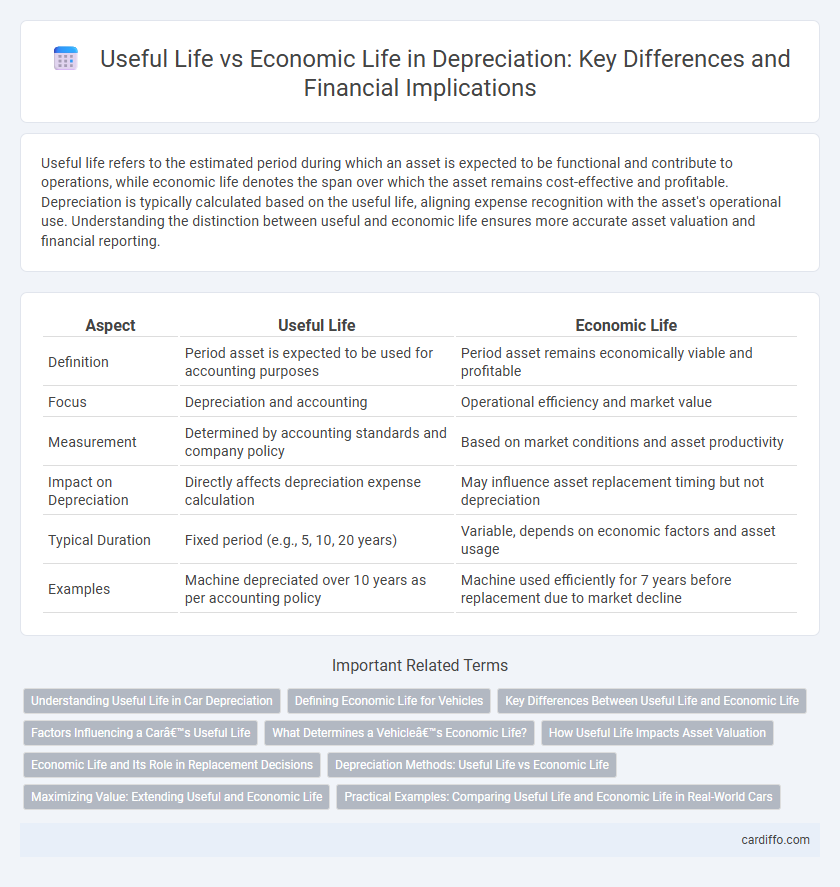

Useful life refers to the estimated period during which an asset is expected to be functional and contribute to operations, while economic life denotes the span over which the asset remains cost-effective and profitable. Depreciation is typically calculated based on the useful life, aligning expense recognition with the asset's operational use. Understanding the distinction between useful and economic life ensures more accurate asset valuation and financial reporting.

Table of Comparison

| Aspect | Useful Life | Economic Life |

|---|---|---|

| Definition | Period asset is expected to be used for accounting purposes | Period asset remains economically viable and profitable |

| Focus | Depreciation and accounting | Operational efficiency and market value |

| Measurement | Determined by accounting standards and company policy | Based on market conditions and asset productivity |

| Impact on Depreciation | Directly affects depreciation expense calculation | May influence asset replacement timing but not depreciation |

| Typical Duration | Fixed period (e.g., 5, 10, 20 years) | Variable, depends on economic factors and asset usage |

| Examples | Machine depreciated over 10 years as per accounting policy | Machine used efficiently for 7 years before replacement due to market decline |

Understanding Useful Life in Car Depreciation

Useful life in car depreciation refers to the estimated period during which a vehicle is expected to remain functional and economically viable for use. It directly impacts the calculation of depreciation expenses, as the cost of the car is allocated over this timeframe for accounting and tax purposes. Understanding useful life helps accurately assess a car's residual value and manage asset replacement planning effectively.

