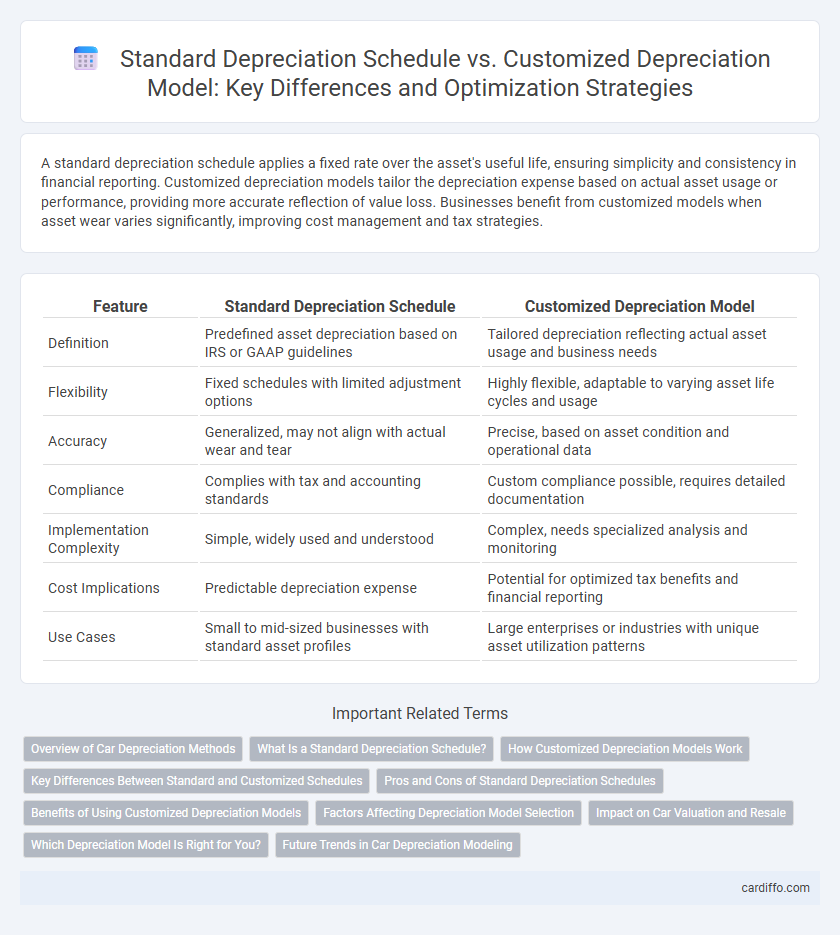

A standard depreciation schedule applies a fixed rate over the asset's useful life, ensuring simplicity and consistency in financial reporting. Customized depreciation models tailor the depreciation expense based on actual asset usage or performance, providing more accurate reflection of value loss. Businesses benefit from customized models when asset wear varies significantly, improving cost management and tax strategies.

Table of Comparison

| Feature | Standard Depreciation Schedule | Customized Depreciation Model |

|---|---|---|

| Definition | Predefined asset depreciation based on IRS or GAAP guidelines | Tailored depreciation reflecting actual asset usage and business needs |

| Flexibility | Fixed schedules with limited adjustment options | Highly flexible, adaptable to varying asset life cycles and usage |

| Accuracy | Generalized, may not align with actual wear and tear | Precise, based on asset condition and operational data |

| Compliance | Complies with tax and accounting standards | Custom compliance possible, requires detailed documentation |

| Implementation Complexity | Simple, widely used and understood | Complex, needs specialized analysis and monitoring |

| Cost Implications | Predictable depreciation expense | Potential for optimized tax benefits and financial reporting |

| Use Cases | Small to mid-sized businesses with standard asset profiles | Large enterprises or industries with unique asset utilization patterns |

Overview of Car Depreciation Methods

Standard depreciation schedules apply fixed percentage rates over predetermined periods, offering simplicity and consistency for calculating vehicle value reduction. Customized depreciation models adjust factors such as usage, maintenance, and market conditions to more accurately reflect a car's actual loss in value. Choosing between these methods impacts financial reporting, tax calculations, and asset management strategies in automotive depreciation accounting.

