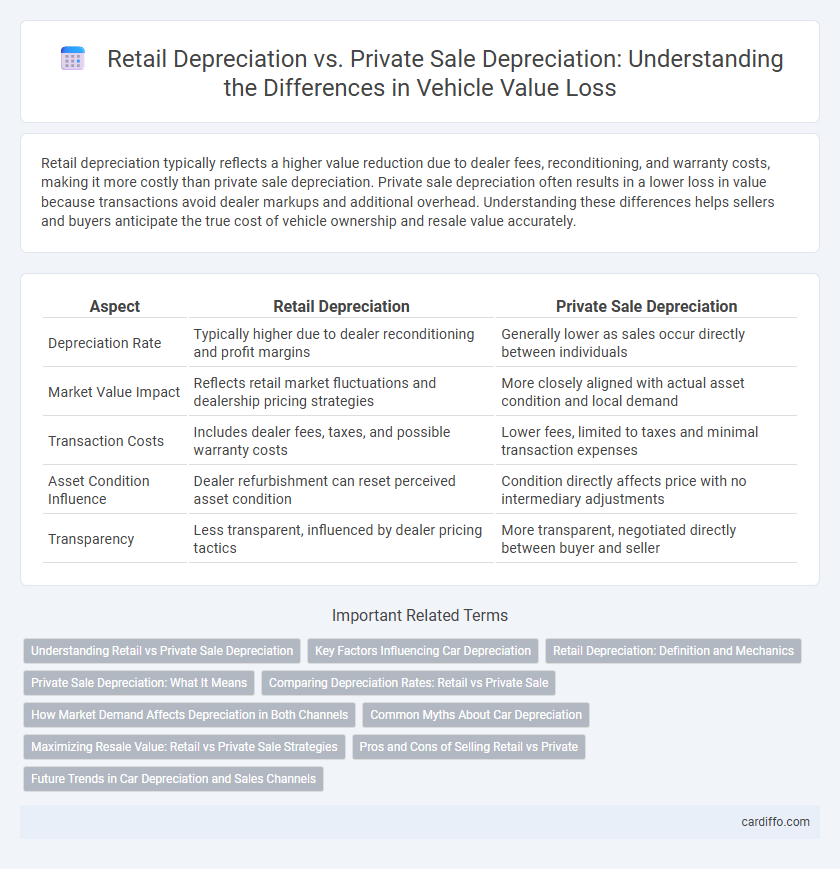

Retail depreciation typically reflects a higher value reduction due to dealer fees, reconditioning, and warranty costs, making it more costly than private sale depreciation. Private sale depreciation often results in a lower loss in value because transactions avoid dealer markups and additional overhead. Understanding these differences helps sellers and buyers anticipate the true cost of vehicle ownership and resale value accurately.

Table of Comparison

| Aspect | Retail Depreciation | Private Sale Depreciation |

|---|---|---|

| Depreciation Rate | Typically higher due to dealer reconditioning and profit margins | Generally lower as sales occur directly between individuals |

| Market Value Impact | Reflects retail market fluctuations and dealership pricing strategies | More closely aligned with actual asset condition and local demand |

| Transaction Costs | Includes dealer fees, taxes, and possible warranty costs | Lower fees, limited to taxes and minimal transaction expenses |

| Asset Condition Influence | Dealer refurbishment can reset perceived asset condition | Condition directly affects price with no intermediary adjustments |

| Transparency | Less transparent, influenced by dealer pricing tactics | More transparent, negotiated directly between buyer and seller |

Understanding Retail vs Private Sale Depreciation

Retail depreciation typically reflects a higher loss in value due to the inclusion of retail profit margins and additional reconditioning costs, resulting in a greater difference between the original price and resale value. Private sale depreciation is often lower as it excludes these extra costs, representing direct market value decline without dealer markups. Understanding this distinction is essential for accurately assessing asset value and potential resale outcomes in both retail and private sale contexts.

