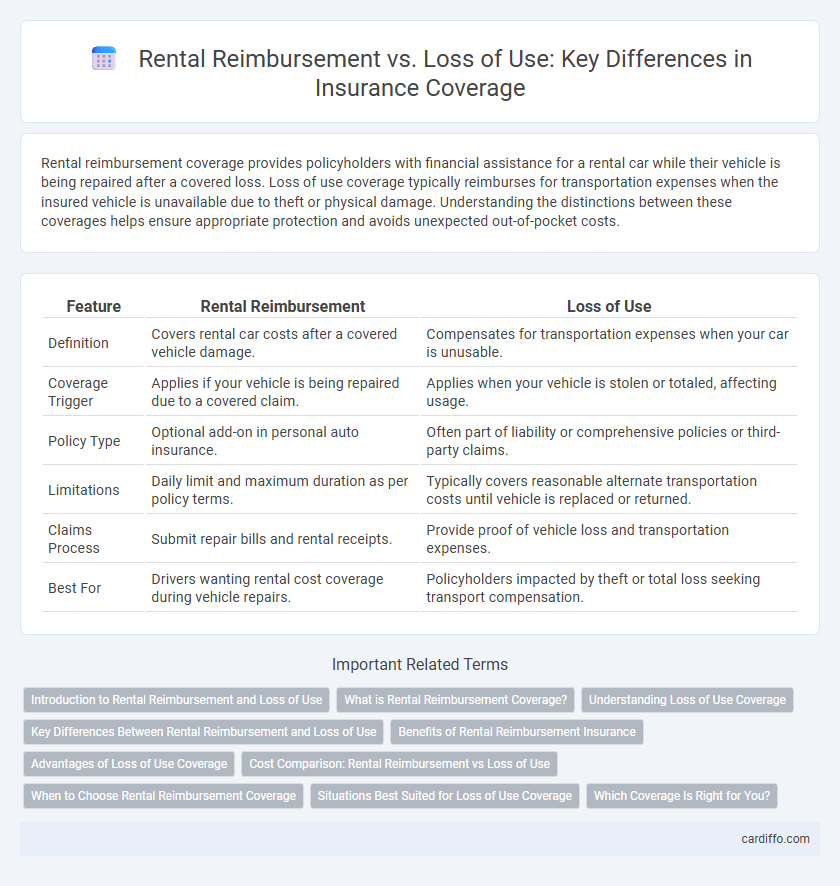

Rental reimbursement coverage provides policyholders with financial assistance for a rental car while their vehicle is being repaired after a covered loss. Loss of use coverage typically reimburses for transportation expenses when the insured vehicle is unavailable due to theft or physical damage. Understanding the distinctions between these coverages helps ensure appropriate protection and avoids unexpected out-of-pocket costs.

Table of Comparison

| Feature | Rental Reimbursement | Loss of Use |

|---|---|---|

| Definition | Covers rental car costs after a covered vehicle damage. | Compensates for transportation expenses when your car is unusable. |

| Coverage Trigger | Applies if your vehicle is being repaired due to a covered claim. | Applies when your vehicle is stolen or totaled, affecting usage. |

| Policy Type | Optional add-on in personal auto insurance. | Often part of liability or comprehensive policies or third-party claims. |

| Limitations | Daily limit and maximum duration as per policy terms. | Typically covers reasonable alternate transportation costs until vehicle is replaced or returned. |

| Claims Process | Submit repair bills and rental receipts. | Provide proof of vehicle loss and transportation expenses. |

| Best For | Drivers wanting rental cost coverage during vehicle repairs. | Policyholders impacted by theft or total loss seeking transport compensation. |

Introduction to Rental Reimbursement and Loss of Use

Rental Reimbursement coverage provides policyholders with compensation for rental car expenses incurred while their vehicle is being repaired due to a covered claim. Loss of Use coverage compensates rental costs or other transportation expenses when the insured vehicle is unavailable following an accident or theft, often provided by the at-fault party's insurance. Both coverages help mitigate transportation costs but differ in terms of who pays and policy specifics.

What is Rental Reimbursement Coverage?

