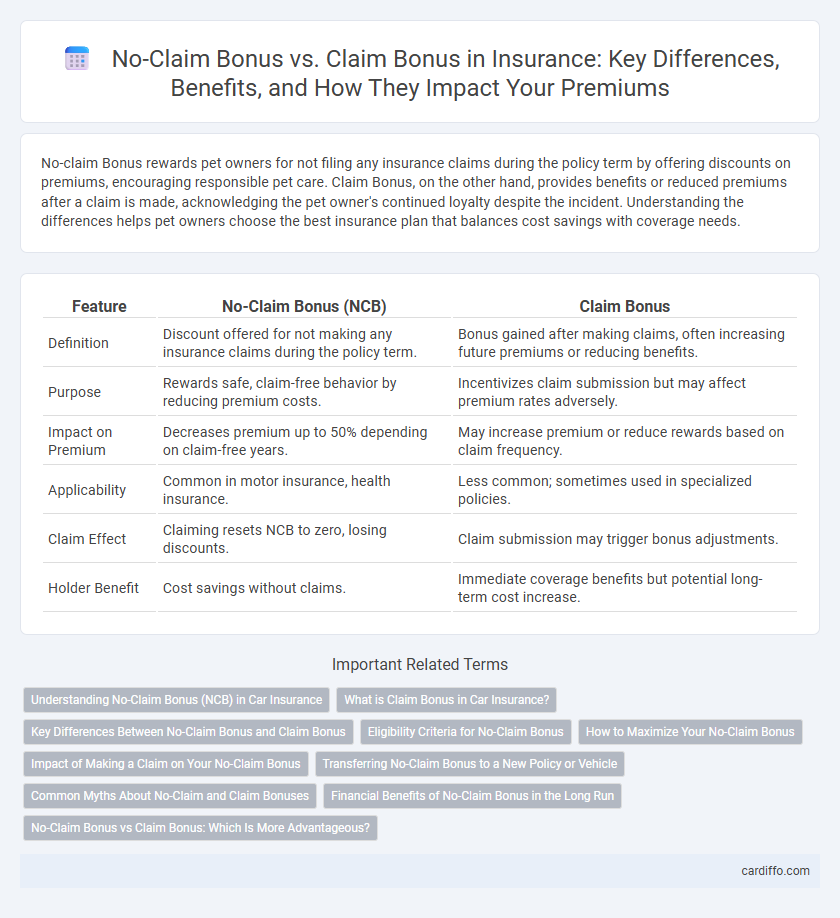

No-claim Bonus rewards pet owners for not filing any insurance claims during the policy term by offering discounts on premiums, encouraging responsible pet care. Claim Bonus, on the other hand, provides benefits or reduced premiums after a claim is made, acknowledging the pet owner's continued loyalty despite the incident. Understanding the differences helps pet owners choose the best insurance plan that balances cost savings with coverage needs.

Table of Comparison

| Feature | No-Claim Bonus (NCB) | Claim Bonus |

|---|---|---|

| Definition | Discount offered for not making any insurance claims during the policy term. | Bonus gained after making claims, often increasing future premiums or reducing benefits. |

| Purpose | Rewards safe, claim-free behavior by reducing premium costs. | Incentivizes claim submission but may affect premium rates adversely. |

| Impact on Premium | Decreases premium up to 50% depending on claim-free years. | May increase premium or reduce rewards based on claim frequency. |

| Applicability | Common in motor insurance, health insurance. | Less common; sometimes used in specialized policies. |

| Claim Effect | Claiming resets NCB to zero, losing discounts. | Claim submission may trigger bonus adjustments. |

| Holder Benefit | Cost savings without claims. | Immediate coverage benefits but potential long-term cost increase. |

Understanding No-Claim Bonus (NCB) in Car Insurance

No-Claim Bonus (NCB) in car insurance rewards policyholders with a discount on their premium for each claim-free year, typically ranging from 20% to 50%. Unlike Claim Bonus, which may increase premiums after a claim, NCB encourages safe driving by lowering costs and protecting drivers from premium hikes. Understanding NCB helps insured drivers maximize savings by maintaining a clean driving record and avoiding unnecessary claims.

