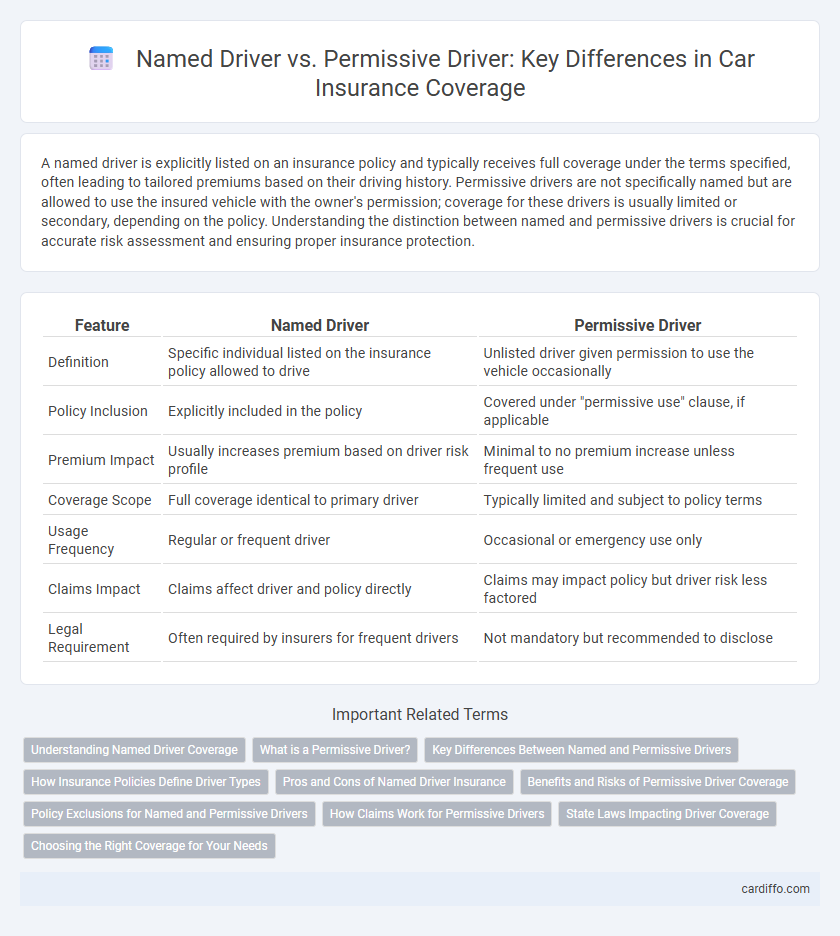

A named driver is explicitly listed on an insurance policy and typically receives full coverage under the terms specified, often leading to tailored premiums based on their driving history. Permissive drivers are not specifically named but are allowed to use the insured vehicle with the owner's permission; coverage for these drivers is usually limited or secondary, depending on the policy. Understanding the distinction between named and permissive drivers is crucial for accurate risk assessment and ensuring proper insurance protection.

Table of Comparison

| Feature | Named Driver | Permissive Driver |

|---|---|---|

| Definition | Specific individual listed on the insurance policy allowed to drive | Unlisted driver given permission to use the vehicle occasionally |

| Policy Inclusion | Explicitly included in the policy | Covered under "permissive use" clause, if applicable |

| Premium Impact | Usually increases premium based on driver risk profile | Minimal to no premium increase unless frequent use |

| Coverage Scope | Full coverage identical to primary driver | Typically limited and subject to policy terms |

| Usage Frequency | Regular or frequent driver | Occasional or emergency use only |

| Claims Impact | Claims affect driver and policy directly | Claims may impact policy but driver risk less factored |

| Legal Requirement | Often required by insurers for frequent drivers | Not mandatory but recommended to disclose |

Understanding Named Driver Coverage

Named driver coverage specifically includes individuals listed on an insurance policy who are authorized to drive the insured vehicle, providing tailored risk assessment and premium calculations based on their driving history. Permissive driver coverage, by contrast, extends insurance protection to drivers not explicitly named on the policy but who have the policyholder's permission to use the vehicle occasionally. Understanding the distinction between named and permissive drivers is essential for accurate coverage limits, potential claim handling, and avoiding coverage denial in the event of an accident.

