Black Box Insurance uses telematics devices to monitor driving behavior, enabling personalized premiums based on actual risk rather than generic factors. Traditional Insurance relies on historical data, demographics, and credit scores to determine rates, often resulting in less individualized pricing. By leveraging real-time data, Black Box Insurance promotes safer driving habits and can offer more competitive rates for low-risk drivers.

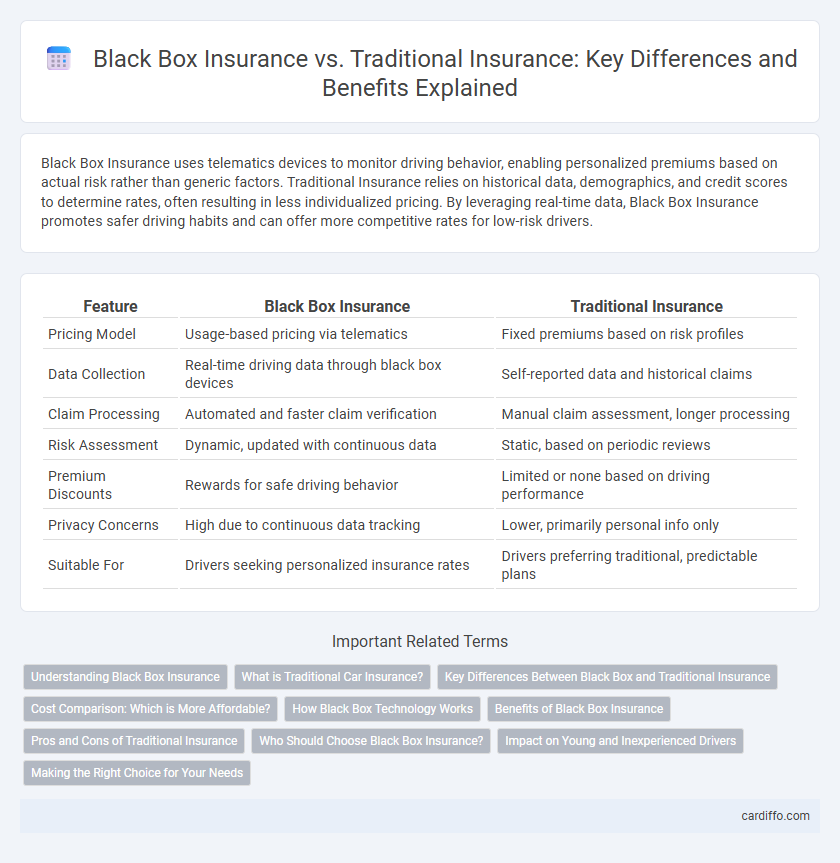

Table of Comparison

| Feature | Black Box Insurance | Traditional Insurance |

|---|---|---|

| Pricing Model | Usage-based pricing via telematics | Fixed premiums based on risk profiles |

| Data Collection | Real-time driving data through black box devices | Self-reported data and historical claims |

| Claim Processing | Automated and faster claim verification | Manual claim assessment, longer processing |

| Risk Assessment | Dynamic, updated with continuous data | Static, based on periodic reviews |

| Premium Discounts | Rewards for safe driving behavior | Limited or none based on driving performance |

| Privacy Concerns | High due to continuous data tracking | Lower, primarily personal info only |

| Suitable For | Drivers seeking personalized insurance rates | Drivers preferring traditional, predictable plans |

Understanding Black Box Insurance

Black Box Insurance uses telematics technology to monitor driving behavior in real-time, allowing insurers to offer personalized premiums based on actual risk rather than general statistics. This data-driven approach promotes safer driving habits and can result in significant cost savings for low-risk drivers compared to Traditional Insurance that relies on demographic and historical claim data. Understanding Black Box Insurance means recognizing its potential for enhanced accuracy in risk assessment and increased transparency in premium calculation.

What is Traditional Car Insurance?

Traditional car insurance provides coverage through fixed premiums based on factors like driver history, vehicle type, and location, without real-time monitoring. Policies typically include liability, collision, and comprehensive coverage with predictable monthly or annual payments. This model relies on historical data rather than usage patterns to assess risk and determine costs.

Key Differences Between Black Box and Traditional Insurance

Black Box Insurance uses telematics technology to monitor driving behavior in real-time, allowing for personalized premiums based on actual risk, whereas Traditional Insurance relies on generalized risk factors like age, location, and driving history for policy pricing. Black Box policies encourage safer driving habits by providing feedback and potential discounts, while Traditional Insurance typically offers fixed premiums regardless of individual driving patterns. Claims processing in Black Box Insurance can be streamlined through data collected during incidents, contrasting with the often more manual and time-consuming assessments in Traditional Insurance.

Cost Comparison: Which is More Affordable?

Black box insurance typically offers lower premiums compared to traditional insurance by using telematics to monitor driving behavior and reward safe driving with discounts. Traditional insurance calculates costs based on historical data, demographic factors, and fixed risk assessments, often resulting in higher base rates. For cost-conscious drivers, black box insurance can be more affordable due to its personalized pricing model influenced by actual driving performance.

How Black Box Technology Works

Black box insurance leverages telematics devices installed in vehicles to monitor driving behavior, capturing data such as speed, acceleration, braking patterns, and mileage in real-time. This collected information is transmitted to insurers, enabling personalized premium calculations based on actual risk profiles rather than generalized statistics. Traditional insurance relies primarily on historical data and demographic factors, lacking the granular insights provided by continuous telematics monitoring.

Benefits of Black Box Insurance

Black Box Insurance offers precise, data-driven premiums by monitoring real-time driving behavior through telematics devices, resulting in personalized and often lower costs compared to Traditional Insurance. This technology incentivizes safer driving habits, which can reduce accident rates and claims over time. Enhanced transparency and immediate feedback empower policyholders to manage their risk more effectively, leading to potential long-term savings.

Pros and Cons of Traditional Insurance

Traditional insurance offers widespread availability and the security of long-established policies with predictable premium structures. It lacks real-time data tracking, which can result in less personalized rates and slower claim processing compared to Black Box Insurance. However, traditional plans often provide broader coverage options and are accessible regardless of driving behavior or technology use.

Who Should Choose Black Box Insurance?

Black Box Insurance suits drivers who prioritize personalized premiums based on real-time driving behavior, offering cost savings for safe and low-mileage individuals. It is ideal for tech-savvy consumers comfortable with continuous monitoring and data sharing to optimize their insurance costs. Customers seeking straightforward coverage without usage-based adjustments may prefer traditional insurance options.

Impact on Young and Inexperienced Drivers

Black Box Insurance uses telematics technology to monitor young and inexperienced drivers' behavior, offering personalized premiums based on real-time data, which often results in lower costs for safe drivers. Traditional Insurance relies on demographic factors and historical data, frequently charging higher premiums for high-risk groups like young drivers due to the lack of individualized driving assessment. The integration of Black Box Insurance encourages safer driving habits by providing feedback and financial incentives, potentially reducing accidents and insurance costs over time for novice drivers.

Making the Right Choice for Your Needs

Black box insurance uses telematics devices to monitor driving behavior, offering personalized premiums and potential savings based on real-time data. Traditional insurance relies on standard risk factors such as age, driving history, and location to set fixed rates, providing simplicity and predictability. Choosing between black box and traditional insurance depends on your driving habits, preference for customized pricing, and comfort with technology tracking.

Black Box Insurance vs Traditional Insurance Infographic

cardiffo.com

cardiffo.com