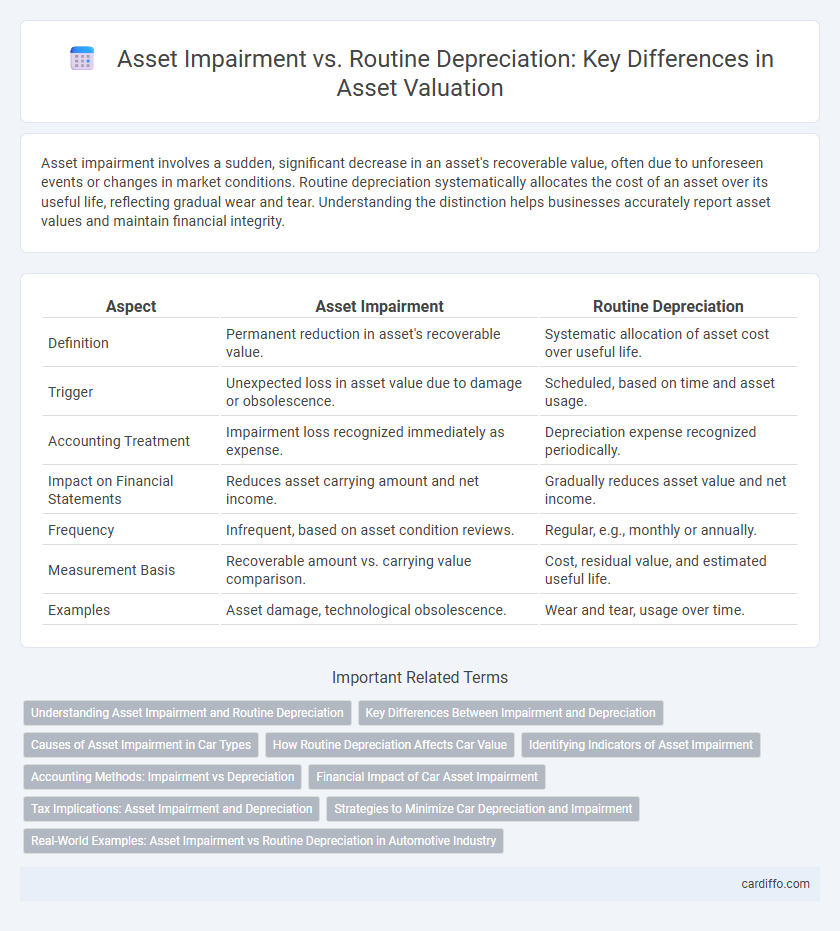

Asset impairment involves a sudden, significant decrease in an asset's recoverable value, often due to unforeseen events or changes in market conditions. Routine depreciation systematically allocates the cost of an asset over its useful life, reflecting gradual wear and tear. Understanding the distinction helps businesses accurately report asset values and maintain financial integrity.

Table of Comparison

| Aspect | Asset Impairment | Routine Depreciation |

|---|---|---|

| Definition | Permanent reduction in asset's recoverable value. | Systematic allocation of asset cost over useful life. |

| Trigger | Unexpected loss in asset value due to damage or obsolescence. | Scheduled, based on time and asset usage. |

| Accounting Treatment | Impairment loss recognized immediately as expense. | Depreciation expense recognized periodically. |

| Impact on Financial Statements | Reduces asset carrying amount and net income. | Gradually reduces asset value and net income. |

| Frequency | Infrequent, based on asset condition reviews. | Regular, e.g., monthly or annually. |

| Measurement Basis | Recoverable amount vs. carrying value comparison. | Cost, residual value, and estimated useful life. |

| Examples | Asset damage, technological obsolescence. | Wear and tear, usage over time. |

Understanding Asset Impairment and Routine Depreciation

Asset impairment occurs when an asset's market value drops significantly below its book value, requiring an immediate write-down to reflect the reduced recoverable amount. Routine depreciation systematically allocates an asset's cost over its useful life, matching expense recognition with revenue generation. Understanding the distinction is crucial for accurate financial reporting and asset management.

