Trade-in value reflects the market worth of a vehicle when exchanged for another, often higher than the written-down value, which accounts for depreciation on the balance sheet. Understanding the difference helps owners make informed decisions about selling or trading their assets. Evaluating both values ensures accurate financial reporting and optimal trade strategies.

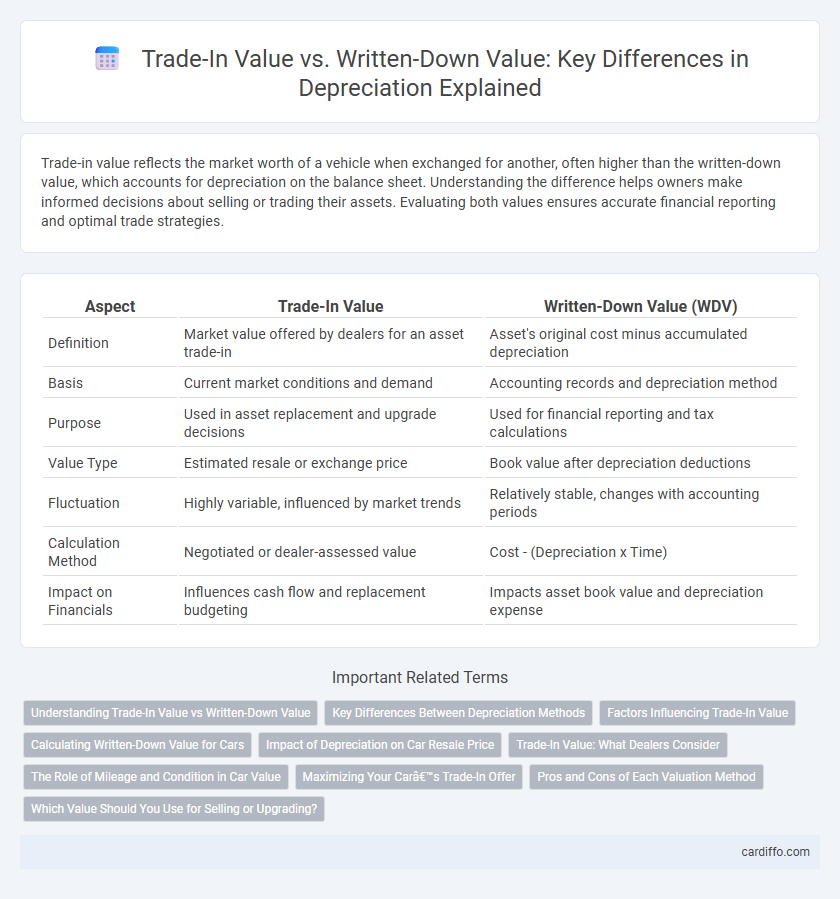

Table of Comparison

| Aspect | Trade-In Value | Written-Down Value (WDV) |

|---|---|---|

| Definition | Market value offered by dealers for an asset trade-in | Asset's original cost minus accumulated depreciation |

| Basis | Current market conditions and demand | Accounting records and depreciation method |

| Purpose | Used in asset replacement and upgrade decisions | Used for financial reporting and tax calculations |

| Value Type | Estimated resale or exchange price | Book value after depreciation deductions |

| Fluctuation | Highly variable, influenced by market trends | Relatively stable, changes with accounting periods |

| Calculation Method | Negotiated or dealer-assessed value | Cost - (Depreciation x Time) |

| Impact on Financials | Influences cash flow and replacement budgeting | Impacts asset book value and depreciation expense |

Understanding Trade-In Value vs Written-Down Value

Trade-in value represents the amount a seller can receive by exchanging an asset, such as a vehicle or equipment, while written-down value reflects the asset's net book value after accounting for accumulated depreciation over time. Understanding the difference is crucial for accurate financial reporting and decision-making, as trade-in value is market-driven and can fluctuate, whereas written-down value is based on systematic depreciation schedules. Accurately comparing these values helps businesses assess asset replacement strategies and the economic impact of asset disposals.

