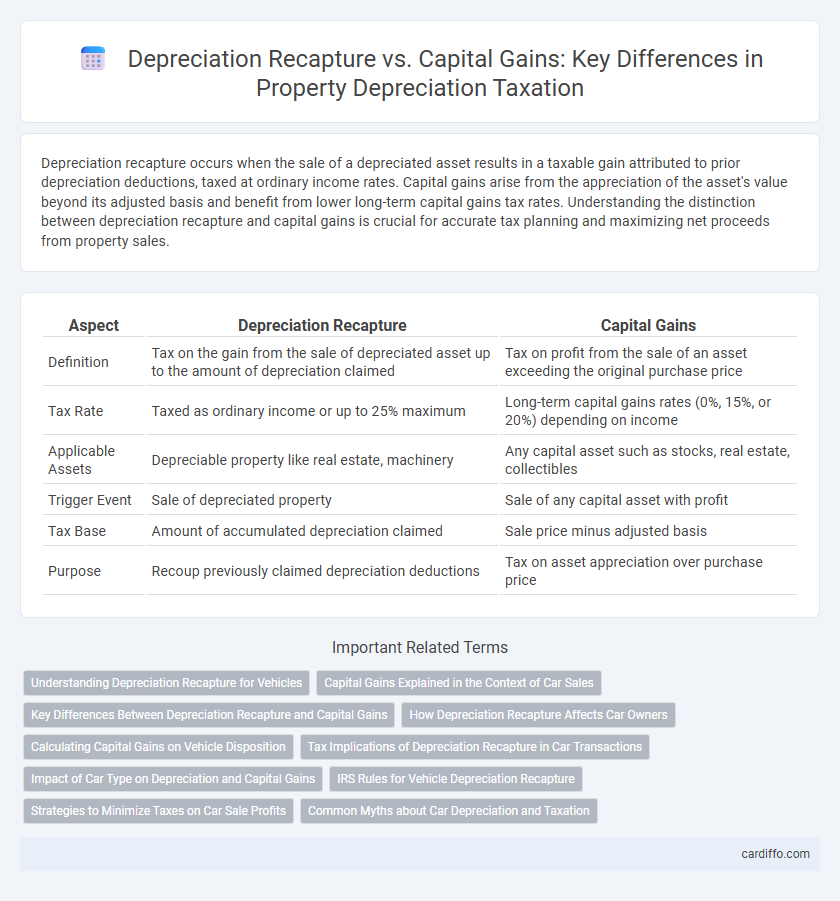

Depreciation recapture occurs when the sale of a depreciated asset results in a taxable gain attributed to prior depreciation deductions, taxed at ordinary income rates. Capital gains arise from the appreciation of the asset's value beyond its adjusted basis and benefit from lower long-term capital gains tax rates. Understanding the distinction between depreciation recapture and capital gains is crucial for accurate tax planning and maximizing net proceeds from property sales.

Table of Comparison

| Aspect | Depreciation Recapture | Capital Gains |

|---|---|---|

| Definition | Tax on the gain from the sale of depreciated asset up to the amount of depreciation claimed | Tax on profit from the sale of an asset exceeding the original purchase price |

| Tax Rate | Taxed as ordinary income or up to 25% maximum | Long-term capital gains rates (0%, 15%, or 20%) depending on income |

| Applicable Assets | Depreciable property like real estate, machinery | Any capital asset such as stocks, real estate, collectibles |

| Trigger Event | Sale of depreciated property | Sale of any capital asset with profit |

| Tax Base | Amount of accumulated depreciation claimed | Sale price minus adjusted basis |

| Purpose | Recoup previously claimed depreciation deductions | Tax on asset appreciation over purchase price |

Understanding Depreciation Recapture for Vehicles

Depreciation recapture for vehicles occurs when a used vehicle is sold for more than its depreciated value but less than its original purchase price, requiring the seller to report the difference as ordinary income. Unlike capital gains, which are taxed at favorable long-term rates, depreciation recapture is subject to higher ordinary income tax rates, making it essential to distinguish between these two taxation types. Understanding the vehicle's adjusted basis--the original cost minus accumulated depreciation--is key to accurately calculating potential recapture and managing tax liabilities effectively.

