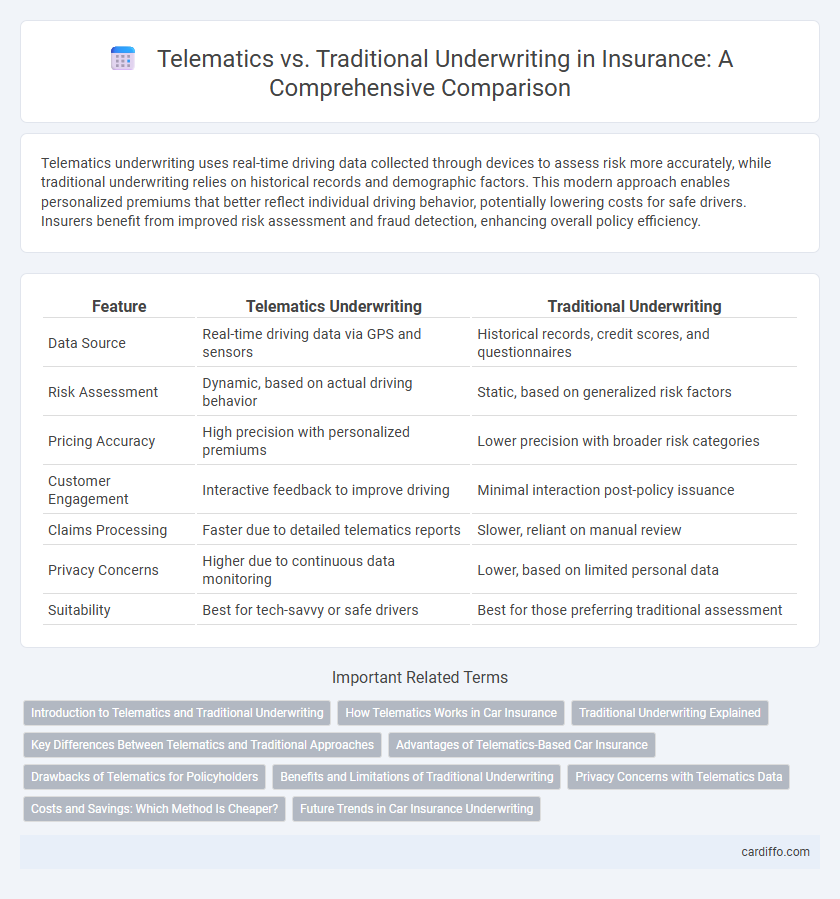

Telematics underwriting uses real-time driving data collected through devices to assess risk more accurately, while traditional underwriting relies on historical records and demographic factors. This modern approach enables personalized premiums that better reflect individual driving behavior, potentially lowering costs for safe drivers. Insurers benefit from improved risk assessment and fraud detection, enhancing overall policy efficiency.

Table of Comparison

| Feature | Telematics Underwriting | Traditional Underwriting |

|---|---|---|

| Data Source | Real-time driving data via GPS and sensors | Historical records, credit scores, and questionnaires |

| Risk Assessment | Dynamic, based on actual driving behavior | Static, based on generalized risk factors |

| Pricing Accuracy | High precision with personalized premiums | Lower precision with broader risk categories |

| Customer Engagement | Interactive feedback to improve driving | Minimal interaction post-policy issuance |

| Claims Processing | Faster due to detailed telematics reports | Slower, reliant on manual review |

| Privacy Concerns | Higher due to continuous data monitoring | Lower, based on limited personal data |

| Suitability | Best for tech-savvy or safe drivers | Best for those preferring traditional assessment |

Introduction to Telematics and Traditional Underwriting

Telematics in insurance utilizes real-time driving data collected via GPS and onboard sensors to assess risk more accurately compared to traditional underwriting methods, which rely on historical data, credit scores, and self-reported information. This technology enables personalized premium pricing based on individual driving behavior, improving risk assessment and promoting safer driving habits. Traditional underwriting, while time-tested, often lacks the precision and adaptability offered by telematics-driven models.

