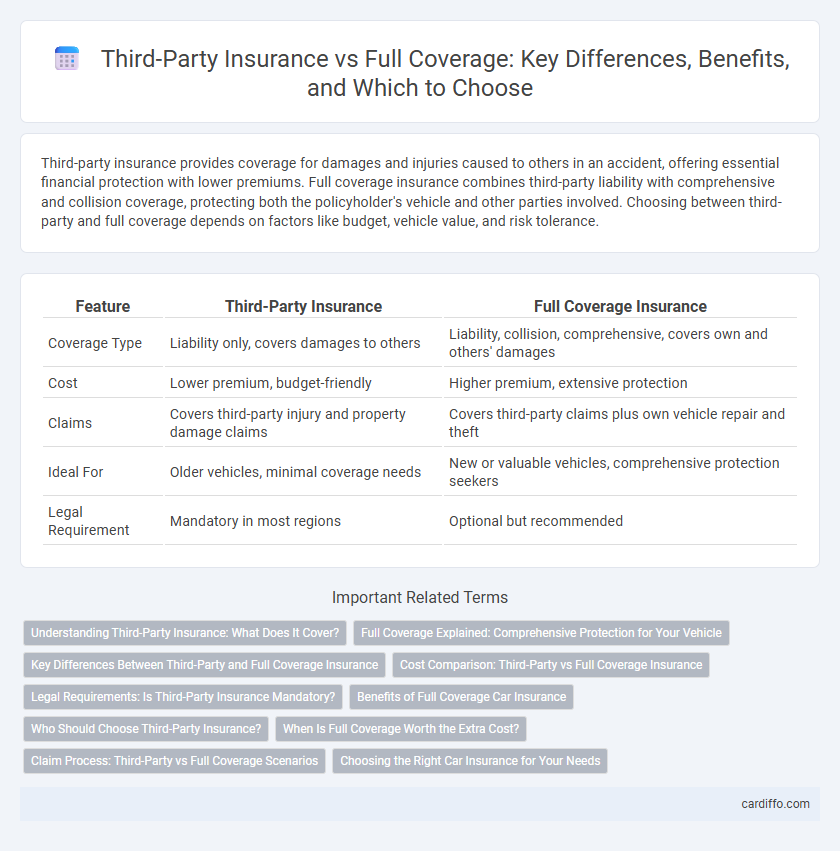

Table of Comparison

| Feature | Third-Party Insurance | Full Coverage Insurance |

|---|---|---|

| Coverage Type | Liability only, covers damages to others | Liability, collision, comprehensive, covers own and others' damages |

| Cost | Lower premium, budget-friendly | Higher premium, extensive protection |

| Claims | Covers third-party injury and property damage claims | Covers third-party claims plus own vehicle repair and theft |

| Ideal For | Older vehicles, minimal coverage needs | New or valuable vehicles, comprehensive protection seekers |

| Legal Requirement | Mandatory in most regions | Optional but recommended |

Understanding Third-Party Insurance: What Does It Cover?

Third-party insurance primarily covers damages and injuries you cause to other people or their property, including bodily injury liability and property damage liability. It does not cover your own vehicle repairs or medical expenses, making it a more affordable option compared to full coverage. Understanding the limitations and protections of third-party insurance helps policyholders make informed decisions based on their risk tolerance and financial situation.

Full Coverage Explained: Comprehensive Protection for Your Vehicle

Full coverage insurance combines third-party liability, collision, and comprehensive protection, ensuring extensive financial security against accidents, theft, vandalism, and natural disasters. This policy covers damage to your vehicle regardless of fault, providing peace of mind and safeguarding your investment. By including medical payments and uninsured motorist coverage, full coverage offers a robust safety net for drivers on the road.

Key Differences Between Third-Party and Full Coverage Insurance

Third-party insurance covers damages and injuries caused to others in an accident, excluding any damages to the policyholder's own vehicle, while full coverage insurance offers comprehensive protection, including third-party liability, collision, and comprehensive damage to the insured vehicle. Third-party insurance is typically more affordable but provides limited financial security in accidents involving the policyholder, whereas full coverage insurance offers broader protection with higher premiums. Understanding these key differences helps drivers select the right policy based on budget, liability risks, and asset protection needs.

Cost Comparison: Third-Party vs Full Coverage Insurance

Third-party insurance typically offers a lower premium compared to full coverage insurance, making it a cost-effective option for budget-conscious drivers seeking basic liability protection. Full coverage insurance, while more expensive, provides extensive protection including collision, comprehensive, and uninsured motorist coverage, which can significantly reduce out-of-pocket expenses after an accident. The choice between third-party and full coverage insurance depends on individual risk tolerance, vehicle value, and financial capacity to handle potential repair or medical costs.

Legal Requirements: Is Third-Party Insurance Mandatory?

Third-party insurance is mandatory in most countries as it legally covers damages or injuries caused to others in an accident, ensuring compliance with road safety regulations. Full coverage insurance, while optional, provides broader protection including damage to the policyholder's vehicle and theft, but only third-party insurance meets the minimum legal requirements. Failing to have third-party insurance can result in fines, license suspension, or legal penalties, making it essential for all vehicle owners.

Benefits of Full Coverage Car Insurance

Full coverage car insurance offers comprehensive protection by covering both third-party liabilities and damages to your own vehicle, providing peace of mind in accidents or theft. It often includes benefits such as collision coverage, comprehensive coverage, and uninsured motorist protection, reducing out-of-pocket expenses. This type of insurance enhances financial security by addressing a wide range of risks beyond the basic third-party liability.

Who Should Choose Third-Party Insurance?

Third-party insurance is ideal for drivers seeking basic liability protection at an affordable cost, particularly those with older vehicles or limited budgets. It covers damages and injuries caused to others but excludes coverage for the insured's own vehicle or personal injuries. Individuals prioritizing financial protection against legal claims without paying for comprehensive coverage typically choose third-party insurance.

When Is Full Coverage Worth the Extra Cost?

Full coverage insurance is worth the extra cost when the vehicle's value is high or when financial stability depends on protecting against theft, collision, or comprehensive damages. Drivers with loans or leases typically require full coverage to meet lender requirements and avoid costly out-of-pocket repairs. In contrast, third-party insurance suits older or low-value vehicles where the risk of expensive repairs outweighs the benefits of broader coverage.

Claim Process: Third-Party vs Full Coverage Scenarios

Third-party insurance claims typically involve the insured party reporting damages to a third party's vehicle or property, requiring evidence of liability before the insurer compensates the affected individual. Full coverage claims encompass comprehensive and collision damages, allowing policyholders to file claims for their own vehicle repairs as well as third-party liabilities, often expediting the settlement process with broader protection. Understanding the distinct claim procedures and documentation requirements in third-party versus full coverage insurance helps policyholders efficiently navigate claim approvals and maximize benefits.

Choosing the Right Car Insurance for Your Needs

Choosing the right car insurance depends on evaluating third-party insurance and full coverage options based on your budget, vehicle value, and risk tolerance. Third-party insurance offers minimal protection by covering damages to others, making it cost-effective for older cars or low-risk drivers. Full coverage combines third-party liability, comprehensive, and collision coverage, providing extensive protection against theft, accidents, and natural disasters, ideal for new or financed vehicles.

Third-Party Insurance vs Full Coverage Infographic

cardiffo.com

cardiffo.com