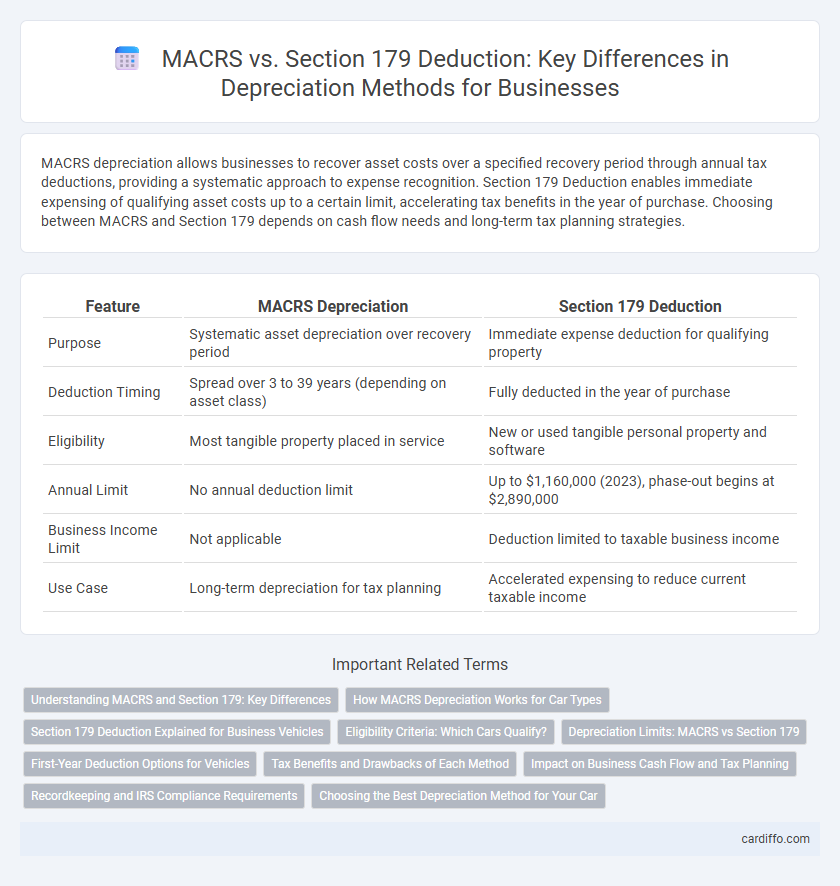

MACRS depreciation allows businesses to recover asset costs over a specified recovery period through annual tax deductions, providing a systematic approach to expense recognition. Section 179 Deduction enables immediate expensing of qualifying asset costs up to a certain limit, accelerating tax benefits in the year of purchase. Choosing between MACRS and Section 179 depends on cash flow needs and long-term tax planning strategies.

Table of Comparison

| Feature | MACRS Depreciation | Section 179 Deduction |

|---|---|---|

| Purpose | Systematic asset depreciation over recovery period | Immediate expense deduction for qualifying property |

| Deduction Timing | Spread over 3 to 39 years (depending on asset class) | Fully deducted in the year of purchase |

| Eligibility | Most tangible property placed in service | New or used tangible personal property and software |

| Annual Limit | No annual deduction limit | Up to $1,160,000 (2023), phase-out begins at $2,890,000 |

| Business Income Limit | Not applicable | Deduction limited to taxable business income |

| Use Case | Long-term depreciation for tax planning | Accelerated expensing to reduce current taxable income |

Understanding MACRS and Section 179: Key Differences

MACRS (Modified Accelerated Cost Recovery System) allows businesses to depreciate assets over a set recovery period, spreading the expense across several years according to IRS-specified class lives. Section 179 enables immediate expense deduction for qualifying property up to an annual limit, accelerating tax benefits by reducing taxable income in the acquisition year. Understanding these differences helps optimize tax strategy by balancing upfront deductions with long-term depreciation schedules.

