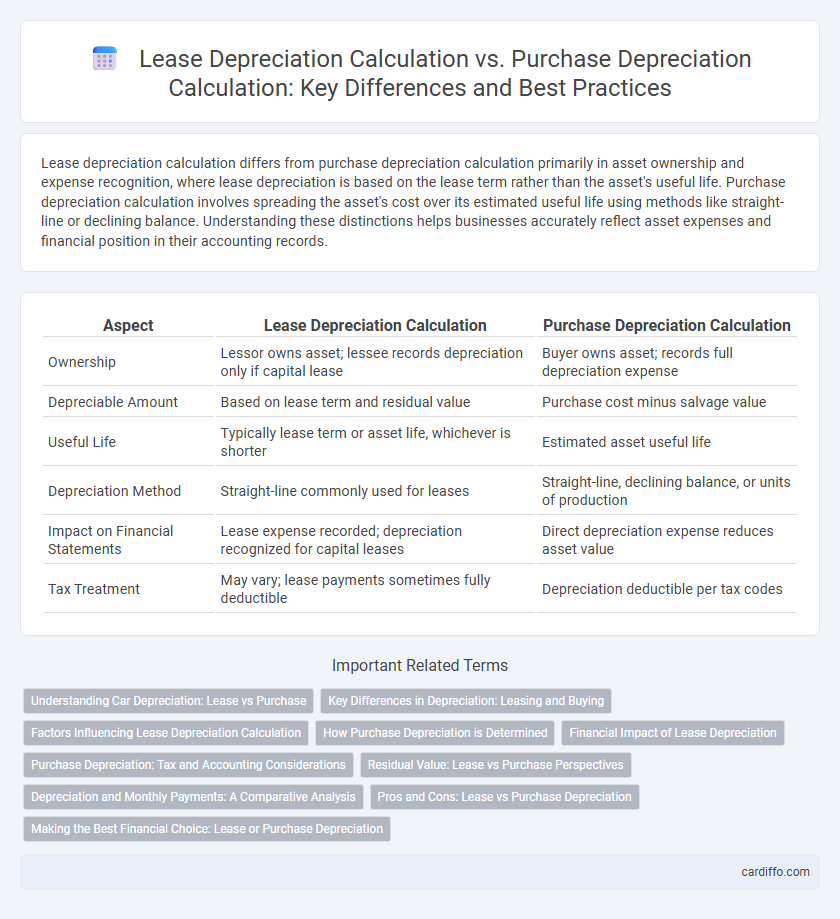

Lease depreciation calculation differs from purchase depreciation calculation primarily in asset ownership and expense recognition, where lease depreciation is based on the lease term rather than the asset's useful life. Purchase depreciation calculation involves spreading the asset's cost over its estimated useful life using methods like straight-line or declining balance. Understanding these distinctions helps businesses accurately reflect asset expenses and financial position in their accounting records.

Table of Comparison

| Aspect | Lease Depreciation Calculation | Purchase Depreciation Calculation |

|---|---|---|

| Ownership | Lessor owns asset; lessee records depreciation only if capital lease | Buyer owns asset; records full depreciation expense |

| Depreciable Amount | Based on lease term and residual value | Purchase cost minus salvage value |

| Useful Life | Typically lease term or asset life, whichever is shorter | Estimated asset useful life |

| Depreciation Method | Straight-line commonly used for leases | Straight-line, declining balance, or units of production |

| Impact on Financial Statements | Lease expense recorded; depreciation recognized for capital leases | Direct depreciation expense reduces asset value |

| Tax Treatment | May vary; lease payments sometimes fully deductible | Depreciation deductible per tax codes |

Understanding Car Depreciation: Lease vs Purchase

Lease depreciation calculation typically uses the vehicle's predicted lease-end value to determine monthly payments, reflecting only the expected loss in value over the lease term. Purchase depreciation calculation considers the car's total depreciation over ownership, factoring in initial cost, resale value, and ownership duration. Understanding car depreciation differences helps consumers decide between lower monthly lease costs and the long-term financial impact of purchasing.

Key Differences in Depreciation: Leasing and Buying

Lease depreciation calculation involves allocating the asset's cost over a fixed lease term without considering ownership benefits, often resulting in lower monthly depreciation expenses. Purchase depreciation calculation requires spreading the asset's cost, minus salvage value, over its useful life, reflecting full ownership and enabling tax benefits. Key differences include asset ownership impact, depreciation methods allowed, and financial statement treatment, which affect overall expense recognition and tax implications.

