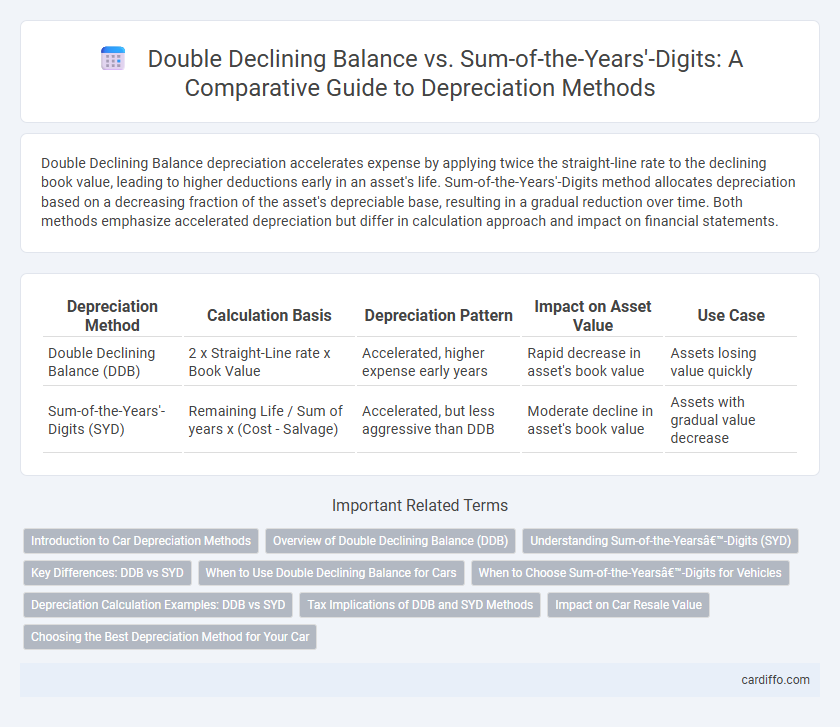

Double Declining Balance depreciation accelerates expense by applying twice the straight-line rate to the declining book value, leading to higher deductions early in an asset's life. Sum-of-the-Years'-Digits method allocates depreciation based on a decreasing fraction of the asset's depreciable base, resulting in a gradual reduction over time. Both methods emphasize accelerated depreciation but differ in calculation approach and impact on financial statements.

Table of Comparison

| Depreciation Method | Calculation Basis | Depreciation Pattern | Impact on Asset Value | Use Case |

|---|---|---|---|---|

| Double Declining Balance (DDB) | 2 x Straight-Line rate x Book Value | Accelerated, higher expense early years | Rapid decrease in asset's book value | Assets losing value quickly |

| Sum-of-the-Years'-Digits (SYD) | Remaining Life / Sum of years x (Cost - Salvage) | Accelerated, but less aggressive than DDB | Moderate decline in asset's book value | Assets with gradual value decrease |

Introduction to Car Depreciation Methods

Double Declining Balance depreciates a car faster by applying a fixed percentage to the declining book value, accelerating expense recognition in early years. Sum-of-the-Years'-Digits calculates depreciation by multiplying the depreciable base by a fraction that decreases annually, reflecting a systematic allocation over the car's useful life. Both methods provide accelerated depreciation compared to straight-line, influencing tax benefits and financial statements differently.

Overview of Double Declining Balance (DDB)

Double Declining Balance (DDB) depreciation is an accelerated method that doubles the straight-line depreciation rate, allocating higher expense in the early years of an asset's life to reflect rapid value loss. This technique is suitable for assets that experience significant obsolescence or wear initially, such as technology and vehicles. Unlike the Sum-of-the-Years'-Digits method, DDB does not allocate depreciation based on a fixed sum but relies on a fixed multiple of the book value.

