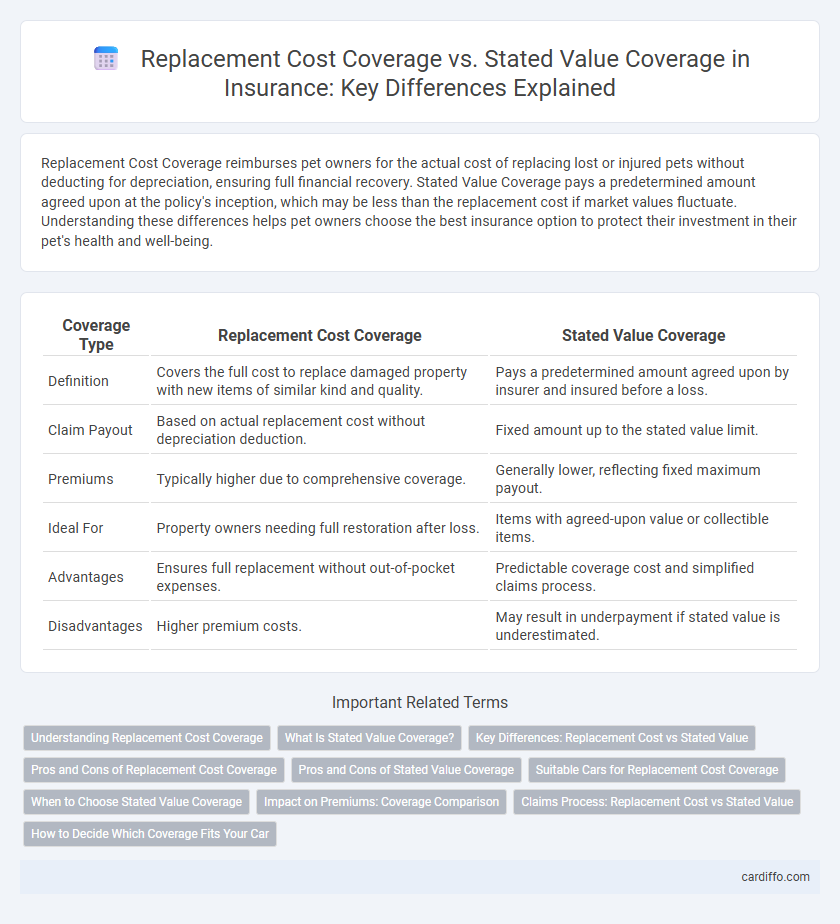

Replacement Cost Coverage reimburses pet owners for the actual cost of replacing lost or injured pets without deducting for depreciation, ensuring full financial recovery. Stated Value Coverage pays a predetermined amount agreed upon at the policy's inception, which may be less than the replacement cost if market values fluctuate. Understanding these differences helps pet owners choose the best insurance option to protect their investment in their pet's health and well-being.

Table of Comparison

| Coverage Type | Replacement Cost Coverage | Stated Value Coverage |

|---|---|---|

| Definition | Covers the full cost to replace damaged property with new items of similar kind and quality. | Pays a predetermined amount agreed upon by insurer and insured before a loss. |

| Claim Payout | Based on actual replacement cost without depreciation deduction. | Fixed amount up to the stated value limit. |

| Premiums | Typically higher due to comprehensive coverage. | Generally lower, reflecting fixed maximum payout. |

| Ideal For | Property owners needing full restoration after loss. | Items with agreed-upon value or collectible items. |

| Advantages | Ensures full replacement without out-of-pocket expenses. | Predictable coverage cost and simplified claims process. |

| Disadvantages | Higher premium costs. | May result in underpayment if stated value is underestimated. |

Understanding Replacement Cost Coverage

Replacement Cost Coverage reimburses the full cost to repair or replace damaged property without deducting depreciation, ensuring policyholders receive funds to restore assets to their original condition. This coverage applies to items like homes, vehicles, and personal belongings, providing financial protection aligned with current market prices and materials. Understanding Replacement Cost Coverage is crucial for avoiding out-of-pocket expenses that result from depreciation calculations in other policy types.

What Is Stated Value Coverage?