Key Factors Influencing Car Depreciation

Retail depreciation typically exceeds private sale depreciation due to higher dealer fees, reconditioning costs, and market demand factors embedded in retail pricing. Key factors influencing car depreciation include vehicle age, mileage, brand reputation, condition, and regional market trends. Understanding these elements helps buyers evaluate the true cost differences between retail and private sale depreciation.

Retail Depreciation: Definition and Mechanics

Retail depreciation refers to the reduction in value of a vehicle based on its retail market price, reflecting what a dealer might expect to sell it for after factoring in reconditioning and profit margins. This type of depreciation is typically higher than private sale depreciation because it includes additional costs such as dealer overhead and retail markup. The mechanics involve calculating the difference between the original retail price and the vehicle's current retail trade-in value, providing a realistic estimate of market-driven loss in value.

Private Sale Depreciation: What It Means

Private sale depreciation refers to the reduction in value of an asset when sold directly between individuals, often resulting in a lower resale price compared to retail transactions. This form of depreciation typically reflects market factors such as buyer demand, asset condition, and negotiation leverage without the added costs associated with dealership markups. Understanding private sale depreciation helps sellers set realistic price expectations and buyers identify potential bargains in peer-to-peer transactions.

Comparing Depreciation Rates: Retail vs Private Sale

Retail depreciation rates typically exceed private sale depreciation due to higher markup costs and dealer fees embedded in retail pricing. Private sales often reflect closer-to-market vehicle values, resulting in comparatively slower depreciation. Consequently, vehicles sold privately usually retain a higher percentage of their value than those sold at retail, impacting overall depreciation rates significantly.

How Market Demand Affects Depreciation in Both Channels

Market demand significantly influences retail and private sale depreciation rates, with retail channels experiencing slower depreciation due to manufacturer warranties and certified pre-owned programs that sustain vehicle value. In private sales, higher market demand can reduce depreciation by increasing buyer competition, although the lack of institutional guarantees typically results in steeper value declines than retail. Fluctuations in consumer preferences and economic conditions create variable depreciation patterns, impacting resale values differently across these channels.

Common Myths About Car Depreciation

Retail depreciation is often overestimated due to misconceptions about immediate value loss upon purchase, while private sale depreciation tends to reflect a more gradual decline based on market demand and vehicle condition. Many consumers believe cars depreciate sharply only in retail settings, ignoring factors such as mileage, maintenance, and model popularity that affect private sale values significantly. Understanding these distinctions clarifies that private sale prices can sometimes retain more value than expected compared to dealership offers, challenging common myths about uniform depreciation across selling methods.

Maximizing Resale Value: Retail vs Private Sale Strategies

Retail depreciation often results in a higher resale value due to the professional reconditioning and broader market exposure, which attract buyers willing to pay a premium. Private sale depreciation typically leads to a lower resale value because of limited marketing reach and the absence of certified inspections, reducing buyer confidence. Maximizing resale value involves choosing retail channels with certified appraisals and transparent histories, whereas private sales require strategic pricing and thorough vehicle maintenance to minimize depreciation impact.

Pros and Cons of Selling Retail vs Private

Selling a vehicle retail typically yields a higher sale price due to dealership warranties and certifications, enhancing buyer confidence but involves longer selling times and dealer commission fees. Private sale depreciation often results in a lower sale price caused by limited buyer reach and the buyer's perception of risk without warranties, though it benefits the seller with faster transactions and no commission costs. Choosing between retail and private sale depends on balancing higher returns against time investment and selling convenience.

Future Trends in Car Depreciation and Sales Channels

Future trends in car depreciation indicate a growing divergence between retail depreciation and private sale depreciation due to evolving consumer preferences and digital sales platforms. Retail depreciation often remains higher because dealerships incorporate fixed costs and market demand fluctuations, while private sales can capture more accurate vehicle values through direct owner-to-buyer negotiations. The rise of online marketplaces and certified pre-owned programs is expected to further influence these depreciation patterns by enhancing transparency and expanding sales channel options.

Retail Depreciation vs Private Sale Depreciation Infographic

cardiffo.com

cardiffo.com