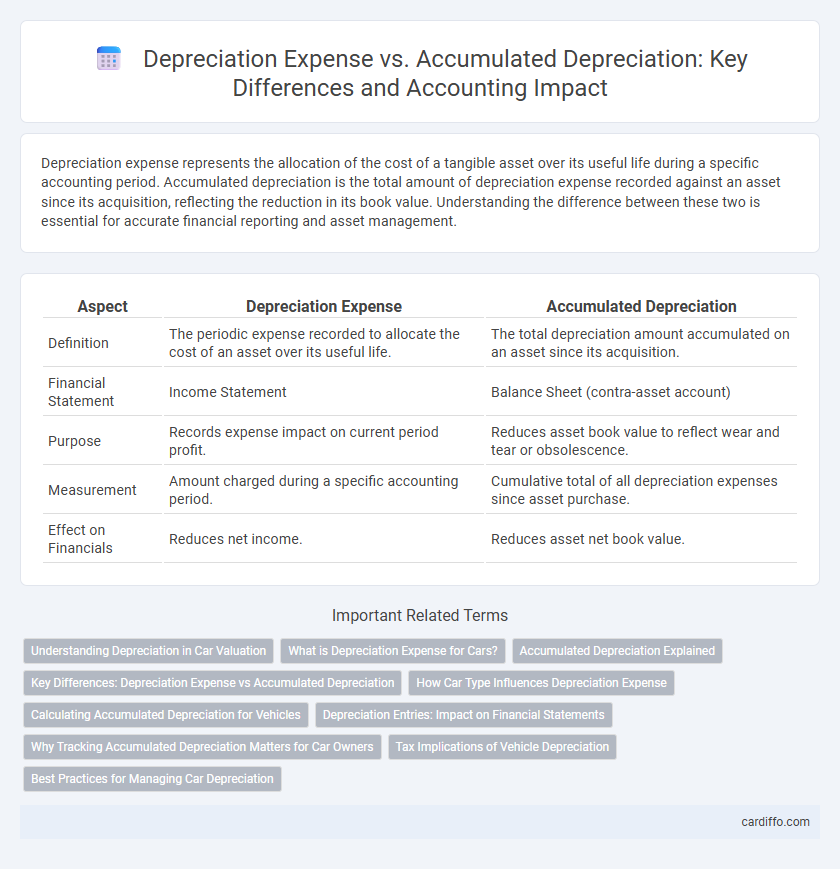

Depreciation expense represents the allocation of the cost of a tangible asset over its useful life during a specific accounting period. Accumulated depreciation is the total amount of depreciation expense recorded against an asset since its acquisition, reflecting the reduction in its book value. Understanding the difference between these two is essential for accurate financial reporting and asset management.

Table of Comparison

| Aspect | Depreciation Expense | Accumulated Depreciation |

|---|---|---|

| Definition | The periodic expense recorded to allocate the cost of an asset over its useful life. | The total depreciation amount accumulated on an asset since its acquisition. |

| Financial Statement | Income Statement | Balance Sheet (contra-asset account) |

| Purpose | Records expense impact on current period profit. | Reduces asset book value to reflect wear and tear or obsolescence. |

| Measurement | Amount charged during a specific accounting period. | Cumulative total of all depreciation expenses since asset purchase. |

| Effect on Financials | Reduces net income. | Reduces asset net book value. |

Understanding Depreciation in Car Valuation

Depreciation Expense reflects the cost allocated for a car's usage over a specific period, directly impacting its book value on financial statements. Accumulated Depreciation represents the total depreciation charged since the car's purchase, reducing its carrying amount and providing a clearer picture of current valuation. Analyzing both allows accurate assessment of a vehicle's market worth and aids in predicting future resale value.

What is Depreciation Expense for Cars?

Depreciation expense for cars represents the portion of the vehicle's cost allocated as an expense over a specific accounting period, reflecting the car's usage and wear. This expense reduces the car's book value on financial statements, impacting net income. Accumulated depreciation aggregates these periodic expenses, showing the total reduction in the vehicle's value since its purchase.

