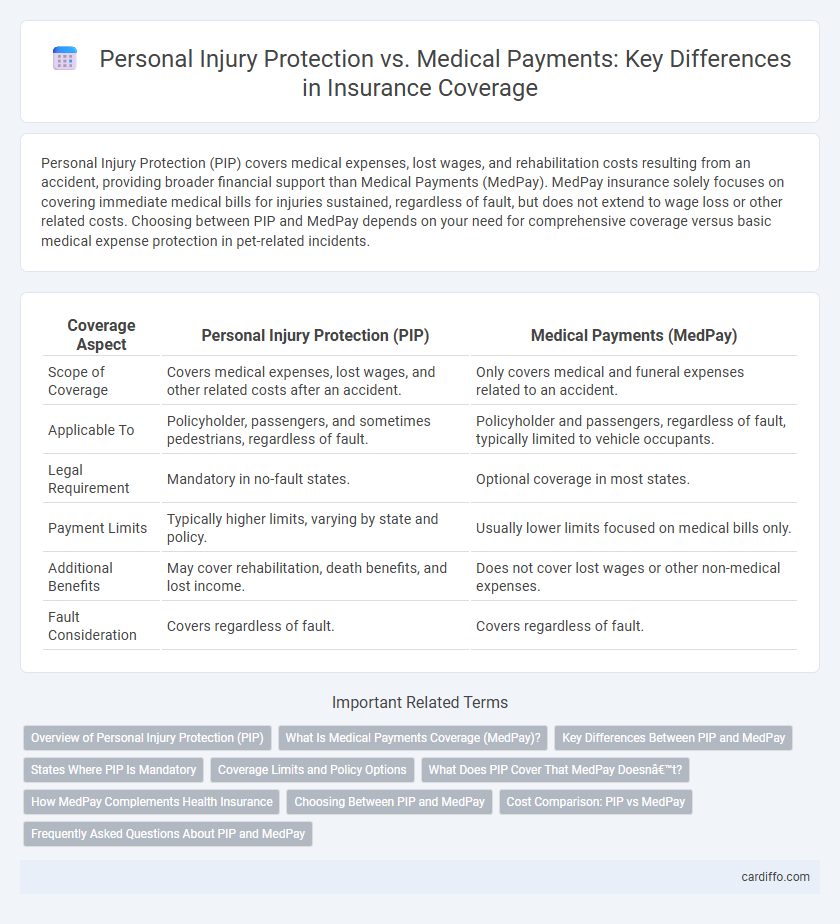

Personal Injury Protection (PIP) covers medical expenses, lost wages, and rehabilitation costs resulting from an accident, providing broader financial support than Medical Payments (MedPay). MedPay insurance solely focuses on covering immediate medical bills for injuries sustained, regardless of fault, but does not extend to wage loss or other related costs. Choosing between PIP and MedPay depends on your need for comprehensive coverage versus basic medical expense protection in pet-related incidents.

Table of Comparison

| Coverage Aspect | Personal Injury Protection (PIP) | Medical Payments (MedPay) |

|---|---|---|

| Scope of Coverage | Covers medical expenses, lost wages, and other related costs after an accident. | Only covers medical and funeral expenses related to an accident. |

| Applicable To | Policyholder, passengers, and sometimes pedestrians, regardless of fault. | Policyholder and passengers, regardless of fault, typically limited to vehicle occupants. |

| Legal Requirement | Mandatory in no-fault states. | Optional coverage in most states. |

| Payment Limits | Typically higher limits, varying by state and policy. | Usually lower limits focused on medical bills only. |

| Additional Benefits | May cover rehabilitation, death benefits, and lost income. | Does not cover lost wages or other non-medical expenses. |

| Fault Consideration | Covers regardless of fault. | Covers regardless of fault. |

Overview of Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is an auto insurance coverage designed to pay for medical expenses, lost wages, and other related costs resulting from an automobile accident, regardless of fault. It typically covers medical treatment, rehabilitation, and sometimes even funeral expenses, providing broader protection compared to Medical Payments coverage, which primarily focuses on medical bills. PIP aims to deliver swift financial relief and reduce the need for litigation by settling injury claims promptly after an accident.

