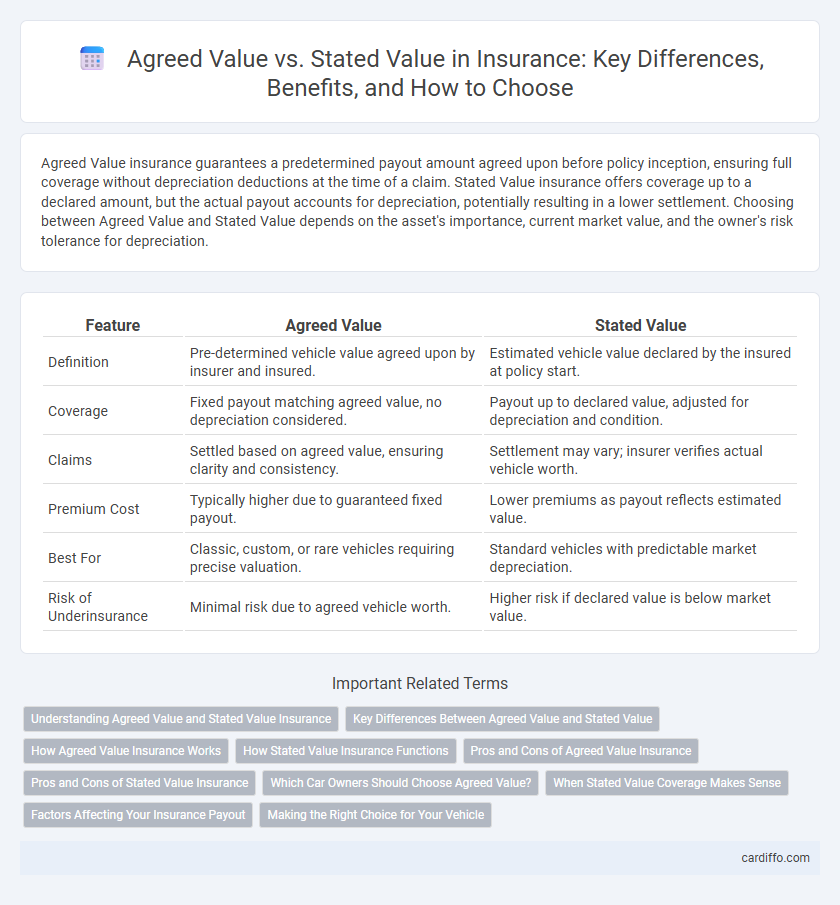

Agreed Value insurance guarantees a predetermined payout amount agreed upon before policy inception, ensuring full coverage without depreciation deductions at the time of a claim. Stated Value insurance offers coverage up to a declared amount, but the actual payout accounts for depreciation, potentially resulting in a lower settlement. Choosing between Agreed Value and Stated Value depends on the asset's importance, current market value, and the owner's risk tolerance for depreciation.

Table of Comparison

| Feature | Agreed Value | Stated Value |

|---|---|---|

| Definition | Pre-determined vehicle value agreed upon by insurer and insured. | Estimated vehicle value declared by the insured at policy start. |

| Coverage | Fixed payout matching agreed value, no depreciation considered. | Payout up to declared value, adjusted for depreciation and condition. |

| Claims | Settled based on agreed value, ensuring clarity and consistency. | Settlement may vary; insurer verifies actual vehicle worth. |

| Premium Cost | Typically higher due to guaranteed fixed payout. | Lower premiums as payout reflects estimated value. |

| Best For | Classic, custom, or rare vehicles requiring precise valuation. | Standard vehicles with predictable market depreciation. |

| Risk of Underinsurance | Minimal risk due to agreed vehicle worth. | Higher risk if declared value is below market value. |

Understanding Agreed Value and Stated Value Insurance

Agreed Value insurance specifies a predetermined amount agreed upon by the insurer and policyholder, which will be paid out in the event of a total loss, ensuring clarity and eliminating depreciation concerns. Stated Value insurance requires the policyholder to declare the value of the insured item, which the insurer uses to determine coverage limits but may adjust for depreciation or market value at the time of loss. Understanding the distinction between agreed and stated value helps policyholders choose the most accurate coverage to protect classic cars, collectibles, or unique assets.

