A Named Driver Policy specifies which individuals are authorized to drive a vehicle, providing clarity and often lower premiums by limiting coverage to listed drivers only. In contrast, a Permissive Use Policy extends coverage to any driver with the owner's permission, offering more flexibility but potentially higher costs due to increased risk exposure. Selecting the appropriate policy impacts both insurance premiums and liability protection for pet owners who might share driving responsibilities.

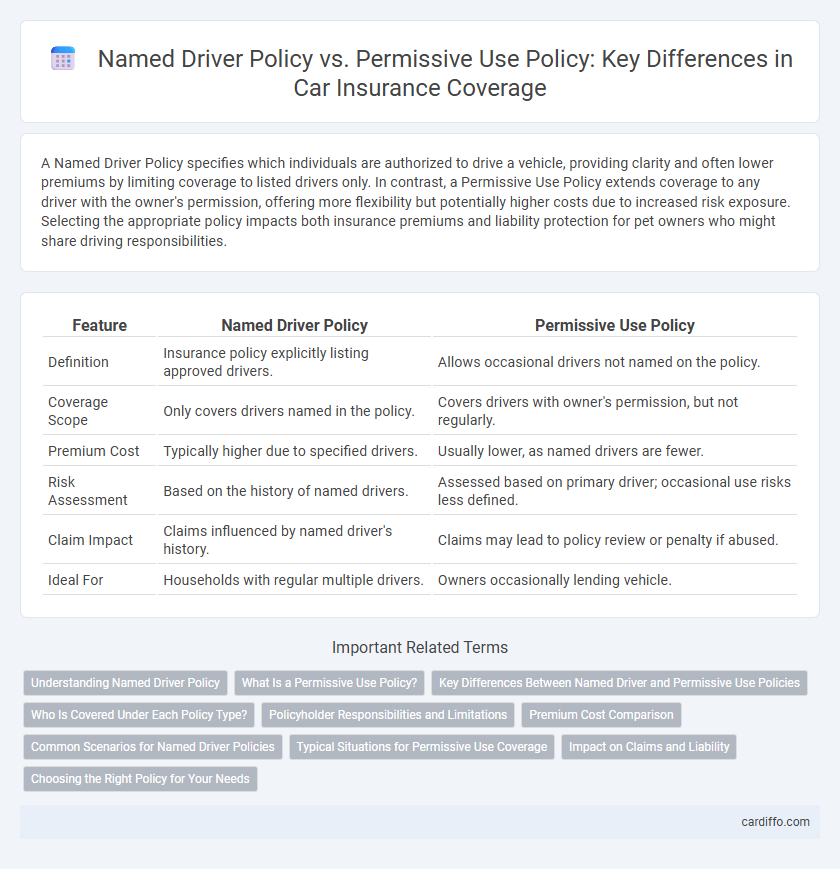

Table of Comparison

| Feature | Named Driver Policy | Permissive Use Policy |

|---|---|---|

| Definition | Insurance policy explicitly listing approved drivers. | Allows occasional drivers not named on the policy. |

| Coverage Scope | Only covers drivers named in the policy. | Covers drivers with owner's permission, but not regularly. |

| Premium Cost | Typically higher due to specified drivers. | Usually lower, as named drivers are fewer. |

| Risk Assessment | Based on the history of named drivers. | Assessed based on primary driver; occasional use risks less defined. |

| Claim Impact | Claims influenced by named driver's history. | Claims may lead to policy review or penalty if abused. |

| Ideal For | Households with regular multiple drivers. | Owners occasionally lending vehicle. |

Understanding Named Driver Policy

A Named Driver Policy specifically lists individuals authorized to drive a vehicle under the insurance coverage, ensuring tailored risk assessment and premium calculation based on each driver's history. This policy type restricts coverage exclusively to the named drivers, offering precise control over who is insured, unlike permissive use policies that extend coverage to occasional drivers. Understanding the implications of a Named Driver Policy helps vehicle owners optimize their insurance costs by limiting coverage to only frequent or trusted drivers.