Accumulated Depreciation Explained

Accumulated depreciation represents the total amount of depreciation expense recorded against a fixed asset since its purchase, acting as a contra-asset account that reduces the asset's book value on the balance sheet. It accumulates over time, reflecting the wear and tear or obsolescence of the asset, while depreciation expense records the periodic allocation of an asset's cost during each accounting period. Understanding accumulated depreciation is crucial for accurate asset valuation and financial reporting, as it provides insight into the asset's remaining useful life and net book value.

Key Differences: Depreciation Expense vs Accumulated Depreciation

Depreciation expense represents the portion of an asset's cost allocated as an expense in a specific accounting period, directly reducing net income. Accumulated depreciation, conversely, is the total amount of depreciation expense recorded over the asset's life, shown as a contra-asset account on the balance sheet to reduce the asset's book value. The key difference lies in timing and presentation: depreciation expense impacts the income statement each period, while accumulated depreciation reflects the cumulative depreciation on the balance sheet.

How Car Type Influences Depreciation Expense

Depreciation expense varies significantly with car type, as luxury vehicles typically experience higher depreciation rates compared to economy cars due to rapid value loss and higher initial costs. Accumulated depreciation reflects the total depreciation expense recorded over the asset's useful life, which grows faster for car types with steep annual depreciation, such as luxury sedans and sports cars. Understanding the relationship between car type and depreciation expense helps businesses and individuals accurately forecast asset value decline and optimize tax deductions.

Calculating Accumulated Depreciation for Vehicles

Accumulated depreciation for vehicles is calculated by summing all depreciation expenses recorded over the asset's useful life to date. This total reflects the current book value reduction of the vehicle, providing an accurate measure of the asset's depreciated cost on the balance sheet. Accurate calculation involves consistent application of the chosen depreciation method, such as straight-line or declining balance, based on the vehicle's initial cost and estimated useful life.

Depreciation Entries: Impact on Financial Statements

Depreciation expense reduces net income on the income statement by allocating the cost of a fixed asset over its useful life, reflecting asset usage and wear. Accumulated depreciation, presented on the balance sheet as a contra asset account, aggregates total depreciation expense recorded since the asset's acquisition, reducing the asset's book value. Together, depreciation entries ensure accurate matching of expenses with revenues while providing a realistic valuation of long-term assets.

Why Tracking Accumulated Depreciation Matters for Car Owners

Tracking accumulated depreciation matters for car owners because it reflects the total reduction in the vehicle's value over time, aiding in accurate financial reporting and resale price estimation. Depreciation expense records the periodic value loss, while accumulated depreciation aggregates this loss to show the car's current book value. Understanding these metrics helps owners plan maintenance, insurance, and replacement decisions effectively.

Tax Implications of Vehicle Depreciation

Depreciation expense for vehicles directly reduces taxable income by allocating the vehicle's cost over its useful life, resulting in lower immediate tax liabilities for businesses. Accumulated depreciation represents the total amount of depreciation expense claimed to date, impacting the vehicle's book value but having no direct tax effect until asset disposal. Tax regulations often allow accelerated depreciation methods for vehicles, enabling larger upfront tax deductions and improved cash flow management for businesses.

Best Practices for Managing Car Depreciation

Depreciation expense represents the periodic allocation of a car's cost over its useful life, while accumulated depreciation is the total amount expensed to date, reflecting the car's reduced book value. Best practices for managing car depreciation include accurately estimating the vehicle's useful life and salvage value, consistently applying a suitable depreciation method such as straight-line or declining balance, and regularly reviewing the asset's condition to adjust depreciation schedules as necessary. Monitoring accumulated depreciation helps businesses track the total wear and tear on the vehicle, ensuring accurate financial reporting and informed decision-making regarding asset replacement.

Depreciation Expense vs Accumulated Depreciation Infographic

cardiffo.com

cardiffo.com