Understanding Sum-of-the-Years’-Digits (SYD)

Sum-of-the-Years'-Digits (SYD) depreciation accelerates expense recognition by allocating higher depreciation costs to earlier years based on a decreasing fraction of the asset's depreciable base. The SYD method calculates depreciation using the sum of the years in the asset's useful life as the denominator, multiplying this fraction by the asset's depreciable amount each year. This approach provides a more balanced acceleration compared to Double Declining Balance, reflecting asset usage patterns while simplifying calculations for irregular asset wear.

Key Differences: DDB vs SYD

Double Declining Balance (DDB) depreciation applies a fixed double rate to the book value, resulting in higher expenses early in the asset's life, while Sum-of-the-Years'-Digits (SYD) allocates depreciation based on a decreasing fraction of the asset's useful life, also front-loading expenses but with a different calculation. DDB calculates depreciation by doubling the straight-line rate and applying it to the diminishing book value, whereas SYD uses a fraction derived from the sum of the years of the asset's useful life multiplied by its depreciable cost. DDB typically results in more aggressive early depreciation and reduces the carrying amount faster, whereas SYD provides a more gradual, yet accelerated, expense recognition pattern over time.

When to Use Double Declining Balance for Cars

Double Declining Balance (DDB) is ideal for cars that experience rapid value loss in the early years, providing accelerated depreciation that matches the vehicle's actual wear and tear. This method is preferable when a company aims to maximize tax benefits sooner by aligning expense recognition with higher early depreciation costs. Use DDB for vehicles expected to have heavy usage or technological obsolescence within the first few years of ownership.

When to Choose Sum-of-the-Years’-Digits for Vehicles

Sum-of-the-Years'-Digits (SYD) is ideal for vehicles that experience rapid value loss in the initial years but maintain utility beyond that period. This method accelerates depreciation more moderately than Double Declining Balance, reflecting actual wear and tear. SYD suits scenarios where vehicle usage and maintenance costs decline progressively rather than uniformly.

Depreciation Calculation Examples: DDB vs SYD

The Double Declining Balance (DDB) method accelerates depreciation by applying twice the straight-line rate to the declining book value, resulting in higher expenses in the early years; for example, an asset worth $10,000 with a 5-year life depreciates $4,000 in year one under DDB. The Sum-of-the-Years'-Digits (SYD) method allocates depreciation based on a fraction of the sum of years' digits, producing moderate acceleration; the same asset depreciates $3,333 in year one using SYD. Comparing both methods reveals that DDB front-loads expenses more aggressively, while SYD provides a smoother reduction over the asset's lifespan.

Tax Implications of DDB and SYD Methods

Double Declining Balance (DDB) accelerates depreciation, allowing higher deductions in the early years, which reduces taxable income and defers tax liabilities. Sum-of-the-Years'-Digits (SYD) also accelerates depreciation but results in a more moderate expense compared to DDB, balancing tax savings and book value recovery. Both methods impact cash flow by lowering initial tax payments, but DDB typically offers greater upfront tax benefits, making it advantageous for assets needing rapid cost recovery.

Impact on Car Resale Value

Double Declining Balance (DDB) depreciation accelerates expense recognition, reducing the book value of a car more rapidly in early years, which may lower the reported asset value on resale but better matches tax benefits. Sum-of-the-Years'-Digits (SYD) method also accelerates depreciation but at a slightly slower rate, resulting in higher book value compared to DDB over the same period. The choice between DDB and SYD can influence perceived car depreciation, affecting resale negotiations as buyers and sellers often consider book value alongside market value.

Choosing the Best Depreciation Method for Your Car

Double Declining Balance (DDB) accelerates depreciation by applying twice the straight-line rate, making it ideal for cars that lose value rapidly in the initial years. Sum-of-the-Years'-Digits (SYD) method also accelerates depreciation but at a gradually decreasing rate, better suited for vehicles with moderate early depreciation. Selecting between DDB and SYD depends on your car's usage pattern and tax strategy, with DDB maximizing early-year expense deductions while SYD offers a smoother decline.

Double Declining Balance vs Sum-of-the-Years’-Digits Infographic

cardiffo.com

cardiffo.com