Stated Value Coverage is an insurance policy that pays a predetermined amount agreed upon by the insurer and insured, rather than the actual cash value or replacement cost of the item. This coverage type is commonly used for high-value or collectible items where market value fluctuations make standard valuation challenging. It provides clarity and certainty in claims, ensuring the insured receives the specific agreed amount regardless of depreciation.

Key Differences: Replacement Cost vs Stated Value

Replacement Cost Coverage reimburses policyholders for the full cost to repair or replace damaged property without deduction for depreciation, ensuring the restored value matches the original asset's condition. Stated Value Coverage provides a predetermined payout limit based on the agreed-upon value of the insured item, regardless of actual repair or replacement costs at the claim time. Key differences include how depreciation impacts claims and the flexibility of reimbursement amounts, with Replacement Cost offering broader coverage and Stated Value providing predictable limits.

Pros and Cons of Replacement Cost Coverage

Replacement Cost Coverage reimburses policyholders for the actual cost to repair or replace damaged property without depreciation, ensuring full restoration of assets after a loss. The primary advantage lies in comprehensive financial protection, but premiums tend to be higher compared to Stated Value Coverage, which may lead to increased insurance costs. A significant drawback is the potential for disputes if the insurer determines the replacement cost lower than anticipated, causing delays or partial payments.

Pros and Cons of Stated Value Coverage

Stated Value Coverage offers a predetermined reimbursement amount that simplifies claims by avoiding depreciation calculations, ensuring certainty in payout. However, this coverage may result in underinsurance if the stated value is set too low, potentially leaving policyholders responsible for significant out-of-pocket expenses. It is best suited for unique or older items where replacement cost is difficult to determine, but it lacks the flexibility of replacement cost coverage to fully cover current market values.

Suitable Cars for Replacement Cost Coverage

Replacement Cost Coverage is most suitable for newer vehicles or those with high market value, such as luxury cars and recent models, where repair or replacement expenses are significantly expensive. It ensures the insured receives the full cost to replace or repair the car without depreciation deductions, ideal for owners seeking optimal protection. In contrast, Stated Value Coverage is better suited for older or classic cars where the agreed-upon value is fixed and may be lower than replacement cost.

When to Choose Stated Value Coverage

Choose stated value coverage when insuring items with stable or easily appraised values, such as antiques or collectibles, as it provides a predetermined payout limit agreed upon by insurer and policyholder. This coverage is ideal if you want certainty in claim settlements without the fluctuations of market value or replacement cost. Stated value policies minimize disputes over valuation, making them suitable for unique property that may be difficult to replace or repair at market cost.

Impact on Premiums: Coverage Comparison

Replacement Cost Coverage typically results in higher premiums as it reimburses the full cost to repair or replace property without depreciation, providing more comprehensive protection. Stated Value Coverage sets a fixed payout based on the agreed value at policy inception, often leading to lower premiums but potentially less compensation in the event of a claim. Insurers factor in risk, property age, and coverage limits when determining premiums, making Replacement Cost Coverage a costlier yet more protective option.

Claims Process: Replacement Cost vs Stated Value

Replacement Cost Coverage ensures claims are paid based on the actual cost to repair or replace damaged property without deducting depreciation, streamlining reimbursement for policyholders. In contrast, Stated Value Coverage pays out a predetermined amount agreed upon when the policy is issued, which may result in lower claim payments if the replacement cost exceeds the stated value. Understanding these differences is crucial for policyholders to manage expectations during the claims process and select coverage aligned with their financial risk tolerance.

How to Decide Which Coverage Fits Your Car

Replacement Cost Coverage reimburses the full cost to repair or replace your vehicle with a new one of similar make and model, ensuring comprehensive protection against depreciation. Stated Value Coverage provides a predetermined payout based on the agreed-upon value between you and the insurer, often suited for classic or vintage cars with fluctuating market values. Choosing the right coverage depends on factors such as your car's age, market value stability, and whether you prefer guaranteed full replacement or a fixed payout aligned with your vehicle's current worth.

Replacement Cost Coverage vs Stated Value Coverage Infographic

cardiffo.com

cardiffo.com