How MACRS Depreciation Works for Car Types

MACRS depreciation applies to vehicles by classifying them based on their weight and usage, with passenger cars typically following a 5-year recovery period using the 200% declining balance method switching to straight-line depreciation. Heavier vehicles, such as trucks and SUVs over 6,000 pounds gross vehicle weight, qualify for a longer recovery period or may be eligible for faster depreciation methods. This system accelerates expense recognition, optimizing tax benefits for business-use vehicles under IRS guidelines.

Section 179 Deduction Explained for Business Vehicles

Section 179 Deduction allows businesses to immediately expense the cost of qualifying business vehicles, up to a specified limit of $1,160,000 in 2024, rather than depreciating them over several years through MACRS. This deduction applies to vehicles used more than 50% for business purposes and can significantly reduce taxable income by accelerating the write-off. Unlike MACRS, which spreads depreciation over a fixed schedule, Section 179 provides upfront tax relief, particularly beneficial for small to medium-sized enterprises investing in business trucks, SUVs, and vans.

Eligibility Criteria: Which Cars Qualify?

Under MACRS, passenger vehicles used more than 50% for business purposes qualify for depreciation, with limits on luxury auto depreciation. Section 179 allows businesses to deduct the full purchase price of qualifying new and used vehicles used over 50% for business, but SUVs over 6,000 pounds GVWR qualify for higher deduction limits. Both methods require strict adherence to IRS guidelines on vehicle use and types to ensure eligibility for tax benefits.

Depreciation Limits: MACRS vs Section 179

MACRS depreciation applies fixed recovery periods and allows businesses to deduct asset costs over several years, following IRS-prescribed class lives. Section 179 deduction permits immediate expense recognition but has annual limits on the total amount and phase-out thresholds based on equipment purchases. Unlike MACRS, Section 179's deduction limits restrict how much can be written off in the first year, impacting overall depreciation benefits for high-cost asset acquisitions.

First-Year Deduction Options for Vehicles

MACRS allows businesses to recover the cost of vehicles through depreciation over several years, typically five years for passenger vehicles, with limited first-year bonus depreciation options. Section 179 Deduction permits an immediate expense of up to $1,160,000 in 2024 for qualifying vehicle purchases, subject to specific business-use and vehicle type limitations. Choosing between MACRS and Section 179 depends on cash flow needs and long-term tax planning, especially considering Section 179's cap on luxury auto depreciation limits.

Tax Benefits and Drawbacks of Each Method

MACRS depreciation offers accelerated asset cost recovery over defined recovery periods, providing substantial upfront tax deductions but limits flexibility and may lead to higher taxable income in later years. Section 179 deduction enables immediate expensing of qualifying asset costs up to specified limits, maximizing current-year tax relief but is constrained by income limitations and annual deduction caps. Choosing between MACRS and Section 179 depends on business cash flow, taxable income, and long-term tax planning objectives.

Impact on Business Cash Flow and Tax Planning

MACRS depreciation accelerates asset cost recovery, maximizing tax deductions over several years, which can smooth taxable income but delay full cash flow benefits. Section 179 allows immediate deduction of the entire asset cost up to limits, significantly improving near-term cash flow and reducing tax liability for qualifying businesses. Strategic use of Section 179 enhances tax planning by enabling rapid asset write-offs, while MACRS supports long-term depreciation planning and balanced financial management.

Recordkeeping and IRS Compliance Requirements

MACRS depreciation requires detailed recordkeeping of asset class lives, placed-in-service dates, and depreciation methods to ensure IRS compliance. Section 179 deduction mandates accurate documentation of qualifying property purchases and business use percentages to support immediate expense claims. Maintaining organized IRS forms, such as Form 4562, is essential for substantiating both MACRS depreciation schedules and Section 179 deductions during audits.

Choosing the Best Depreciation Method for Your Car

Choosing the best depreciation method for your car depends on your business needs and tax strategy. MACRS offers accelerated depreciation over a set recovery period, maximizing upfront deductions but spreading them across several years, while Section 179 Deduction allows immediate expensing of the vehicle's cost, subject to limits and eligibility. Evaluating factors like vehicle use, total cost, and annual income will help determine whether MACRS or Section 179 provides optimal tax benefits.

MACRS vs Section 179 Deduction Infographic

cardiffo.com

cardiffo.com