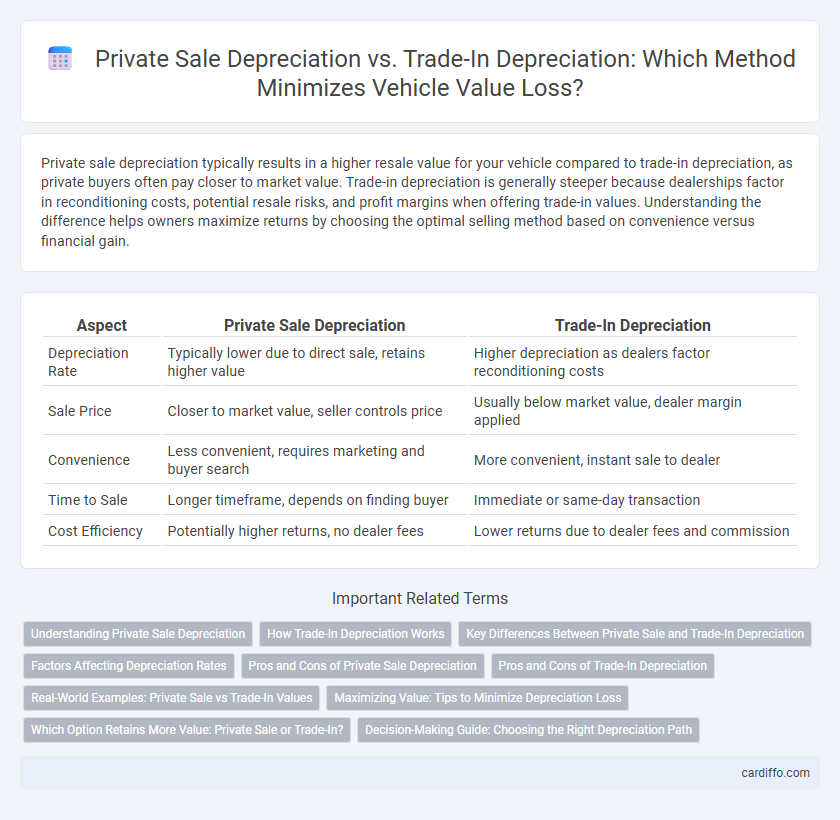

Private sale depreciation typically results in a higher resale value for your vehicle compared to trade-in depreciation, as private buyers often pay closer to market value. Trade-in depreciation is generally steeper because dealerships factor in reconditioning costs, potential resale risks, and profit margins when offering trade-in values. Understanding the difference helps owners maximize returns by choosing the optimal selling method based on convenience versus financial gain.

Table of Comparison

| Aspect | Private Sale Depreciation | Trade-In Depreciation |

|---|---|---|

| Depreciation Rate | Typically lower due to direct sale, retains higher value | Higher depreciation as dealers factor reconditioning costs |

| Sale Price | Closer to market value, seller controls price | Usually below market value, dealer margin applied |

| Convenience | Less convenient, requires marketing and buyer search | More convenient, instant sale to dealer |

| Time to Sale | Longer timeframe, depends on finding buyer | Immediate or same-day transaction |

| Cost Efficiency | Potentially higher returns, no dealer fees | Lower returns due to dealer fees and commission |

Understanding Private Sale Depreciation

Private sale depreciation typically results in a higher resale value compared to trade-in depreciation because private sales allow sellers to negotiate directly with buyers, often achieving closer to market value. This form of depreciation reflects the actual wear and market demand rather than dealer trade-in offers, which factor in dealer costs and profit margins, reducing the vehicle's perceived value. Understanding private sale depreciation enables sellers to maximize returns by setting realistic prices based on thorough market research and vehicle condition.