Key Differences Between Agreed Value and Stated Value

Agreed Value insurance guarantees a fixed payout amount agreed upon by the insurer and insured at policy inception, regardless of market fluctuations or depreciation. Stated Value insurance provides coverage up to a specified amount chosen by the insured, but actual payout considers the vehicle's current market value minus depreciation, which may result in a lower settlement. The key difference lies in how the claim amount is determined: Agreed Value offers certainty with a predetermined sum, while Stated Value depends on the depreciated market value at the time of loss.

How Agreed Value Insurance Works

Agreed Value insurance establishes a predetermined payout amount for insured property, agreed upon by both insurer and policyholder at the policy's inception, ensuring full compensation without depreciation deductions in the event of a total loss. This method eliminates disputes over the property's worth during claims, providing financial certainty and protection, especially for classic cars, fine art, or collectibles. Policyholders benefit from knowing the exact insurance coverage amount, which reflects the current market value agreed upon rather than fluctuating replacement costs.

How Stated Value Insurance Functions

Stated value insurance insures a vehicle for an amount agreed upon by the insurer and insured, typically based on the vehicle's market value rather than its replacement cost. This policy reimburses up to the stated amount specified in the insurance contract, regardless of the actual cash value at the time of a claim. It offers predictability in coverage limits but may result in underinsurance if the vehicle's market value exceeds the stated amount.

Pros and Cons of Agreed Value Insurance

Agreed value insurance sets a predetermined payout amount agreed upon by both insurer and insured at policy inception, ensuring full compensation without depreciation assessment during claims. This coverage benefits classic car owners and collectors by providing certainty and protecting against market value fluctuations. However, it often comes with higher premiums and may require periodic appraisals to maintain accuracy in coverage.

Pros and Cons of Stated Value Insurance

Stated value insurance offers flexibility by allowing policyholders to select a coverage amount based on their vehicle's estimated worth rather than the market value, potentially lowering premiums. However, it carries the risk of underinsurance if the stated amount is set too low, leading to insufficient claim payouts after a loss. Insurers may also dispute valuations, causing potential delays or disputes during claims processing compared to agreed value policies.

Which Car Owners Should Choose Agreed Value?

Car owners with classic, vintage, or highly customized vehicles should choose Agreed Value insurance to ensure full coverage based on a predetermined amount reflecting the car's true market worth. This option protects owners from depreciation discrepancies often encountered in Stated Value policies, which may undervalue unique or rare vehicles. Agreed Value policies provide certainty in claims, offering peace of mind that the agreed amount will be paid out without deductions for depreciation.

When Stated Value Coverage Makes Sense

Stated value coverage makes sense when insuring vehicles or assets with fluctuating market values, such as classic cars or customized equipment, where the replacement cost is difficult to determine. This coverage type allows policyholders to set a predetermined value that reflects the asset's condition and modifications, providing a clear claim payout limit in case of total loss. It offers a practical alternative to agreed value policies when market value consensus is challenging or when owners seek premium affordability combined with guaranteed coverage.

Factors Affecting Your Insurance Payout

Agreed Value policies guarantee a predetermined payout for total loss based on an appraisal or agreement at the policy's inception, ensuring clarity and certainty in claims. Stated Value policies, however, reflect the insurer's assessment of the vehicle's worth at the time of loss, which may result in a lower payout if market depreciation or damage factors reduce value. Factors affecting your insurance payout include the accuracy of vehicle valuation, documentation provided, policy limits, and depreciation considerations inherent in Stated Value coverage.

Making the Right Choice for Your Vehicle

Choosing between Agreed Value and Stated Value insurance is crucial for protecting your vehicle's worth accurately. Agreed Value policies guarantee a fixed settlement amount agreed upon at the start of the contract, ideal for classic or high-value cars with stable market values. Stated Value insurance offers flexibility by estimating your vehicle's worth, but actual payouts depend on depreciation and market conditions, potentially leading to lower claims than expected.

Agreed Value vs Stated Value Infographic

cardiffo.com

cardiffo.com