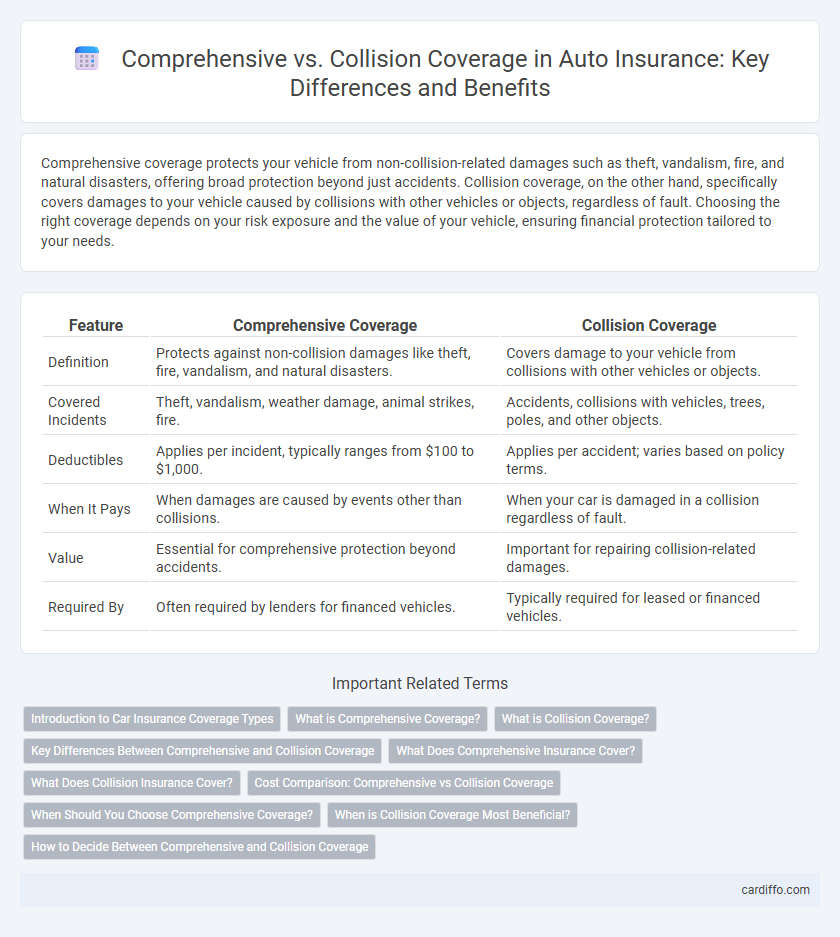

Comprehensive coverage protects your vehicle from non-collision-related damages such as theft, vandalism, fire, and natural disasters, offering broad protection beyond just accidents. Collision coverage, on the other hand, specifically covers damages to your vehicle caused by collisions with other vehicles or objects, regardless of fault. Choosing the right coverage depends on your risk exposure and the value of your vehicle, ensuring financial protection tailored to your needs.

Table of Comparison

| Feature | Comprehensive Coverage | Collision Coverage |

|---|---|---|

| Definition | Protects against non-collision damages like theft, fire, vandalism, and natural disasters. | Covers damage to your vehicle from collisions with other vehicles or objects. |

| Covered Incidents | Theft, vandalism, weather damage, animal strikes, fire. | Accidents, collisions with vehicles, trees, poles, and other objects. |

| Deductibles | Applies per incident, typically ranges from $100 to $1,000. | Applies per accident; varies based on policy terms. |

| When It Pays | When damages are caused by events other than collisions. | When your car is damaged in a collision regardless of fault. |

| Value | Essential for comprehensive protection beyond accidents. | Important for repairing collision-related damages. |

| Required By | Often required by lenders for financed vehicles. | Typically required for leased or financed vehicles. |

Introduction to Car Insurance Coverage Types

Comprehensive coverage protects against non-collision incidents such as theft, vandalism, natural disasters, and animal collisions, offering broader protection for your vehicle. Collision coverage specifically covers damage resulting from collisions with other vehicles or objects, regardless of fault. Choosing the right car insurance coverage type depends on factors like vehicle value, driving habits, and risk tolerance to ensure adequate financial protection.

What is Comprehensive Coverage?

Comprehensive coverage protects your vehicle against non-collision-related damages such as theft, vandalism, natural disasters, and falling objects. It covers repair or replacement costs when weather events like hailstorms or floods damage your car. This type of insurance complements collision coverage by addressing risks beyond accidents involving other vehicles.

What is Collision Coverage?

Collision coverage is an auto insurance policy that pays for damages to your vehicle resulting from a collision with another car or object, such as a tree or guardrail. It typically covers repair or replacement costs regardless of who is at fault in the accident. This coverage is essential for protecting your investment in your vehicle, especially if you drive frequently or have a newer car.

Key Differences Between Comprehensive and Collision Coverage

Comprehensive coverage protects against non-collision-related damages such as theft, vandalism, fire, natural disasters, and animal collisions, whereas collision coverage specifically covers damage to your vehicle resulting from a collision with another vehicle or object. Comprehensive claims often involve unpredictable events outside the driver's control, while collision claims typically result from driving incidents. Understanding these distinctions helps policyholders choose the right coverage based on risk exposure and vehicle value.

What Does Comprehensive Insurance Cover?

Comprehensive insurance covers damage to your vehicle caused by non-collision events such as theft, vandalism, natural disasters, fire, and falling objects. It also includes coverage for windshield damage and animal-related accidents, providing broad protection beyond accidents on the road. This type of coverage helps policyholders avoid out-of-pocket expenses for unexpected incidents that are typically not covered by collision insurance.

What Does Collision Insurance Cover?

Collision insurance covers damages to your vehicle resulting from collisions with other vehicles or objects, regardless of fault. It typically pays for repairs or replacement after accidents such as hitting a tree, guardrail, or another car. This coverage is essential for drivers who want protection against unexpected repair costs from physical impacts.

Cost Comparison: Comprehensive vs Collision Coverage

Comprehensive coverage typically costs less than collision coverage due to a lower likelihood of claims related to events like theft, vandalism, or natural disasters. Collision coverage involves higher premiums because it pays for damages resulting from accidents with other vehicles or objects, which occur more frequently. Comparing average annual costs, comprehensive coverage ranges from $150 to $300, while collision coverage can exceed $400 depending on vehicle type and driving history.

When Should You Choose Comprehensive Coverage?

Choose comprehensive coverage when you want protection against non-collision-related damages such as theft, vandalism, natural disasters, or falling objects. This coverage is essential if you live in areas prone to weather events, have a high-value vehicle, or park in unsecured locations. Comprehensive coverage complements collision coverage by addressing a broader range of potential risks to your vehicle.

When is Collision Coverage Most Beneficial?

Collision coverage is most beneficial when your vehicle is newer or has a high market value, as it helps cover repair costs after accidents involving other vehicles or objects. Drivers who frequently commute in heavy traffic or hazardous road conditions gain additional financial protection against collision-related damages. This coverage is especially advantageous for those without significant savings to handle unexpected repair bills.

How to Decide Between Comprehensive and Collision Coverage

Choosing between comprehensive and collision coverage depends on the specific risks your vehicle faces and your financial goals. Comprehensive coverage protects against non-collision-related damages such as theft, vandalism, or natural disasters, while collision coverage covers damages from accidents involving other vehicles or objects. Assess your vehicle's age, location, and likelihood of accidents or non-collision incidents to determine which coverage offers the best value and protection.

Comprehensive Coverage vs Collision Coverage Infographic

cardiffo.com

cardiffo.com