What Is a Permissive Use Policy?

A permissive use policy in insurance allows drivers not listed on the policy to operate the insured vehicle with the owner's consent, typically providing coverage similar to named drivers. This policy type extends liability protection to occasional or informal drivers without requiring them to be explicitly included in the policy. Coverage limits and terms can vary by insurer, but permissive use generally offers more flexible protection for unexpected or occasional vehicle use compared to a named driver policy.

Key Differences Between Named Driver and Permissive Use Policies

Named driver policies explicitly list authorized drivers, providing clear coverage limits and risk assessment based on each individual's driving record. Permissive use policies allow occasional drivers not listed on the policy to be covered, but often with reduced coverage or subject to policy restrictions. This distinction impacts premium costs, liability risks, and claims handling in automobile insurance policies.

Who Is Covered Under Each Policy Type?

Named Driver Policy covers only drivers explicitly listed on the insurance contract, ensuring that only those individuals are insured to operate the vehicle. Permissive Use Policy extends coverage to drivers not named on the policy but who have the vehicle owner's permission to drive, providing more flexible protection. Understanding these distinctions helps policyholders manage liability risks and tailor coverage to their specific driving needs.

Policyholder Responsibilities and Limitations

Named Driver Policies require the policyholder to list specific drivers authorized to operate the insured vehicle, ensuring precise risk assessment and premium calculation. Permissive Use Policies allow occasional drivers not explicitly named but impose limitations on coverage scope and may reduce claim payouts if unauthorized use occurs. Policyholders must understand that Named Driver Policies limit coverage strictly to designated individuals, while Permissive Use Policies extend limited protection to other drivers, potentially affecting liability and claim validity.

Premium Cost Comparison

Named Driver Policies generally result in higher premium costs than Permissive Use Policies because coverage is restricted to specific individuals, increasing insurer risk assessment precision. Permissive Use Policies offer broader coverage for occasional drivers, often lowering premiums by spreading risk across multiple potential users. Insurers price Named Driver Policies higher due to the limited driver pool and increased likelihood of claims from designated drivers.

Common Scenarios for Named Driver Policies

Named Driver Policies commonly apply in situations where a vehicle owner wants to restrict coverage to specific individuals, such as family members or regular users, ensuring precise control over who is insured to drive the car. These policies often arise when a primary driver occasionally allows a trusted friend or relative to use the vehicle, but the owner prefers not to extend coverage broadly to all possible drivers. This targeted approach helps prevent coverage disputes and can reduce premiums by clearly identifying who is permitted under the insurance contract.

Typical Situations for Permissive Use Coverage

Permissive Use Coverage typically applies when a policyholder allows someone not specifically listed on the insurance policy to drive their vehicle with permission. This includes occasional borrowing by friends, family members, or employees who do not have their own insurance or whose coverage is insufficient. Insurers generally extend liability protection in these scenarios, but coverage limits and exclusions vary based on the policy terms and state regulations.

Impact on Claims and Liability

A Named Driver Policy specifies individual drivers covered under the insurance, limiting liability to those explicitly listed and potentially denying claims if an unauthorized driver operates the vehicle. In contrast, a Permissive Use Policy extends coverage to occasional drivers with the policyholder's consent, increasing the insurer's exposure to claims but offering broader liability protection. Insurers often scrutinize claims under permissive use more closely, as the risk of unlisted drivers increases the likelihood of disputes over coverage and fault determination.

Choosing the Right Policy for Your Needs

Named Driver Policy provides coverage exclusively for drivers specifically listed on the insurance policy, offering tailored risk management for occasional drivers with controlled access. Permissive Use Policy extends coverage to drivers not named on the policy but driving with the insured's permission, suitable for households with multiple or infrequent drivers. Selecting the right policy depends on evaluating driving frequency, risk tolerance, and cost considerations to ensure comprehensive protection without unnecessary premiums.

Named Driver Policy vs Permissive Use Policy Infographic

cardiffo.com

cardiffo.com