Defining Economic Life for Vehicles

Economic life for vehicles refers to the period during which a vehicle remains cost-effective to operate, considering factors such as maintenance expenses, fuel efficiency, and market resale value. It often differs from the vehicle's useful life, which is based on physical wear and expected operational lifespan. Understanding economic life helps businesses optimize depreciation schedules and replacement timing to maximize asset value.

Key Differences Between Useful Life and Economic Life

Useful life refers to the estimated period an asset is expected to be functional and generate revenue for the owner, while economic life represents the span during which the asset remains economically viable, considering factors like market demand and technology changes. Key differences include that useful life is primarily based on physical wear and tear, whereas economic life accounts for external factors such as obsolescence and changing economic conditions. Depreciation calculations typically rely on useful life, but asset replacement decisions often hinge on economic life assessments.

Factors Influencing a Car’s Useful Life

A car's useful life is influenced by factors such as maintenance frequency, driving conditions, and technological advancements in the automotive industry. Harsh weather, road quality, and mileage accumulation accelerate wear and tear, reducing useful life. Economic life fluctuates based on market demand, fuel efficiency improvements, and changes in regulations affecting resale value and operational costs.

What Determines a Vehicle’s Economic Life?

A vehicle's economic life is determined by factors such as maintenance costs, technological obsolescence, and market demand for resale value. Unlike useful life, which estimates the physical duration a vehicle can function, economic life reflects the period during which the vehicle remains financially viable for its owner. Depreciation schedules and operational efficiency significantly influence decisions regarding the optimal replacement time within a vehicle's economic life.

How Useful Life Impacts Asset Valuation

Useful life determines the period over which an asset's cost is allocated for depreciation, directly influencing the asset's book value on financial statements. A longer useful life results in lower annual depreciation expense, maintaining a higher asset valuation over time. Accurate estimation of useful life ensures realistic asset valuation, affecting financial ratios and investment decisions.

Economic Life and Its Role in Replacement Decisions

Economic life refers to the period during which an asset remains economically viable, influencing replacement timing to maximize cost-efficiency and operational productivity. Unlike useful life, which focuses on physical wear and serviceability, economic life accounts for factors such as maintenance costs, technological obsolescence, and market demand. Understanding economic life helps businesses optimize asset management by determining the most financially advantageous point for asset replacement.

Depreciation Methods: Useful Life vs Economic Life

Depreciation methods hinge on distinguishing useful life from economic life, with useful life representing the period an asset is expected to be actively employed, while economic life encompasses the total duration an asset remains valuable or cost-effective. Straight-line depreciation typically aligns with useful life, allocating equal expense annually, whereas accelerated methods like declining balance are better suited for economic life, reflecting higher initial depreciation as the asset's economic benefits diminish over time. Choosing the appropriate depreciation approach requires analyzing asset usage patterns, technological obsolescence, and market conditions to ensure accurate financial reporting and asset management.

Maximizing Value: Extending Useful and Economic Life

Maximizing value involves extending both the useful life and economic life of assets to delay depreciation expenses and increase return on investment. Useful life refers to the period an asset is expected to be productive for accounting purposes, while economic life denotes the actual duration an asset remains economically viable. Implementing regular maintenance, upgrades, and efficient usage can prolong these lifespans, optimizing asset utilization and enhancing financial performance.

Practical Examples: Comparing Useful Life and Economic Life in Real-World Cars

Useful life refers to the period a car is expected to be functional for accounting depreciation, typically 5 to 7 years for passenger vehicles, while economic life considers how long the car remains cost-effective to operate, often extending beyond the useful life depending on maintenance and fuel efficiency. For example, a sedan with a useful life of 6 years might still have an economic life of 10 years if repair costs remain low and it continues delivering value. Fleet managers often rely on economic life to schedule replacements, balancing depreciation expense against operational efficiency to optimize total cost of ownership.

Useful Life vs Economic Life Infographic

cardiffo.com

cardiffo.com