Unit of Production Depreciation allocates asset cost based on actual usage, making it ideal for machinery or vehicles where wear correlates with operational activity. Time-Based Depreciation spreads the expense evenly over the asset's useful life regardless of usage, suitable for assets subject to obsolescence or aging. Comparing both methods reveals that Unit of Production offers more accurate expense matching when usage varies significantly, while Time-Based provides simplicity and consistency in accounting.

Table of Comparison

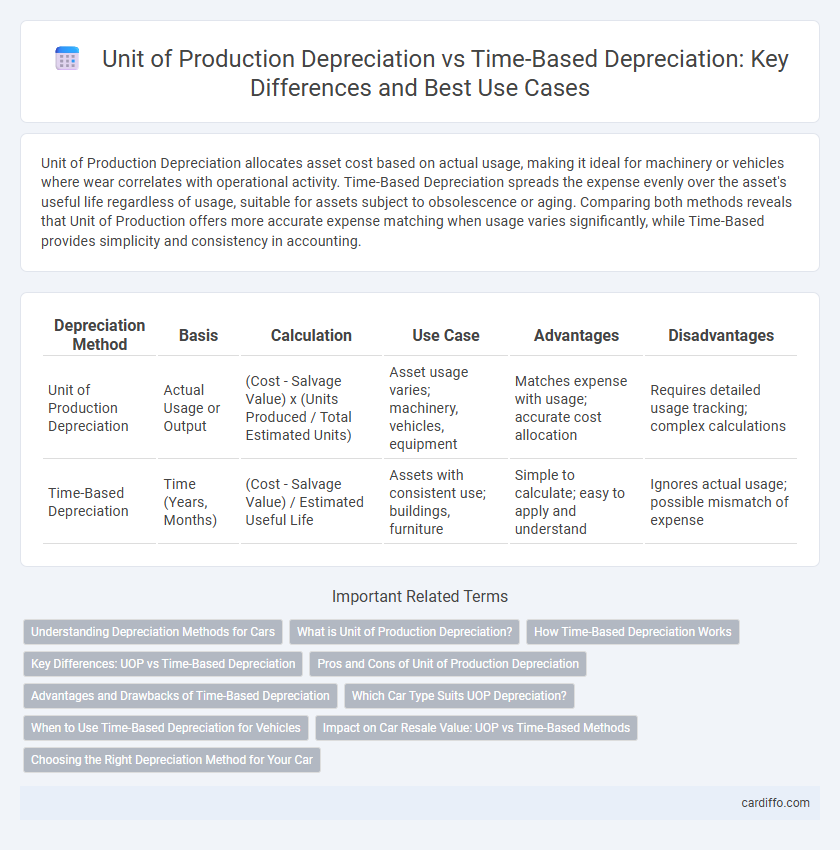

| Depreciation Method | Basis | Calculation | Use Case | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Unit of Production Depreciation | Actual Usage or Output | (Cost - Salvage Value) x (Units Produced / Total Estimated Units) | Asset usage varies; machinery, vehicles, equipment | Matches expense with usage; accurate cost allocation | Requires detailed usage tracking; complex calculations |

| Time-Based Depreciation | Time (Years, Months) | (Cost - Salvage Value) / Estimated Useful Life | Assets with consistent use; buildings, furniture | Simple to calculate; easy to apply and understand | Ignores actual usage; possible mismatch of expense |

Understanding Depreciation Methods for Cars

Unit of Production Depreciation allocates expense based on actual car usage, such as miles driven, providing a precise match between depreciation and wear. Time-Based Depreciation, including Straight-Line and Declining Balance methods, spreads the car's cost evenly or accelerated over its useful life, regardless of usage. For vehicles with variable mileage, Unit of Production offers more accurate depreciation, while Time-Based methods simplify accounting with consistent periodic expenses.

What is Unit of Production Depreciation?

Unit of Production Depreciation allocates asset cost based on actual usage or output, such as hours operated or units produced, rather than the passage of time. This method ties depreciation expense directly to the asset's productivity, making it ideal for machinery or equipment with variable activity levels. It contrasts with time-based depreciation, which spreads cost evenly over a fixed useful life regardless of usage.

How Time-Based Depreciation Works

Time-based depreciation allocates an asset's cost evenly over its useful life, typically using methods like straight-line or declining balance depreciation. This approach calculates expense based on time intervals, such as months or years, regardless of asset usage or output. It simplifies accounting by providing predictable expense recognition, making it suitable for assets with consistent wear and tear over time.

Key Differences: UOP vs Time-Based Depreciation

Unit of Production (UOP) depreciation allocates asset cost based on actual usage or output, making it ideal for machinery or vehicles whose wear correlates with activity levels. Time-based depreciation methods, such as straight-line or declining balance, allocate cost evenly or accelerated over an asset's useful life, regardless of usage. The key difference lies in UOP's activity-driven approach providing more precise expense matching, while time-based methods rely on systematic allocation over time periods.

Pros and Cons of Unit of Production Depreciation

Unit of Production Depreciation aligns asset expense with actual usage, offering precise matching of cost to revenue generation, ideal for machinery with variable output. This method provides detailed expense tracking but can complicate accounting due to fluctuating depreciation amounts and requires reliable usage data. Unlike time-based depreciation, it may not reflect wear and tear due to age, potentially underestimating obsolescence in low-usage periods.

Advantages and Drawbacks of Time-Based Depreciation

Time-based depreciation offers simplicity and predictability by allocating asset cost evenly over its useful life, easing financial planning and reporting. However, it may not accurately reflect actual asset usage or wear, potentially misrepresenting asset value in cases of irregular or intensive use. This method can lead to either overestimating or underestimating expenses compared to the unit of production approach, which aligns depreciation with actual asset output.

Which Car Type Suits UOP Depreciation?

Unit of Production (UOP) depreciation suits vehicles with variable usage patterns such as commercial trucks and delivery vans, where wear and tear correlate directly with miles driven or hours operated. Time-based depreciation methods better fit personal cars driven consistently over time, reflecting decreased value with age regardless of mileage. Choosing UOP depreciation optimizes expense recognition for high-mileage or irregular use vehicles by aligning costs with actual usage.

When to Use Time-Based Depreciation for Vehicles

Time-based depreciation is ideal for vehicles with predictable usage patterns or consistent wear over time, such as company cars used regularly regardless of mileage. This method simplifies expense allocation by spreading cost evenly across the vehicle's useful life, offering straightforward financial planning. It is less accurate for vehicles with highly variable usage but favored when time rather than usage drives depreciation.

Impact on Car Resale Value: UOP vs Time-Based Methods

Unit of Production (UOP) depreciation ties asset value reduction directly to usage, often resulting in a more accurate reflection of a car's wear and tear, which can positively influence its resale value if usage is low. Time-based depreciation methods allocate costs evenly over time, potentially undervaluing a well-maintained, lightly used vehicle and negatively impacting perceived resale value. Buyers tend to favor vehicles with maintenance and usage records consistent with UOP depreciation, viewing them as better preserved compared to those depreciated solely by time.

Choosing the Right Depreciation Method for Your Car

Selecting the appropriate depreciation method for your car depends on its usage and expected wear. Unit of Production Depreciation calculates expense based on actual miles driven, providing accurate expense matching for high-mileage vehicles, while Time-Based Depreciation, such as straight-line, allocates cost evenly over the vehicle's useful life regardless of usage. For owners with variable driving patterns, Unit of Production offers precise expense allocation, whereas Time-Based is simpler and suits consistent usage scenarios.

Unit of Production Depreciation vs Time-Based Depreciation Infographic

cardiffo.com

cardiffo.com