Capital Gains Explained in the Context of Car Sales

Capital gains in car sales refer to the profit realized when a vehicle is sold for more than its original purchase price, excluding adjustments for depreciation. Unlike depreciation recapture, which applies to business or investment properties and requires reporting the depreciation taken as ordinary income, capital gains on cars typically result in a taxable amount reflecting the net gain. Understanding the distinction between capital gains calculation and depreciation recapture is crucial for accurately reporting income from vehicle sales on tax returns.

Key Differences Between Depreciation Recapture and Capital Gains

Depreciation recapture occurs when the IRS taxes the gain from the sale of an asset at ordinary income tax rates up to the amount of depreciation previously claimed, whereas capital gains tax applies to the profit exceeding the original purchase price taxed at typically lower rates. The key difference lies in the treatment of the gain: depreciation recapture recovers tax benefits from prior depreciation deductions, while capital gains reflect appreciation beyond the asset's adjusted basis. Understanding these distinctions is crucial for accurate tax planning and minimizing taxable income on asset disposals.

How Depreciation Recapture Affects Car Owners

Depreciation recapture occurs when car owners sell a vehicle for more than its depreciated value, triggering taxes on the previously claimed depreciation deductions. This tax applies mainly to business or investment vehicles rather than personal cars, increasing the seller's taxable income upon sale. Understanding how depreciation recapture differs from capital gains taxes helps car owners anticipate potential tax liabilities when selling depreciated vehicles.

Calculating Capital Gains on Vehicle Disposition

Calculating capital gains on vehicle disposition involves determining the difference between the sale price and the vehicle's adjusted basis, which includes the original purchase price minus accumulated depreciation. Depreciation recapture requires reporting the portion of the gain attributable to depreciation deductions as ordinary income up to the amount of depreciation taken. Any remaining gain beyond depreciation recapture is typically taxed as a capital gain, necessitating accurate tracking of depreciation schedules and sale values for precise tax calculation.

Tax Implications of Depreciation Recapture in Car Transactions

Depreciation recapture in car transactions occurs when the sale price exceeds the adjusted basis of the vehicle after accounting for depreciation, leading to taxable income at ordinary income tax rates. Unlike capital gains, which are typically taxed at lower rates, depreciation recapture is taxed at a higher rate, increasing the seller's tax liability. Understanding these distinctions is crucial for accurately calculating taxes owed when selling a used vehicle that has been depreciated.

Impact of Car Type on Depreciation and Capital Gains

Depreciation recapture applies differently depending on the car type, with luxury and exotic vehicles typically experiencing higher depreciation rates, which can increase taxable recapture amounts upon sale. In contrast, standard or economy cars tend to depreciate more steadily, resulting in lower capital gains but also smaller depreciation deductions over time. Understanding the specific depreciation schedules tied to car categories is crucial for accurately calculating both recapture tax and capital gains implications during vehicle disposition.

IRS Rules for Vehicle Depreciation Recapture

IRS rules for vehicle depreciation recapture require taxpayers to report recaptured depreciation as ordinary income when a business vehicle is sold for more than its adjusted basis but less than its original cost. Depreciation recapture applies under Section 1245 of the Internal Revenue Code, mandating the inclusion of prior depreciation deductions as income up to the amount of gain realized. Capital gains treatment applies only to amounts exceeding the original purchase price, differentiating recapture income from capital gains tax.

Strategies to Minimize Taxes on Car Sale Profits

Maximizing tax efficiency on car sale profits involves understanding the difference between depreciation recapture and capital gains taxes; depreciation recapture applies to the portion of the gain attributed to previous depreciation deductions and is taxed at ordinary income rates. Strategies to minimize taxes include accurately calculating adjusted cost basis by adding depreciation claimed, utilizing installment sales to spread tax liability over multiple years, and reinvesting profits into similar assets through like-kind exchanges if applicable. Consulting with a tax professional can facilitate identifying opportunities for deductions or credits to offset recapture income while optimizing overall tax outcomes.

Common Myths about Car Depreciation and Taxation

Car depreciation often leads to misconceptions that all losses are deductible or that depreciation recapture always results in higher taxes. In reality, depreciation recapture tax applies only when selling a business or investment asset at a gain, not personal vehicles, while capital gains tax applies to the profit beyond the asset's adjusted basis. Many mistakenly assume personal car sales trigger these taxes, but IRS rules clearly exclude standard passenger automobiles from depreciation recapture and capital gains taxation.

Depreciation Recapture vs Capital Gains Infographic

cardiffo.com

cardiffo.com