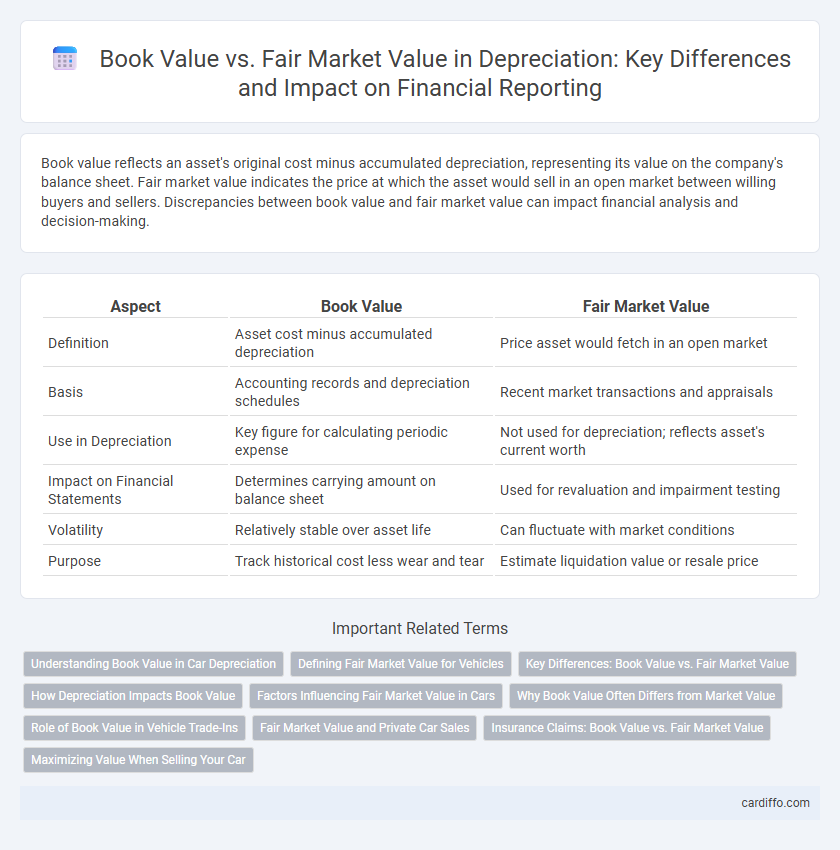

Book value reflects an asset's original cost minus accumulated depreciation, representing its value on the company's balance sheet. Fair market value indicates the price at which the asset would sell in an open market between willing buyers and sellers. Discrepancies between book value and fair market value can impact financial analysis and decision-making.

Table of Comparison

| Aspect | Book Value | Fair Market Value |

|---|---|---|

| Definition | Asset cost minus accumulated depreciation | Price asset would fetch in an open market |

| Basis | Accounting records and depreciation schedules | Recent market transactions and appraisals |

| Use in Depreciation | Key figure for calculating periodic expense | Not used for depreciation; reflects asset's current worth |

| Impact on Financial Statements | Determines carrying amount on balance sheet | Used for revaluation and impairment testing |

| Volatility | Relatively stable over asset life | Can fluctuate with market conditions |

| Purpose | Track historical cost less wear and tear | Estimate liquidation value or resale price |

Understanding Book Value in Car Depreciation

Book value in car depreciation represents the original purchase price minus accumulated depreciation expenses, reflecting the vehicle's net accounting value. This figure is used for financial reporting and tax purposes, providing a systematic allocation of the car's cost over its useful life. Understanding book value helps differentiate it from fair market value, which is driven by current market conditions and buyer demand.

Defining Fair Market Value for Vehicles

Fair market value for vehicles represents the estimated price that a willing buyer would pay to a willing seller in an open market, reflecting current market conditions and vehicle condition. It differs from book value, which is the asset's original cost minus accumulated depreciation, often based on standardized depreciation schedules rather than real-time market fluctuations. Accurate fair market value assessments consider factors such as mileage, vehicle age, make, model, and recent sales data in the local market.

Key Differences: Book Value vs. Fair Market Value

Book value represents the asset's original cost minus accumulated depreciation, reflecting its accounting value on the balance sheet. Fair market value indicates the price an asset would fetch in an open market transaction between willing buyers and sellers, often influenced by current market conditions. Key differences include book value's basis in historical cost and accounting rules versus fair market value's reliance on real-time valuation and market demand.

How Depreciation Impacts Book Value

Depreciation systematically reduces the book value of an asset over its useful life, reflecting wear and tear or obsolescence. Book value represents the original cost minus accumulated depreciation, providing a historical cost basis that may differ significantly from the fair market value. While fair market value fluctuates based on current market conditions, depreciation directly impacts book value by lowering the asset's recorded value on financial statements.

Factors Influencing Fair Market Value in Cars

Fair Market Value of cars is influenced by factors such as age, mileage, overall condition, and brand reputation. Market demand, recent sale prices of similar vehicles, and economic conditions also play critical roles in determining fair market value. Unlike book value, which is based on accounting depreciation schedules, fair market value reflects real-time market dynamics and buyer perceptions.

Why Book Value Often Differs from Market Value

Book value represents an asset's original cost minus accumulated depreciation, reflecting its value on financial statements, while fair market value is the price an asset could fetch in an open market transaction. Differences arise because book value is based on historical costs and systematic depreciation methods, which may not capture current market conditions or asset obsolescence. Market value fluctuates with supply and demand, economic trends, and asset utility, causing it to often exceed or fall below the book value recorded in accounting records.

Role of Book Value in Vehicle Trade-Ins

Book value represents the original cost of a vehicle minus accumulated depreciation, serving as a standardized measure for accounting and tax purposes. In vehicle trade-ins, dealerships use book value to estimate baseline worth, but adjustments are often made based on fair market value, which reflects current demand, condition, and regional factors. Understanding book value helps sellers set realistic expectations and negotiate effectively during trade-in transactions.

Fair Market Value and Private Car Sales

Fair Market Value (FMV) represents the price a willing buyer would pay a willing seller for a private car sale, reflecting current market conditions without considering depreciation schedules. FMV often deviates from Book Value, which is calculated based on the vehicle's original price minus accumulated depreciation, potentially undervaluing a car in private sales. Understanding FMV is crucial in private car transactions to ensure accurate pricing and fair compensation.

Insurance Claims: Book Value vs. Fair Market Value

Insurance claims often hinge on the distinction between book value and fair market value, where book value represents the asset's original cost minus accumulated depreciation, while fair market value reflects the current price an asset would fetch in an open market. Insurers may compensate based on fair market value, which typically results in higher claim amounts compared to book value, ensuring policyholders receive a payout aligned with the asset's true replacement cost. Understanding the discrepancy between these valuations is crucial for accurate claim settlements and adequate coverage during insurance assessments.

Maximizing Value When Selling Your Car

Maximizing value when selling your car involves understanding the difference between book value and fair market value. Book value reflects the vehicle's depreciated cost on your financial records, while fair market value represents the actual price buyers are willing to pay based on current demand and condition. Focusing on factors that enhance the car's condition and market appeal can help bridge the gap, ensuring you receive closer to the fair market value rather than settling for the lower book value.

Book Value vs Fair Market Value Infographic

cardiffo.com

cardiffo.com