What Is a Standard Depreciation Schedule?

A Standard Depreciation Schedule is a predefined method allocated by tax authorities or accounting standards, specifying fixed rates and timelines for asset value reduction. It simplifies financial reporting by applying uniform depreciation percentages based on asset classes, such as straight-line or declining balance methods. This schedule ensures consistency and compliance but may lack flexibility to reflect actual usage or wear and tear of specific assets.

How Customized Depreciation Models Work

Customized depreciation models allocate asset costs based on specific usage patterns, operational hours, or revenue generation, providing a more accurate reflection of asset value decline than standard schedules. These models utilize detailed data inputs such as asset wear and tear, maintenance records, and economic factors to tailor depreciation rates precisely. By aligning depreciation expenses with actual asset consumption, businesses achieve better financial forecasting and tax optimization.

Key Differences Between Standard and Customized Schedules

Standard depreciation schedules follow preset timeframes and rates established by regulatory bodies, providing uniformity and ease of compliance for asset valuation. Customized depreciation models tailor the depreciation method, rate, and period based on specific asset usage, economic conditions, or business strategies, enhancing accuracy in reflecting actual asset value. Key differences include flexibility, precision in expense matching, and alignment with unique organizational financial goals.

Pros and Cons of Standard Depreciation Schedules

Standard depreciation schedules offer simplicity and regulatory compliance by providing predetermined rates and timelines approved by tax authorities, reducing the risk of errors in financial reporting. They enable straightforward calculations and consistent expense recognition but often lack flexibility to reflect the actual usage or wear and tear of specific assets accurately. This rigidity can lead to either underestimating or overestimating asset value, impacting financial statements and decision-making.

Benefits of Using Customized Depreciation Models

Customized depreciation models offer precise asset valuation by accounting for specific usage patterns and economic factors, enhancing financial accuracy compared to standard schedules. These models improve tax planning and cash flow management by aligning depreciation expenses with actual asset performance and wear. Businesses gain strategic insights, enabling optimized budgeting and resource allocation tailored to their unique operational needs.

Factors Affecting Depreciation Model Selection

Standard depreciation schedules rely on fixed timelines and rates, suited for assets with predictable usage and uniform wear patterns. Customized depreciation models consider variables such as asset utilization intensity, maintenance frequency, and technological obsolescence, providing a more accurate reflection of asset value decline. Factors influencing model selection include industry-specific regulations, asset type, business financial strategy, and the need for precise tax compliance or financial reporting.

Impact on Car Valuation and Resale

A standard depreciation schedule applies uniform rates based on industry norms, often leading to generalized car valuation that may not reflect individual vehicle condition or market variations. Customized depreciation models incorporate factors like usage, maintenance records, and market trends, producing more accurate valuations and potentially higher resale prices. Tailoring depreciation allows sellers to better capture the true residual value, enhancing negotiation power during resale.

Which Depreciation Model Is Right for You?

Choosing the right depreciation model depends on your asset usage, financial goals, and tax strategy. A standard depreciation schedule offers simplicity and compliance with tax regulations, ideal for businesses seeking predictable expense patterns. Customized depreciation models provide flexibility to match actual asset wear and tear, maximizing tax benefits and reflecting true asset value over time.

Future Trends in Car Depreciation Modeling

Future trends in car depreciation modeling emphasize the shift from standard depreciation schedules to customized models that leverage big data and machine learning algorithms to predict vehicle value more accurately. Customized depreciation models incorporate factors such as mileage, maintenance history, geographic location, and market demand, enabling real-time adjustments and personalized valuations. This approach improves depreciation forecasting precision, directly benefiting manufacturers, insurers, and resale market participants.

Standard Depreciation Schedule vs Customized Depreciation Model Infographic

cardiffo.com

cardiffo.com