Key Differences Between Impairment and Depreciation

Asset impairment represents a significant, often unexpected, reduction in the recoverable value of an asset due to events like damage or market decline, whereas routine depreciation systematically allocates the asset's cost over its useful life. Impairment is recognized through a one-time write-down when the asset's carrying amount exceeds its recoverable amount, impacting financial statements immediately. Depreciation follows a predetermined schedule based on time or usage, reflecting predictable usage and wear over the asset's lifespan.

Causes of Asset Impairment in Car Types

Asset impairment in car types occurs due to sudden events such as accidents, regulatory changes affecting emissions standards, or significant market value declines from technological obsolescence. Routine depreciation typically reflects predictable wear and tear or age-related value loss, whereas impairment addresses unexpected and substantial drops in asset recoverable value. Factors like flood damage, mechanical failures, or extensive body damage also contribute significantly to asset impairment in vehicles.

How Routine Depreciation Affects Car Value

Routine depreciation systematically allocates the cost of a car over its useful life, reflecting gradual wear and tear and reducing its book value annually. This consistent decline in value impacts resale price by signaling expected usage and age, rather than sudden loss of utility or market value. Unlike asset impairment, which indicates an abrupt decrease due to damage or obsolescence, routine depreciation provides a predictable estimate of a car's diminishing economic value.

Identifying Indicators of Asset Impairment

Identifying indicators of asset impairment involves recognizing significant declines in asset value beyond routine depreciation, such as physical damage, obsolescence, or changes in market conditions. Routine depreciation systematically allocates an asset's cost over its useful life, reflecting normal wear and tear without signaling impairment. Timely detection of impairment indicators ensures accurate financial reporting and prevents overstating asset values on the balance sheet.

Accounting Methods: Impairment vs Depreciation

Asset impairment and routine depreciation represent distinct accounting methods for reflecting asset value changes; impairment accounts for sudden, significant declines in an asset's recoverable amount, requiring immediate write-downs to fair value, while routine depreciation systematically allocates an asset's cost over its useful life. Impairment testing adheres to standards such as IAS 36, identifying losses when carrying amounts exceed recoverable amounts, contrasting with periodic depreciation methods like straight-line or declining balance that amortize cost based on usage or time. Companies must accurately differentiate these methods to ensure transparent financial reporting and compliance with accounting principles.

Financial Impact of Car Asset Impairment

Asset impairment results in an immediate write-down of the car asset's book value, significantly reducing net income in the financial period it is recognized. Routine depreciation spreads the cost of the car asset evenly over its useful life, causing a predictable and gradual expense impact on earnings. Unlike routine depreciation, asset impairment reflects a sudden decline in the asset's recoverable amount, directly affecting cash flow projections and financial ratios such as return on assets (ROA).

Tax Implications: Asset Impairment and Depreciation

Asset impairment results in an immediate write-down of an asset's book value, which may trigger distinct tax treatments compared to routine depreciation. Routine depreciation allocates asset cost over its useful life, providing consistent tax deductions annually, while impairment often requires special tax adjustments or recaptures. Tax authorities may impose specific rules for recognizing impairment losses, potentially affecting taxable income differently than standard depreciation deductions.

Strategies to Minimize Car Depreciation and Impairment

Regularly maintaining your vehicle, including timely servicing and avoiding harsh driving conditions, helps slow routine depreciation and preserves resale value. Monitoring market trends and promptly recognizing signs of asset impairment, such as significant damage or technological obsolescence, can prevent unexpected losses. Strategic decisions like choosing vehicles with high resale value and purchasing extended warranties also safeguard against accelerated depreciation and impairment costs.

Real-World Examples: Asset Impairment vs Routine Depreciation in Automotive Industry

In the automotive industry, routine depreciation typically follows a systematic schedule reflecting expected wear and tear, such as a luxury car depreciating 15-20% annually. Asset impairment occurs when unforeseen factors like a sudden recall or technological obsolescence drastically reduce an asset's market value, for example, when a hybrid vehicle's battery technology becomes outdated due to new innovations. Unlike routine depreciation, asset impairment requires an immediate write-down to reflect the asset's lower market value on the company's financial statements.

Asset Impairment vs Routine Depreciation Infographic

cardiffo.com

cardiffo.com