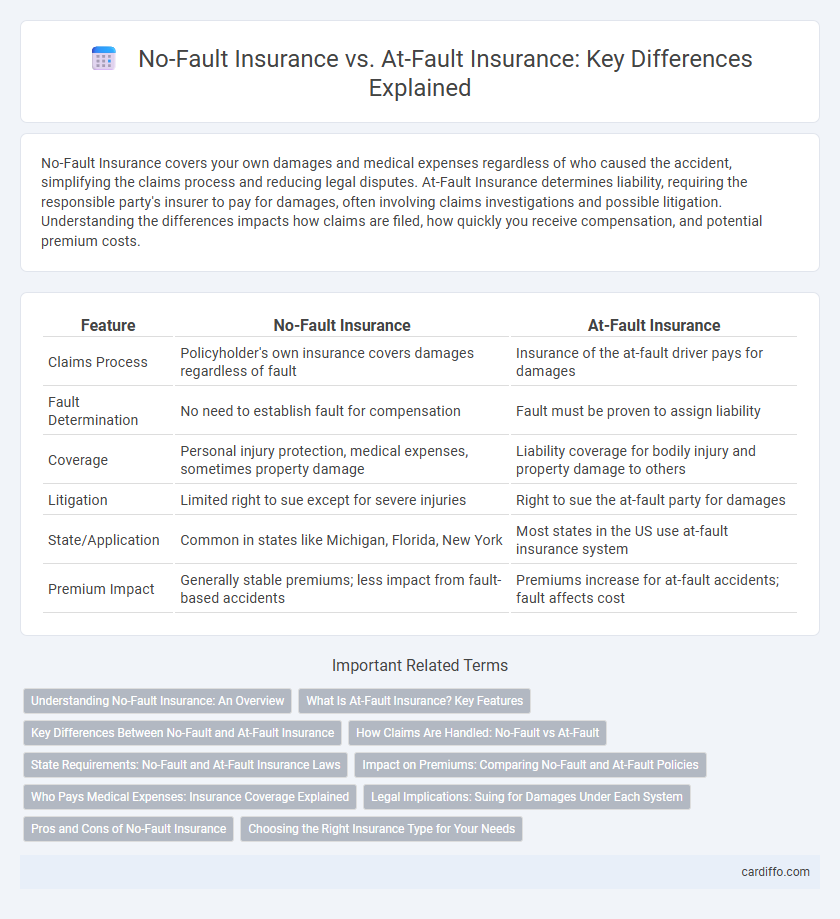

No-Fault Insurance covers your own damages and medical expenses regardless of who caused the accident, simplifying the claims process and reducing legal disputes. At-Fault Insurance determines liability, requiring the responsible party's insurer to pay for damages, often involving claims investigations and possible litigation. Understanding the differences impacts how claims are filed, how quickly you receive compensation, and potential premium costs.

Table of Comparison

| Feature | No-Fault Insurance | At-Fault Insurance |

|---|---|---|

| Claims Process | Policyholder's own insurance covers damages regardless of fault | Insurance of the at-fault driver pays for damages |

| Fault Determination | No need to establish fault for compensation | Fault must be proven to assign liability |

| Coverage | Personal injury protection, medical expenses, sometimes property damage | Liability coverage for bodily injury and property damage to others |

| Litigation | Limited right to sue except for severe injuries | Right to sue the at-fault party for damages |

| State/Application | Common in states like Michigan, Florida, New York | Most states in the US use at-fault insurance system |

| Premium Impact | Generally stable premiums; less impact from fault-based accidents | Premiums increase for at-fault accidents; fault affects cost |

Understanding No-Fault Insurance: An Overview

No-fault insurance allows policyholders to receive compensation from their own insurance company regardless of who caused the accident, streamlining claim processes and reducing litigation. This system covers medical expenses and lost wages up to a policy limit, emphasizing prompt financial support over determining liability. No-fault insurance is mandated in several states to minimize disputes and ensure faster claim settlements for accident victims.

