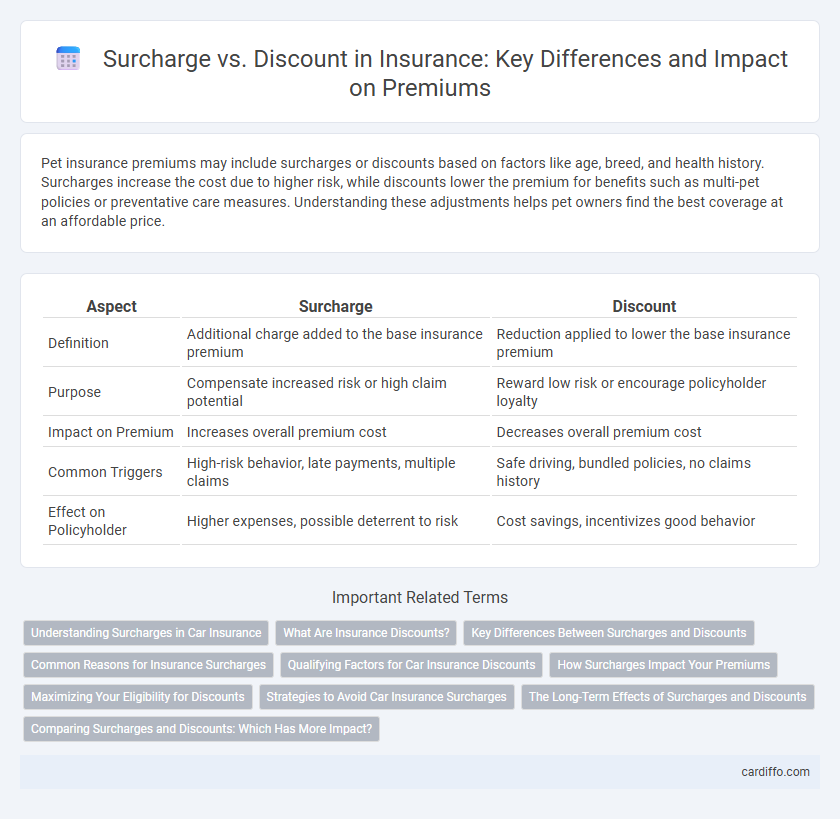

Pet insurance premiums may include surcharges or discounts based on factors like age, breed, and health history. Surcharges increase the cost due to higher risk, while discounts lower the premium for benefits such as multi-pet policies or preventative care measures. Understanding these adjustments helps pet owners find the best coverage at an affordable price.

Table of Comparison

| Aspect | Surcharge | Discount |

|---|---|---|

| Definition | Additional charge added to the base insurance premium | Reduction applied to lower the base insurance premium |

| Purpose | Compensate increased risk or high claim potential | Reward low risk or encourage policyholder loyalty |

| Impact on Premium | Increases overall premium cost | Decreases overall premium cost |

| Common Triggers | High-risk behavior, late payments, multiple claims | Safe driving, bundled policies, no claims history |

| Effect on Policyholder | Higher expenses, possible deterrent to risk | Cost savings, incentivizes good behavior |

Understanding Surcharges in Car Insurance

Surcharges in car insurance are additional fees applied to premiums based on risk factors such as past accidents, traffic violations, or claims history, increasing the overall cost. These surcharge amounts vary by insurer and state regulations, often remaining on the policy for several years before they expire. Understanding these surcharges helps policyholders manage risks and potentially reduce costs by maintaining a clean driving record and minimizing claims.

What Are Insurance Discounts?

Insurance discounts reduce premium costs by rewarding policyholders for factors like safe driving, bundling policies, or installing security devices. These discounts are designed to lower financial risk for insurers by encouraging behaviors that minimize claims. Understanding specific discount programs helps consumers select coverage that maximizes savings while maintaining adequate protection.

Key Differences Between Surcharges and Discounts

Surcharges are additional fees added to the base insurance premium due to increased risk factors, while discounts reduce the premium as a reward for lower risk or policyholder incentives. Surcharges typically arise from factors like poor driving records or high-risk locations, whereas discounts may be offered for safe driving, bundling policies, or installing safety devices. The key difference lies in their impact on the total cost: surcharges increase the overall premium, whereas discounts decrease it.

Common Reasons for Insurance Surcharges

Insurance surcharges commonly arise from factors such as a history of traffic violations, claims history, high-risk driving behaviors, or poor credit scores. Other reasons include gaps in insurance coverage, multiple at-fault accidents, or certain occupations that pose greater risk. Understanding these surcharge triggers helps policyholders take proactive steps to reduce premiums and maintain affordable coverage.

Qualifying Factors for Car Insurance Discounts

Qualifying factors for car insurance discounts include a clean driving record, vehicle safety features, and low annual mileage, which can significantly reduce premiums. Insurers often offer discounts for bundling policies, maintaining continuous coverage, and completing defensive driving courses. Understanding these factors helps drivers optimize savings by balancing potential surcharges triggered by claims or high-risk behavior.

How Surcharges Impact Your Premiums

Surcharges increase insurance premiums by adding extra costs based on risk factors such as driving history, age, or credit score, resulting in higher overall payments. These additional fees directly affect the affordability of your policy and can accumulate over time, making coverage more expensive. Understanding how surcharges apply helps policyholders manage expenses and identify opportunities to reduce premiums through risk mitigation.

Maximizing Your Eligibility for Discounts

Maximizing your eligibility for insurance discounts involves understanding the factors that typically lead to surcharges, such as a history of claims or poor credit scores, and proactively improving these areas. Maintaining a clean driving record, bundling multiple insurance policies, and installing safety devices in your vehicle can significantly increase your chances of qualifying for discounts. Regularly reviewing your insurance policy and consulting with your agent ensures you take full advantage of all available discounts to offset potential surcharges.

Strategies to Avoid Car Insurance Surcharges

Maintaining a clean driving record and avoiding traffic violations are crucial strategies to prevent car insurance surcharges, as insurers typically increase premiums after accidents or infractions. Choosing comprehensive coverage with higher deductibles can reduce the chance of frequent claims that lead to surcharges. Regularly reviewing and comparing insurance policies ensures access to discounts for safe driving, bundling policies, or installing anti-theft devices, minimizing surcharge risks effectively.

The Long-Term Effects of Surcharges and Discounts

Surcharges on insurance policies increase premium costs, often signaling higher risk to insurers and potentially leading to more stringent coverage terms over time. Discounts, on the other hand, reward low-risk behaviors and can encourage policyholders to maintain safer practices, resulting in lower premiums and improved insurer relationships. Over the long term, consistent surcharges can strain finances and coverage options, while sustained discounts promote affordability and enhanced policy benefits.

Comparing Surcharges and Discounts: Which Has More Impact?

Surcharges increase the overall cost of insurance premiums by adding fees due to higher risk factors such as poor driving records or claims history, often leading to significant long-term financial impact. Discounts reduce premiums by rewarding low-risk behaviors like safe driving, bundling policies, or installing safety devices, directly lowering the base rate. In terms of impact, surcharges generally exert a stronger influence on premium cost because they amplify risk costs, whereas discounts usually provide modest reductions aimed at encouraging positive behavior.

Surcharge vs Discount Infographic

cardiffo.com

cardiffo.com