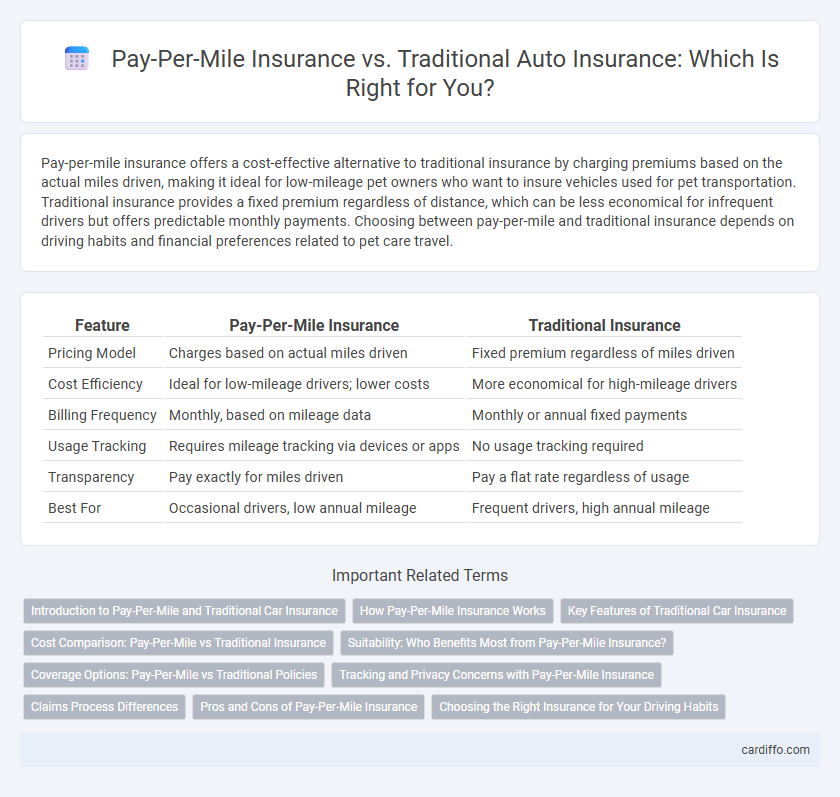

Pay-per-mile insurance offers a cost-effective alternative to traditional insurance by charging premiums based on the actual miles driven, making it ideal for low-mileage pet owners who want to insure vehicles used for pet transportation. Traditional insurance provides a fixed premium regardless of distance, which can be less economical for infrequent drivers but offers predictable monthly payments. Choosing between pay-per-mile and traditional insurance depends on driving habits and financial preferences related to pet care travel.

Table of Comparison

| Feature | Pay-Per-Mile Insurance | Traditional Insurance |

|---|---|---|

| Pricing Model | Charges based on actual miles driven | Fixed premium regardless of miles driven |

| Cost Efficiency | Ideal for low-mileage drivers; lower costs | More economical for high-mileage drivers |

| Billing Frequency | Monthly, based on mileage data | Monthly or annual fixed payments |

| Usage Tracking | Requires mileage tracking via devices or apps | No usage tracking required |

| Transparency | Pay exactly for miles driven | Pay a flat rate regardless of usage |

| Best For | Occasional drivers, low annual mileage | Frequent drivers, high annual mileage |

Introduction to Pay-Per-Mile and Traditional Car Insurance

Pay-per-mile insurance charges drivers based on the exact miles they drive, offering cost savings for low-mileage drivers by combining a base rate with a per-mile fee tracked via a telematics device. Traditional car insurance typically involves fixed premiums determined by factors such as vehicle type, driving history, age, and location, regardless of actual mileage. This usage-based model contrasts with standard policies by aligning costs more closely with driving behavior and distance, enabling more personalized and potentially economical coverage.

How Pay-Per-Mile Insurance Works

Pay-Per-Mile insurance calculates premiums based on the exact number of miles driven, using telematics devices or smartphone apps to track mileage in real-time. This model offers personalized rates by charging a low base fee plus a fixed rate per mile, benefiting low-mileage drivers with significant cost savings. Unlike traditional insurance, which relies on estimated annual mileage and broad risk factors, pay-per-mile provides precise, usage-based pricing that reflects actual driving behavior.