Key Differences Between Depreciation Methods

Trade-In Value reflects the market price a company can receive when exchanging an asset, while Written-Down Value represents the asset's book value after accounting for accumulated depreciation. Depreciation methods like Straight-Line allocate cost evenly over an asset's useful life, resulting in a consistent Written-Down Value reduction, whereas Declining Balance accelerates depreciation, causing a faster decrease in book value compared to Trade-In Value. Understanding these differences helps businesses make informed decisions about asset replacement timing and financial reporting accuracy.

Factors Influencing Trade-In Value

Trade-in value is influenced by factors such as market demand, vehicle condition, mileage, and brand reputation, which can cause it to deviate significantly from the written-down value calculated through depreciation methods. Wear and tear, cosmetic damages, and recent repairs directly impact the trade-in offer, whereas the written-down value strictly reflects the asset's book value after accounting for accumulated depreciation. Economic conditions and evolving consumer preferences also play a crucial role in determining the practical trade-in value compared to standardized accounting figures.

Calculating Written-Down Value for Cars

Written-down value (WDV) of a car is calculated by subtracting accumulated depreciation from the car's original purchase price, reflecting its current book value. Depreciation is typically computed using a fixed percentage rate applied annually to the car's reducing balance, capturing its decline in market worth over time. Trade-in value often differs from WDV, as it accounts for market demand, condition, and mileage, which can either increase or decrease the car's resale price beyond its accounting value.

Impact of Depreciation on Car Resale Price

Trade-in value often falls below the written-down value due to cumulative depreciation reflected in market demand and vehicle condition. Depreciation directly impacts car resale price by reducing the vehicle's book value, which influences buyer willingness to pay. Understanding the gap between trade-in value and written-down value helps sellers anticipate realistic resale expectations.

Trade-In Value: What Dealers Consider

Dealers focus on trade-in value as the current market worth of a vehicle, which often surpasses the written-down value found in accounting records. Trade-in value reflects real-time demand, vehicle condition, mileage, and market trends, rather than the vehicle's depreciated book value. This market-driven figure influences trade-in offers more effectively than the theoretical depreciation captured by written-down value.

The Role of Mileage and Condition in Car Value

Trade-in value and written-down value differ significantly based on mileage and vehicle condition, which are critical factors in depreciation calculations. Higher mileage typically accelerates depreciation, reducing the written-down value more than the trade-in value might reflect, since trade-in assessments consider market demand and current condition. Well-maintained vehicles with lower mileage retain a higher trade-in value relative to their written-down value due to better appeal in the resale market.

Maximizing Your Car’s Trade-In Offer

Maximizing your car's trade-in offer requires understanding the difference between trade-in value and written-down value, where trade-in value reflects the market price a dealer offers, often higher than the accounting-based written-down value. Factors such as vehicle condition, mileage, market demand, and maintenance records directly influence trade-in offers, making regular upkeep essential. Strategic timing of trade-in, aligned with peak market demand and low depreciation periods, helps bridge the gap between the vehicle's book value and trade-in price for optimal returns.

Pros and Cons of Each Valuation Method

Trade-in value reflects the current market price a dealer offers, often higher than the written-down value, making it advantageous for sellers seeking immediate cash returns. Written-down value represents the asset's net book value after accounting for depreciation, providing a realistic estimate for accounting and tax purposes but typically undervaluing the asset in a resale context. Choosing between trade-in and written-down value depends on whether the goal is maximizing sale price or maintaining accurate financial records.

Which Value Should You Use for Selling or Upgrading?

When deciding whether to sell or upgrade an asset, the trade-in value reflects the current market price a buyer is willing to pay, often higher than the written-down value, which represents the asset's depreciated book value on financial statements. Using the trade-in value provides a realistic estimate of the asset's market worth for negotiation purposes, while the written-down value is essential for calculating tax implications and accounting records. Prioritizing the trade-in value optimizes decision-making for maximizing returns during upgrades or sales.

Trade-In Value vs Written-Down Value Infographic

cardiffo.com

cardiffo.com