How Telematics Works in Car Insurance

Telematics in car insurance works by using GPS and onboard devices to collect real-time driving data such as speed, braking patterns, acceleration, and mileage. This data is transmitted to insurers, allowing for personalized risk assessment and dynamic premium adjustments based on actual driving behavior. Compared to traditional underwriting, which relies on historical data and demographic factors, telematics provides more accurate and fair pricing through continuous monitoring.

Traditional Underwriting Explained

Traditional underwriting in insurance relies heavily on historical data, such as credit scores, claims history, and demographic information, to assess risk and determine policy premiums. Underwriters manually evaluate applications, using established criteria to predict the likelihood of future claims while ensuring compliance with regulatory standards. This method, though time-tested and widely accepted, often results in less personalized pricing compared to telematics-based models, which utilize real-time data from devices for dynamic risk assessment.

Key Differences Between Telematics and Traditional Approaches

Telematics underwriting leverages real-time driving data collected through devices or mobile apps to assess risk based on actual behavior, whereas traditional underwriting relies on historical data such as age, gender, and driving records. The telematics approach enables personalized premiums by analyzing factors like speed, braking patterns, and mileage, offering a dynamic and accurate risk profile. Traditional underwriting uses static information and statistical models, often resulting in less precise risk assessment and pricing.

Advantages of Telematics-Based Car Insurance

Telematics-based car insurance offers real-time driving behavior data, enabling more accurate risk assessment and personalized premium pricing compared to traditional underwriting. This data-driven approach rewards safe drivers with lower rates, promoting safer road habits and potentially reducing claims. Moreover, telematics facilitates quicker claims processing through automated accident detection and detailed incident reports.

Drawbacks of Telematics for Policyholders

Telematics-based underwriting can raise privacy concerns for policyholders due to the continuous tracking of driving behavior and location data. The reliance on telematics devices may lead to potential data security risks and unauthorized access to sensitive personal information. Furthermore, policyholders who exhibit inconsistent or cautious driving might receive unfairly high premiums compared to traditional risk assessments.

Benefits and Limitations of Traditional Underwriting

Traditional underwriting in insurance relies on historical data, credit scores, and broad risk assessments to determine policy terms, often resulting in standardized premiums that may not accurately reflect individual driver behavior. This method provides a well-established framework with regulatory acceptance but lacks real-time insights, potentially leading to less personalized pricing and slower policy issuance. Limitations include reduced accuracy in risk prediction, limited incentives for safer driving, and an inability to leverage dynamic data compared to telematics-based underwriting.

Privacy Concerns with Telematics Data

Telematics underwriting collects real-time driving data, raising significant privacy concerns over continuous location tracking and personal behavior monitoring. Traditional underwriting relies on historical data like credit scores and claims history, minimizing intrusive data capture. Insurers must ensure transparent data policies and robust cybersecurity measures to protect sensitive telematics information and maintain customer trust.

Costs and Savings: Which Method Is Cheaper?

Telematics underwriting leverages real-time driving data to offer personalized premiums, often resulting in significant cost savings for safe drivers compared to traditional underwriting, which relies on static factors like age and claims history. By accurately assessing risk through telematics, insurers reduce administrative costs and minimize loss ratios, translating into lower premiums. Traditional underwriting may initially seem cheaper but lacks the dynamic risk assessment that can lead to long-term savings through behavioral incentives.

Future Trends in Car Insurance Underwriting

Future trends in car insurance underwriting emphasize the growing adoption of telematics, which leverages real-time driving data to enhance risk assessment accuracy and personalize premiums. Traditional underwriting methods, reliant on static historical data, face limitations in predicting driver behavior and risk dynamics. Innovations in artificial intelligence and machine learning integrated with telematics are expected to drive more dynamic pricing models and foster proactive risk management strategies in the insurance industry.

Telematics vs Traditional Underwriting Infographic

cardiffo.com

cardiffo.com