Key Features of Traditional Car Insurance

Traditional car insurance typically offers comprehensive coverage options, including liability, collision, and uninsured motorist protection, ensuring broad financial protection against various risks. Premiums are calculated based on factors such as driver age, driving history, vehicle type, and location, resulting in a fixed monthly or annual payment regardless of miles driven. Policyholders benefit from established customer support, standardized claim processes, and potential discounts for safety features and bundling multiple policies.

Cost Comparison: Pay-Per-Mile vs Traditional Insurance

Pay-Per-Mile insurance typically offers lower premiums for low-mileage drivers by charging based on actual miles driven, making it cost-effective for infrequent drivers. Traditional insurance uses fixed premiums based on factors like age, location, and driving history, often resulting in higher costs regardless of mileage. For drivers averaging fewer than 10,000 miles per year, Pay-Per-Mile insurance can reduce overall expenses by up to 30% compared to standard policies.

Suitability: Who Benefits Most from Pay-Per-Mile Insurance?

Pay-per-mile insurance is ideal for low-mileage drivers who use their vehicles infrequently, such as remote workers, occasional travelers, or retirees. Traditional insurance suits frequent drivers or those requiring extensive coverage due to higher risk exposure or daily commutes. By aligning insurance costs with actual road usage, pay-per-mile policies offer cost efficiency and personalized premiums for selective drivers.

Coverage Options: Pay-Per-Mile vs Traditional Policies

Pay-per-mile insurance offers personalized coverage that charges premiums based on actual miles driven, making it ideal for low-mileage drivers seeking cost efficiency. Traditional insurance policies provide a broad range of coverage options including liability, collision, comprehensive, and uninsured motorist protection, typically with fixed premiums regardless of mileage. This flexibility in traditional insurance caters to diverse driving habits and risk levels, while pay-per-mile plans emphasize usage-based cost savings without compromising essential coverage elements.

Tracking and Privacy Concerns with Pay-Per-Mile Insurance

Pay-per-mile insurance relies on telematics devices or smartphone apps to track actual mileage, raising significant privacy concerns about continuous location monitoring and data security. Unlike traditional insurance that assesses risk using static factors, pay-per-mile policies require real-time data transmission, increasing the risk of unauthorized access to sensitive driving information. Consumers must weigh the benefits of cost savings against potential invasions of privacy and ensure providers employ robust encryption and stringent data protection policies.

Claims Process Differences

Pay-Per-Mile insurance claims often require precise mileage verification through telematics or GPS data, streamlining fraud detection and speeding up claim validation. Traditional insurance claims rely more heavily on policy terms and less on real-time data, potentially leading to longer adjustment periods and manual mileage assessments. The integration of digital technology in pay-per-mile models enhances transparency and reduces disputes in the claims process.

Pros and Cons of Pay-Per-Mile Insurance

Pay-Per-Mile Insurance offers cost efficiency for low-mileage drivers by charging premiums based solely on miles driven, potentially saving significant money compared to traditional fixed-rate policies. This model encourages reduced driving, which can lower accident risk and environmental impact, but it may result in higher per-mile costs for frequent drivers and requires consistent mileage tracking through telematics. Some policyholders may experience privacy concerns and limited coverage options, making it less suitable for those with unpredictable or high driving patterns.

Choosing the Right Insurance for Your Driving Habits

Pay-per-mile insurance offers significant savings for low-mileage drivers by charging premiums based on actual miles driven, unlike traditional insurance which uses fixed rates regardless of usage. Evaluating your average annual mileage and driving patterns helps determine if a usage-based policy aligns with your financial goals and risk profile. For frequent or long-distance drivers, traditional insurance often provides more predictable coverage, whereas pay-per-mile plans maximize benefits for occasional or city drivers.

Pay-Per-Mile Insurance vs Traditional Insurance Infographic

cardiffo.com

cardiffo.com