Rental Reimbursement Coverage is an insurance policy add-on that pays for a rental car if your vehicle is being repaired due to a covered claim, such as an accident. This coverage helps policyholders maintain mobility without out-of-pocket expenses for transportation while their car is in the shop. It typically reimburses daily rental costs up to a specified limit and duration based on the terms outlined in the insurance contract.

Understanding Loss of Use Coverage

Loss of Use coverage reimburses policyholders for transportation costs when their vehicle is temporarily unusable due to a covered claim, such as an accident or theft. This coverage typically includes expenses like rental car fees, taxis, or rideshares, ensuring mobility without additional out-of-pocket costs. Understanding Loss of Use helps drivers select appropriate insurance that addresses indirect losses from vehicle downtime.

Key Differences Between Rental Reimbursement and Loss of Use

Rental Reimbursement coverage specifically pays for the cost of a rental car while your vehicle is being repaired after a covered claim, with predetermined daily and total limits. Loss of Use coverage compensates for the loss of the insured vehicle's availability, often reimbursing actual expenses or a predetermined amount related to transportation costs caused by an insured event. Key differences include their payment methods--rental reimbursement typically has fixed limits and requires the rental purchase, whereas loss of use may cover a broader range of transportation expenses without necessarily requiring rental receipts.

Benefits of Rental Reimbursement Insurance

Rental reimbursement insurance provides direct financial support by covering the cost of a rental car while your vehicle is being repaired after a covered loss, ensuring uninterrupted transportation without out-of-pocket expenses. Unlike loss of use coverage, which may only reimburse rental costs after a lengthy claims process, rental reimbursement offers immediate assistance and peace of mind. This coverage is essential for reducing inconvenience and maintaining mobility during vehicle repairs or total loss situations.

Advantages of Loss of Use Coverage

Loss of Use coverage provides reimbursement for alternative transportation or lodging expenses when a rental vehicle is unavailable due to an insured event, ensuring continuous mobility without out-of-pocket costs. It covers not only rental car fees but also other transportation arrangements such as rideshares or public transit, offering broader flexibility compared to Rental Reimbursement. This coverage reduces financial strain by addressing diverse transportation needs during vehicle repairs or replacement periods.

Cost Comparison: Rental Reimbursement vs Loss of Use

Rental reimbursement coverage generally offers a fixed daily limit for car rentals, often ranging from $20 to $50 per day, helping policyholders manage replacement vehicle expenses during repairs. Loss of use claims, typically negotiated through liability or third-party claims, can result in variable reimbursement amounts based on actual rental costs and duration, sometimes leading to higher overall compensation. Comparing costs, rental reimbursement provides predictable out-of-pocket expenses, while loss of use coverage might yield more reimbursement but can involve longer claim processing times and potential disputes.

When to Choose Rental Reimbursement Coverage

Rental reimbursement coverage is ideal when you anticipate being without your vehicle for an extended period due to repairs after a covered accident, ensuring you have a rental car while your vehicle is in the shop. Loss of use coverage reimburses you only if the rental expenses are proven, often involving legal action or proof of financial loss. Choosing rental reimbursement coverage provides immediate, hassle-free access to a rental car, making it the preferred option for continuous transportation needs during vehicle repairs.

Situations Best Suited for Loss of Use Coverage

Loss of Use coverage is best suited for situations where a vehicle is unavailable due to repairs from a covered accident, providing compensation for transportation expenses beyond rental cars, such as rideshares or public transit. This coverage effectively addresses scenarios involving long-term repairs or total loss, where Rental Reimbursement limits may be insufficient. It is particularly valuable for policyholders who rely heavily on alternative transportation methods or face extended downtime without their vehicle.

Which Coverage Is Right for You?

Rental Reimbursement covers the cost of a rental car while your vehicle is being repaired due to a covered claim, ensuring you maintain mobility without out-of-pocket expenses. Loss of Use reimburses expenses incurred from alternative transportation when your vehicle is unavailable due to damage not necessarily requiring repairs covered by insurance. Choosing the right coverage depends on your typical vehicle downtime, rental needs, and whether your policy already includes Loss of Use benefits alongside comprehensive or collision coverage.

Rental Reimbursement vs Loss of Use Infographic

cardiffo.com

cardiffo.com