What is Claim Bonus in Car Insurance?

Claim bonus in car insurance refers to the discount offered by insurers for each year a policyholder does not file a claim, encouraging safe driving and reducing premium costs. Unlike no-claim bonus, which typically applies when no claims are made, claim bonus may also include rewards for small or partial claims that do not significantly impact the insurer's risk assessment. This bonus directly lowers the renewal premium, making it a valuable feature for maintaining affordable car insurance coverage.

Key Differences Between No-Claim Bonus and Claim Bonus

No-Claim Bonus (NCB) rewards policyholders with a premium discount for not making any claims during the policy term, enhancing long-term savings and encouraging cautious behavior. Claim Bonus, on the other hand, refers to benefits or increased coverage provided after a claim is made, often leading to higher premiums in the renewal period. The key difference lies in NCB promoting no claim activity with financial incentives, while Claim Bonus offers immediate claim-related advantages but may impact future premium costs.

Eligibility Criteria for No-Claim Bonus

Eligibility for a No-Claim Bonus (NCB) typically requires the policyholder to have completed a full insurance policy term without filing any claims. This bonus is awarded as a discount on the premium during policy renewal, incentivizing claim-free behavior. In contrast, a Claim Bonus may not offer premium discounts but often includes benefits like increased coverage or reduced deductibles after a claim-free period.

How to Maximize Your No-Claim Bonus

Maximizing your No-Claim Bonus (NCB) requires maintaining a claim-free record over multiple policy periods, which directly reduces your insurance premiums. Opt for comprehensive coverage but avoid making minor claims that could reset your NCB, balancing risk and savings strategically. Regularly reviewing policy terms and opting for insurers with generous NCB protection clauses further enhances long-term cost benefits.

Impact of Making a Claim on Your No-Claim Bonus

Making a claim on your insurance policy typically reduces your No-Claim Bonus, leading to higher premiums during renewal. The No-Claim Bonus rewards claim-free policyholders with discounts, which are forfeited or decreased upon filing a claim. Maintaining a claim-free record maximizes premium savings and preserves the full benefits of the No-Claim Bonus.

Transferring No-Claim Bonus to a New Policy or Vehicle

Transferring a No-Claim Bonus (NCB) from an existing insurance policy to a new policy or vehicle preserves the discount earned for claim-free years, reducing premium costs significantly. Insurance providers typically require proof of the previous policy's claim history and may allow transfer only if the new policy covers the same insurance type, such as comprehensive vehicle insurance. Maintaining the NCB benefits accelerates savings on future premiums and incentivizes safer driving habits without forfeiting accrued advantages.

Common Myths About No-Claim and Claim Bonuses

No-claim bonus (NCB) and claim bonus are often misunderstood in insurance, with many believing that making a claim always results in losing the entire NCB, which is not true as some policies offer partial bonuses even after claims. Another common myth is that claim bonuses and no-claim bonuses are the same, whereas no-claim bonuses reward claim-free periods with premium discounts, while claim bonuses provide benefits after filing a claim. Policyholders should review their insurer's specific terms to understand the nuanced differences and avoid misconceptions about eligibility and benefits.

Financial Benefits of No-Claim Bonus in the Long Run

No-claim bonus (NCB) offers significant financial benefits by rewarding policyholders with discounts on premiums for every claim-free year, leading to substantial savings over time. Unlike claim bonus which often results in increased premiums due to filed claims, NCB encourages safe driving and prudent risk management, reducing overall insurance costs. Consistent accumulation of NCB can lower insurance expenses by up to 50%, making it a valuable long-term financial incentive for both individual and commercial vehicle owners.

No-Claim Bonus vs Claim Bonus: Which Is More Advantageous?

No-Claim Bonus (NCB) rewards policyholders with premium discounts for not filing claims, promoting disciplined risk management and cost savings over time. In contrast, Claim Bonus provides benefits after filing claims but often leads to higher premiums in subsequent renewals, reducing long-term advantages. Evaluating NCB versus Claim Bonus, the No-Claim Bonus is generally more advantageous for maintaining lower insurance costs and encouraging safer behavior.

No-claim Bonus vs Claim Bonus Infographic

cardiffo.com

cardiffo.com