How Trade-In Depreciation Works

Trade-in depreciation occurs when a vehicle is exchanged at a dealership, and the trade-in value reflects the car's current market worth minus depreciation since purchase. This value is subtracted from the new vehicle's price, effectively reducing the purchase cost but often accounting for higher depreciation due to dealer reconditioning and profit margins. Trade-in depreciation typically results in a lower return compared to private sale depreciation because dealers factor in resale risk and overhead expenses.

Key Differences Between Private Sale and Trade-In Depreciation

Private sale depreciation typically results in a higher resale value because the seller negotiates directly with the buyer, capturing more of the vehicle's market value. Trade-in depreciation occurs when a dealer offers a lower price to account for reconditioning and dealer profit margins, reducing the vehicle's immediate return. The key difference lies in the net financial outcome, with private sales often preserving more asset value compared to trade-ins.

Factors Affecting Depreciation Rates

Private sale depreciation rates tend to be higher due to the lack of warranties and the buyer's increased perception of risk, whereas trade-in depreciation is often lower as dealers factor in refurbishing costs and resell potential. Factors affecting depreciation rates include vehicle condition, mileage, market demand, and timing of sale, with trade-ins typically benefiting from dealer incentives and bulk sales strategies. Geographic location and seasonal trends also influence depreciation differences between private sales and trade-in transactions.

Pros and Cons of Private Sale Depreciation

Private sale depreciation often offers higher resale value compared to trade-in depreciation since sellers can set their own prices and negotiate directly with buyers. However, it requires more time, effort, and knowledge about market trends, while trade-ins provide convenience and instant transactions but at typically lower returns. Sellers must weigh the increased profit potential of private sales against the simplicity and speed of trade-in options when considering depreciation losses.

Pros and Cons of Trade-In Depreciation

Trade-in depreciation offers the advantage of convenience and immediate reduction of the purchase price on a new vehicle, often lowering sales tax due on the transaction. However, the trade-in value typically reflects a lower market price compared to private sale depreciation, potentially resulting in a smaller return for the seller. Balancing the ease of trade-in transactions against the generally higher returns of private sales is essential for optimizing vehicle depreciation outcomes.

Real-World Examples: Private Sale vs Trade-In Values

Private sale depreciation often results in higher resale values compared to trade-in depreciation because private buyers generally pay closer to market value. For example, a 2018 Toyota Camry might depreciate by 25% in a private sale but nearly 35% as a trade-in due to dealer resale margins and reconditioning costs. Real-world data from Kelley Blue Book shows trade-in offers averaging 10-15% less than private sale prices across various vehicle models and conditions.

Maximizing Value: Tips to Minimize Depreciation Loss

Maximizing value when selling a vehicle involves understanding that private sales often yield higher returns due to direct buyer negotiation, reducing depreciation loss compared to trade-in offers, which typically undervalue the car for dealer profit margins. To minimize depreciation loss, maintain the vehicle's condition with regular servicing, keep detailed maintenance records, and time the sale before significant model year updates or mileage milestones reduce its market appeal. Pricing competitively by researching current market trends and comparable private sale prices can further optimize returns and lessen the impact of depreciation.

Which Option Retains More Value: Private Sale or Trade-In?

Private sale generally retains more vehicle value compared to trade-in because sellers can negotiate directly with buyers, often achieving closer to market value. Trade-in depreciation is typically higher due to dealer resale margins and the convenience factor included in the offer. Choosing a private sale maximizes returns by eliminating dealer overhead and allowing for price flexibility based on vehicle condition and market demand.

Decision-Making Guide: Choosing the Right Depreciation Path

Private sale depreciation often results in higher retained value since vehicles typically sell closer to market value compared to trade-ins, which dealers discount to cover reconditioning costs. Trade-in depreciation offers convenience and potential tax benefits by reducing the purchase price of a new vehicle and streamlining the transaction process. Evaluating immediate financial needs, time constraints, and total cost implications helps determine whether private sale or trade-in depreciation aligns better with your personal or business vehicle replacement strategy.

Private Sale Depreciation vs Trade-In Depreciation Infographic

cardiffo.com

cardiffo.com