What is a Permissive Driver?

A permissive driver is someone who has the vehicle owner's consent to drive the insured vehicle but is not listed explicitly on the insurance policy. Most insurance policies extend coverage to permissive drivers, although the coverage limits may be lower compared to named drivers. Understanding the difference between a named driver and a permissive driver is crucial for proper insurance claims and liability protection.

Key Differences Between Named and Permissive Drivers

Named drivers are explicitly listed on an insurance policy and have full coverage according to the terms specified, whereas permissive drivers are occasional users not named on the policy but allowed to drive the insured vehicle with limited coverage. Named driver coverage often includes comprehensive benefits tailored to the individual, while permissive drivers typically receive coverage only for liability, subject to restrictions and lower limits. Insurers may adjust premiums based on named drivers' risk profiles, whereas permissive driver use usually does not influence premiums unless frequent or high-risk use is identified.

How Insurance Policies Define Driver Types

Insurance policies distinguish named drivers as individuals explicitly listed on the policy and covered for driving the insured vehicle, while permissive drivers are those not listed but allowed by the policyholder to operate the vehicle occasionally. Named driver coverage often results in tailored premiums reflecting the specific driver's risk profile, whereas permissive use typically carries higher risk considerations and potential limitations. Understanding these definitions is crucial for accurate premium calculation and ensuring proper coverage under automobile insurance policies.

Pros and Cons of Named Driver Insurance

Named driver insurance primarily covers only the specified individual, often resulting in lower premiums and clearer risk assessment for insurers. However, this limitation restricts coverage to the named driver, leaving any other drivers using the vehicle uninsured and potentially exposing them to liability. The clear boundaries of named driver insurance benefit policyholders seeking cost-effective coverage for a single driver but lack flexibility for occasional or multiple users.

Benefits and Risks of Permissive Driver Coverage

Permissive driver coverage allows insured vehicles to be driven occasionally by non-listed drivers, offering flexible protection in emergencies or unexpected situations. This coverage can reduce claims denials and protect the policyholder from liability when an unlisted driver causes damage. However, risks include potential increased premiums and limited coverage limits compared to named driver policies, which specify approved drivers and can offer more precise risk management.

Policy Exclusions for Named and Permissive Drivers

Policy exclusions for named drivers specifically limit coverage to drivers explicitly listed on the insurance policy, excluding anyone not named, even if permitted to drive. Permissive drivers, although not listed, receive limited coverage only when driving with the policyholder's consent, but insurers often impose stricter exclusions or lower liability limits for these drivers. Understanding these exclusions is critical for avoiding denied claims and ensuring adequate protection under liability and collision coverage terms.

How Claims Work for Permissive Drivers

Claims for permissive drivers are typically covered under the primary policyholder's auto insurance, as insurers extend coverage when the named driver grants permission to use the vehicle. However, the insurance company may hold the named driver responsible for any deductibles or damages if the permissive driver is at fault. Understanding how claims work for permissive drivers is crucial, as coverage limits and policy terms directly impact liability and out-of-pocket costs during accident claims.

State Laws Impacting Driver Coverage

State laws significantly influence the distinction between named driver and permissive driver coverage in insurance policies, with many states requiring explicit listing of all drivers to ensure claims validity. Named driver policies limit coverage strictly to individuals specified on the policy, whereas permissive driver laws can vary, sometimes extending coverage to occasional or unlisted drivers but often with restrictions or reduced benefits. Understanding specific state regulations is crucial for policyholders to avoid coverage gaps or claim denials when unlisted drivers operate the insured vehicle.

Choosing the Right Coverage for Your Needs

Choosing the right coverage involves understanding the difference between Named Driver and Permissive Driver policies, as Named Driver coverage restricts insurance to specific individuals listed on the policy, while Permissive Driver coverage extends protection to occasional drivers not explicitly named. Prioritize clarity on who will be driving the vehicle regularly to avoid coverage gaps and premiums that may not align with actual risk. Carefully evaluate your driving habits, household members, and frequency of others using your insured vehicle to select the most cost-effective and comprehensive option.

Named Driver vs Permissive Driver Infographic

cardiffo.com

cardiffo.com