What Is Medical Payments Coverage (MedPay)?

Medical Payments Coverage (MedPay) is an auto insurance add-on that covers medical expenses for you and your passengers regardless of fault in an accident. It typically pays for hospital visits, surgeries, ambulance fees, and other urgent health care costs immediately after a collision. MedPay complements Personal Injury Protection (PIP) by focusing solely on medical payments without covering additional expenses like lost wages or rehabilitation.

Key Differences Between PIP and MedPay

Personal Injury Protection (PIP) covers a broader range of expenses, including medical bills, lost wages, and rehabilitation costs, while Medical Payments (MedPay) strictly covers medical and funeral expenses regardless of fault. PIP often includes benefits beyond medical care, such as coverage for loss of income and essential services, distinguishing it from MedPay's limited scope. Both types of insurance supplement primary auto liability coverage, but PIP is typically mandatory in no-fault states, whereas MedPay is optional and offers more basic medical expense coverage.

States Where PIP Is Mandatory

Personal Injury Protection (PIP) is mandatory in no-fault states such as Florida, New York, and Michigan, ensuring coverage for medical expenses, lost wages, and rehabilitation regardless of fault. Medical Payments (MedPay) coverage, often optional, provides limited medical expense coverage without wage loss benefits and is available in many states where PIP is not required. Understanding state-specific insurance laws helps drivers choose appropriate coverage to protect against personal injury costs after accidents.

Coverage Limits and Policy Options

Personal Injury Protection (PIP) typically offers higher coverage limits than Medical Payments (MedPay), often covering a broader range of expenses including lost wages and rehabilitation costs. Policy options for PIP vary more widely, allowing insured individuals to customize limits and benefits according to state requirements, whereas MedPay usually has fixed, lower limits focused solely on medical expenses. Choosing between PIP and MedPay depends on the desired level of financial protection and the specific coverage limits offered by insurers in the insured's jurisdiction.

What Does PIP Cover That MedPay Doesn’t?

Personal Injury Protection (PIP) covers a broader range of expenses than Medical Payments (MedPay), including lost wages, rehabilitation costs, and essential services such as childcare and household help after an injury. While MedPay typically only reimburses medical and funeral expenses regardless of fault, PIP provides more comprehensive financial protection by addressing both medical bills and related non-medical costs. This expanded coverage makes PIP crucial for those seeking extensive support following an auto accident.

How MedPay Complements Health Insurance

MedPay Coverage enhances health insurance by covering copayments, deductibles, and services health plans may exclude, such as ambulance fees and dental treatments. It provides immediate medical expense coverage regardless of fault, reducing out-of-pocket costs during injury claims. This synergy ensures comprehensive financial protection in auto accident-related personal injuries.

Choosing Between PIP and MedPay

Choosing between Personal Injury Protection (PIP) and Medical Payments (MedPay) coverage depends on the extent of protection and state requirements. PIP provides broader benefits including medical expenses, lost wages, and other injury-related costs, often mandated in no-fault states. MedPay focuses solely on covering medical and funeral expenses regardless of fault, making it a cost-effective option for additional medical coverage.

Cost Comparison: PIP vs MedPay

Personal Injury Protection (PIP) coverage generally incurs higher premiums compared to Medical Payments (MedPay) due to its broader scope, including lost wages and non-medical expenses. MedPay offers a more cost-effective option, providing limited coverage strictly for medical and funeral expenses regardless of fault. Policyholders should evaluate PIP's comprehensive benefits against MedPay's affordability to determine the best financial protection for their needs.

Frequently Asked Questions About PIP and MedPay

Personal Injury Protection (PIP) covers medical expenses, lost wages, and other related costs arising from car accidents, regardless of fault, while Medical Payments (MedPay) strictly reimburses medical bills without covering lost income. PIP typically offers broader protection and higher coverage limits compared to MedPay, which is often an optional add-on to auto insurance policies. Understanding state-specific regulations and policy details is crucial since PIP is mandatory in no-fault states, whereas MedPay is available nationwide with variable benefits.

Personal Injury Protection vs Medical Payments Infographic

cardiffo.com

cardiffo.com