What Is At-Fault Insurance? Key Features

At-fault insurance requires the driver responsible for an accident to cover the damages to other parties, typically through liability coverage. Key features include determining fault based on police reports or state laws, reimbursement for property damage and bodily injuries, and potential premium increases for the at-fault driver. This system contrasts with no-fault insurance, where each party's own insurer pays for their damages regardless of who caused the accident.

Key Differences Between No-Fault and At-Fault Insurance

No-fault insurance mandates that policyholders receive compensation from their own insurance provider regardless of fault, streamlining claim payments and reducing litigation. In contrast, at-fault insurance requires the party responsible for the accident to cover damages, often leading to liability disputes and higher premiums for the at-fault driver. Understanding these key differences impacts claim processes, legal responsibilities, and insurance costs.

How Claims Are Handled: No-Fault vs At-Fault

No-fault insurance processes claims through each party's own insurer, regardless of who caused the accident, streamlining compensation for medical expenses and lost wages. At-fault insurance requires determining the liable party, with the responsible driver's insurer covering damages, often leading to investigations and potential disputes. Understanding these claim handling differences is crucial for policyholders to navigate reimbursement timelines and legal obligations effectively.

State Requirements: No-Fault and At-Fault Insurance Laws

State requirements for no-fault insurance laws mandate that drivers carry Personal Injury Protection (PIP) coverage regardless of fault in an accident, streamlining claim processes and reducing litigation. In contrast, at-fault insurance laws require the driver who causes the accident to be financially responsible for damages, often involving liability coverage to compensate the injured party. States adopting no-fault systems include Florida, Michigan, and New York, while states enforcing at-fault insurance laws comprise Texas, California, and Illinois, each with distinct legal frameworks governing claims and compensations.

Impact on Premiums: Comparing No-Fault and At-Fault Policies

No-fault insurance typically leads to more stable premiums since claims are paid by each driver's own insurer regardless of fault, reducing the frequency of costly lawsuits. At-fault insurance may result in higher premiums for drivers deemed responsible in accidents, as insurers increase rates to cover claim payouts and legal expenses. Understanding state-specific regulations is essential, as some jurisdictions mandate no-fault coverage while others rely on at-fault systems, directly influencing premium calculations.

Who Pays Medical Expenses: Insurance Coverage Explained

No-fault insurance covers medical expenses regardless of who caused the accident, providing faster claims processing and reducing litigation costs. At-fault insurance requires the responsible party's insurer to pay for medical bills, potentially leading to disputes and longer claim settlements. Understanding these differences helps policyholders choose coverage that best protects them against medical costs after an auto accident.

Legal Implications: Suing for Damages Under Each System

No-fault insurance limits the ability to sue for damages by requiring parties to rely on their own insurance coverage, reducing litigation except in cases of serious injury or exceeding predefined thresholds. In contrast, at-fault insurance allows the injured party to pursue legal action against the responsible driver to recover compensation for damages, often leading to more frequent lawsuits and longer settlement times. Understanding these legal implications is crucial for policyholders to navigate claims procedures and potential liabilities effectively.

Pros and Cons of No-Fault Insurance

No-fault insurance guarantees quicker compensation for accident-related expenses regardless of who caused the accident, minimizing lengthy legal disputes and easing administrative burdens on claimants. However, it often results in higher premiums for all policyholders due to universal coverage and may limit the ability to sue at-fault parties for pain and suffering, potentially reducing accountability. This system benefits drivers by streamlining claims but may lead to increased overall costs and fewer legal remedies in severe negligence cases.

Choosing the Right Insurance Type for Your Needs

Choosing the right insurance type depends largely on your state's regulations and personal circumstances; no-fault insurance covers your damages regardless of who caused the accident, providing faster claims processing and reduced litigation, while at-fault insurance assigns liability to the responsible party, potentially offering broader compensation but involving more legal complexity. Evaluating factors such as premium costs, coverage limits, and claims process speed ensures an informed decision aligned with your financial protection priorities. Consulting with an insurance expert can clarify which policy minimizes out-of-pocket expenses and suits your driving risk profile.

No-Fault Insurance vs At-Fault Insurance Infographic

cardiffo.com

cardiffo.com