Factors Influencing Lease Depreciation Calculation

Lease depreciation calculation primarily depends on the lease term, residual value, and mileage limits, which directly impact the vehicle's depreciation expense over the lease period. Factors such as expected usage, lease duration, and market value fluctuations influence the residual value, altering the depreciation cost allocated to the lessee. In contrast, purchase depreciation is often calculated using straight-line or accelerated methods based on the asset's cost, useful life, and salvage value, without direct influence from usage or lease-specific terms.

How Purchase Depreciation is Determined

Purchase depreciation is determined based on the asset's initial cost, estimated useful life, and residual value, applying methods such as straight-line or declining balance to allocate expense over time. The calculation focuses on the asset's historical purchase price recorded on the balance sheet, reflecting its consumption and wear during ownership. Unlike lease depreciation, which depends on lease terms and payments, purchase depreciation directly relates to asset ownership and capital expenditure.

Financial Impact of Lease Depreciation

Lease depreciation calculation impacts financial statements by spreading the asset's cost over the lease term, often resulting in lower upfront expenses compared to purchase depreciation. Lease accounting standards, such as ASC 842 and IFRS 16, require lessees to recognize right-of-use assets and lease liabilities, affecting balance sheet and income statement presentation differently than purchased assets. This treatment can improve cash flow management and financial ratios but may increase reported liabilities, influencing credit assessments and investment decisions.

Purchase Depreciation: Tax and Accounting Considerations

Purchase depreciation calculation involves allocating the cost of an acquired asset over its useful life for both tax deduction and financial reporting purposes. Tax regulations often dictate specific depreciation methods and recovery periods, such as Modified Accelerated Cost Recovery System (MACRS) for tax filings, which differ from accounting standards like GAAP that emphasize matching expenses with revenues. Accurate purchase depreciation calculation ensures compliance, optimizes tax benefits, and provides transparent asset valuation on financial statements.

Residual Value: Lease vs Purchase Perspectives

Lease depreciation calculation hinges on the residual value agreed upon at lease inception, representing the estimated asset worth at lease end, significantly impacting monthly lease payments. Purchase depreciation calculation utilizes the asset's initial cost minus its estimated residual value over its useful life to determine annual or periodic depreciation expense, affecting tax deductions and book value. Residual value in lease scenarios is often predicated on market trends and lessor estimations, while purchase residual values typically derive from historical cost and depreciation schedules aligned with accounting standards.

Depreciation and Monthly Payments: A Comparative Analysis

Lease depreciation calculation typically involves estimating the vehicle's residual value and spreading the difference between its initial cost and residual value over the lease term, resulting in lower monthly payments compared to purchase depreciation, which allocates the asset's cost minus salvage value over its useful life. Monthly payments under lease depreciation are generally more predictable and often lower because depreciation expenses are confined to the lease duration, whereas purchase depreciation impacts monthly costs through methods like straight-line or accelerated depreciation affecting tax and accounting outcomes. Comparing the two methods highlights the financial flexibility of lease depreciation versus the asset ownership benefits and potential tax advantages inherent in purchase depreciation calculations.

Pros and Cons: Lease vs Purchase Depreciation

Lease depreciation calculation typically involves straight-line methods based on the lease term and residual value, offering predictable expense recognition with minimal upfront costs but limiting asset control and tax benefits. Purchase depreciation uses methods such as MACRS, enabling accelerated expense deduction and increased tax advantages but requires higher initial capital outlay and exposes the owner to asset obsolescence risks. The choice between lease and purchase depreciation impacts cash flow, tax strategy, and balance sheet presentation, making it crucial for financial planning and decision-making.

Making the Best Financial Choice: Lease or Purchase Depreciation

Lease depreciation calculation typically involves spreading the vehicle's cost over the lease term, reflecting the asset's diminishing value during usage without ownership benefits. Purchase depreciation calculation allocates the vehicle's cost over its useful life, allowing for tax deductions based on ownership and long-term value loss. Evaluating lease versus purchase depreciation hinges on comparing total costs, tax implications, and cash flow impact to determine the most financially advantageous option.

Lease Depreciation Calculation vs Purchase Depreciation Calculation Infographic

cardiffo.com

cardiffo.com